Ahead of International Women's Day on March 8, more women are entering top management roles, but inequalities persist and men continue to dominate business leadership roles, research reveals became.

Despite some high-profile exceptions and legislation to help increase quotas for women on boards and executives, progress to the top remains slow.

A study released last week by diversity data firm Equileap found that only 7% of CEOs and 17% of finance chiefs at large companies in developed countries are women.

“The fight for gender equality continues,” said Diana van Maasdyk, CEO of Equileap.

The World Economic Forum's 2023 report states that “the proportion of women in senior positions and leadership roles has increased steadily globally over the past five years” and that the proportion of women hired in leadership roles has increased. He pointed out that this has increased from over 33% in 2016 to almost 20%. In 2022 she will be 37%.

However, overall figures regarding the representation of women in companies show that women remain underrepresented at top levels.

“The structure of work has been built over the past 200 years to cater to the needs of men,” says Tara, CEO of 25×25, a nonprofit organization that aims to improve gender balance in executive leadership. Semlyn Jones said.

“The only way to avoid that is to be consciously aware that we need to make sure that structures are equally fair to women,” she told AFP.

According to a Deloitte study of 10,500 companies in 51 countries based on 2021 data, about one in five board members are women, while only one in 20 chief executives are women. It was just that.

In the United States, women make up about a quarter of board members, but women make up less than 6% of board seats.

In the UK, women hold around 30 per cent of board seats, but only 6 per cent become directors.

~Quota for female bosses~

Some countries, such as France, have enacted laws to correct gender imbalances.

The country topped Equileap's ranking for gender equality in business, based on a variety of criteria including pay, time off, and protection from harassment.

In 2011, France introduced a law regulating the size of board seats. Boards must include at least 40 percent women.

The changes “will pay off in the long run,” said Diane Segalen, chairman of recruitment consultancy Segalen & Associates.

According to a report by Deloitte, more than 40% of French board members in 2021 were women.

Ariane Boucaille, a partner at Deloitte, called Quota “a great accelerator.”

But while the number of women on executive committees is increasing, “it's more in responsibilities like human resources and marketing,” she says.

Currently, only three companies listed on France's main stock index, the CAC 40, have female chief executives.

In Germany, Merck's Belen Gariho is the only female CEO of a company listed on the blue-chip DAX index.

In Italy, Giuseppina di Foggia was appointed CEO of public energy distribution company Terna last year, making her the first woman to lead a major listed company in the country.

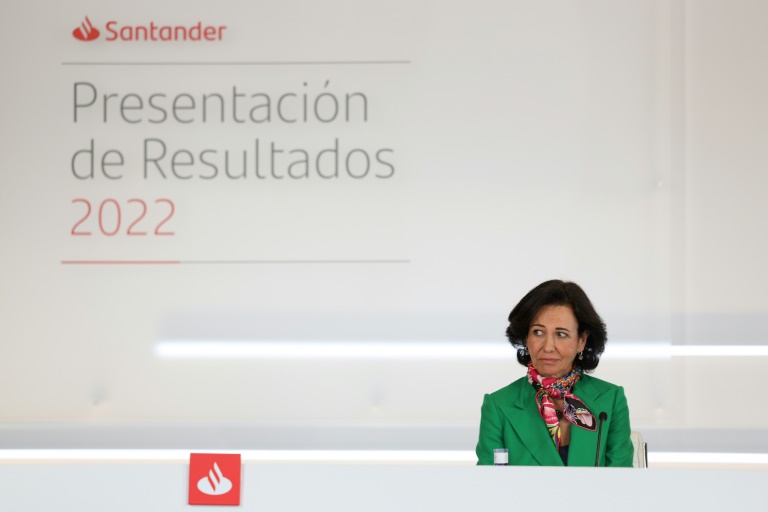

In Spain, most companies listed on the country's stock exchange are run by men, but Zara's owner, Inditex, is headed by Marta Ortega, the founder's daughter, and Banco Santander is headed by Marta Ortega, the founder's daughter. It is led by Executive Chairman Ana Botín, who took over the post from the late Ana Botín. father.

~Role of investors~

A recent report from 25X25 found that women are “significantly underrepresented” in senior management positions, such as finance director, which is a stepping stone to becoming a CEO.

To change this, France introduced legislation in 2021 that sets a goal of increasing the number of women in management positions to at least 30% from 2026 and 40% by 2029.

Bucaille said the law would “promote some progress, but it will inevitably slow down.”

Whether it's quotas or not, it's important to change the system, Semlin-Jones said. To that end, investors need to play a role.

“If their investment decisions are 100% made by white men from very low social backgrounds, then of course that's going to ripple through the system,” she says.

“There needs to be accountability in the investment cycle, and questions like, 'How are these investment decisions made?'” These fund managers say, “Gender doesn't matter.” How is that acceptable? We don't want to hear that. ”

Recruitment director Segalen said she was still confident that female representation would increase.

“I believe the same thing that started in the 2000s will happen with the next generation,” she said.

“They have older women who are inspirational role models.”

lem/jbo/nmc/rlp/lth/ach