Dahlia Nipot

Introduction and investment paper

Amazon(NASDAQ:AMZN) generated an impressive return of 80% in 2023. Some may say “so-so” compared to his amazing 7 competitors on Amazon, but I think this year, The low price at the end of 2022 is staggering. As a long-term investor, I always want to evaluate whether this kind of return and resulting valuation is supported by business and market fundamentals. As we all know, the stock market often acts as a voting machine driven by hype and sentiment in the short term. However, in the long run, they act as a weighing machine that assesses the actual value of a company.There is no doubt that at least some The short-term increase in Amazon's value can be attributed to market momentum and overall bullish sentiment. A market centered on large-cap tech stocks in particular.

Amazon's e-commerce business, disclosed as Online Store/Private Selling (1P) and Third-Party Seller Services (3P), currently accounts for approximately 65% of its total revenue. While other segments, primarily AWS, account for an increasing share of Amazon's revenue, the core e-commerce business remains an important part of Amazon's strategy and will continue to make sense for the company to benefit. The company must demonstrate certain benefits (both sales and profit margin expansion). We will meet your growth expectations. In this article, we'll take a deep dive into e-commerce businesses and cover the following areas:

- A fundamental analysis of this business and what the current share price suggests regarding the sector's future growth and margin expectations.

- A discussion of whether these expectations are realistic and a possible source for achieving the necessary growth and profit expansion.

- Risks of achieving this forecast

Overall, our view on Amazon's e-commerce sector is that the company will remain the leader in North American e-commerce, but will face continued pressure from the likes of Walmart as they move to gain market share. It's called wax. Growth expectations may be reasonable to some extent, but I think that ultimately the real challenge will be improving operating margins. Long-term investors are advised to hold on to the stock and look for price declines where the average value falls.

Basic analysis of Amazon's e-commerce sector

To predict the required expectations from the e-commerce sector, we perform a DCF analysis on the entire business using underlying forecasts that justify the current share price ($151 at the time of writing). did. I won't give all the details here, as several authors at Seeking Alpha have performed a detailed his DCF analysis of Amazon's entire business, but here's a previous article using the standard her DCF methodology: We recommend that you read. Since the focus of this article is a deep dive into e-commerce forecasting, we will stick to the math behind this unit. However, her DCF assumptions are explained below at a high level so that the reader can assess their plausibility.

- Total net sales in 2030: $1.27 trillion (2023: $570 billion)

- Total operating profit margin in 2030: 17% (2023: 6%)

- Tax rate: 12% (average for the past 3 years)

- WACC: 10.5% (midpoint of this source)

- Final growth rate: 3% (i.e. 50% higher than the overall GDP growth rate of 2%)

E-commerce unit forecast

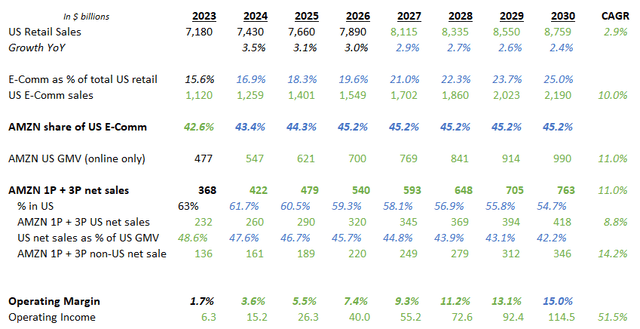

I used the U.S. e-commerce market as the underlying driver and projected the numbers below along with assumptions regarding international growth, e-commerce share of total retail sales, and operating margins.I will try to explain each variable in the commentary below

AMZN eCommerce Forecast (Various sources detailed below; author's speculation)

AMZN e-commerce forecast (various sources detailed below, author's estimates)

US retail sales

Current U.S. retail sales are approximately $7.1 trillion. Although there was a slowdown in 2022 and 2023, sales are expected to normalize as they approach U.S. GDP growth in the future, with higher growth expected in the near term.

Assessing Reasonability: We believe the size and growth assumptions here are reasonable, as they are supported by projections from several sources.

E-commerce share of US retail sales

The current share of e-commerce is around 15.6%, but significant growth is expected here as more consumers go online to purchase goods. This is expected to be driven by underpenetrated categories such as consumer goods, apparel, furniture, and electronics (I now buy all my clothing online, and recently major electronics too. (I'm ordering). I believe that by 2030, e-commerce sales will account for 25% of total US retail sales. This assumption is consistent with data from other sources I investigated.

Assessing rationality: Although the size and growth assumptions here are supported by a variety of sources, we find variability in this variable. Overall, we believe e-commerce's share of retail sales will grow, and we believe a 25% share by 2030 is realistic.

Amazon's share of US e-commerce sales

To calculate Amazon's current market share, we looked at Amazon's gross merchandise value (GMV). It currently stands at approximately $477 billion. Note that the GMV is higher than Amazon's 1P and 3P sales combined, as the 3P net sales disclosed in Amazon's financial information are essentially a percentage of the total product price. please. Although Amazon does not disclose its share of third-party sales (perhaps because they account for a large portion and does not want third-party partners to see their level of profitability), this share is approximately I estimate it to be 30%. I predict Amazon's share of U.S. e-commerce will increase from 42% to 45% over the next few years, then plateau.

Assessing reasonableness: We believe this is an important variable in the assessment and should be carefully considered. Amazon is by far the largest online retailer in the U.S., with Walmart (the second-largest online retailer) by a wide margin with about 6% share. Walmart has recently made aggressive moves to gain additional market share, and other retailers are also deploying e-commerce strategies to gain share. Also, several foreign companies have entered the US market, with players such as Temu offering very low prices to gain market share. Although Amazon is far ahead of its competitors, it's natural to think that it will need to spend more to maintain market share. This is likely to come in the form of lower prices, faster shipping, etc. All of these measures will weigh on Amazon's profits, which will require significant hikes in the coming years to meet investors' growth expectations. Overall, I believe the assumptions about Amazon's market share in our forecast are optimistic.

Comparison of US and international sales

North American sales account for approximately 73% of Amazon's retail sales (excluding AWS). We assumed that 63% would come from the United States, with the remainder coming from Canada and Mexico. Our forecast assumes that the share of international sales should increase over time as these markets experience higher growth within the e-commerce sector. Amazon has recently expanded significantly into emerging markets such as India and Africa.

Assessing rationality: While it's reasonable to assume that Amazon's share of intended revenue will increase over time, there are some considerations investors should keep in mind. There is no doubt that growth in markets outside the US will be accompanied by lower profit margins over time. Amazon's international division, which is disclosed in its financials, is not yet profitable (the North American division showed a modest profit in 2023), and there are already several established competitors in the international market. and Amazon needs to catch up (e.g. Flipkart in India and Jumia in Africa). Overall, we believe the growth assumptions in our forecasts for international markets are reasonable (we will comment later on the margin assumptions that correlate with this variable).

1P and 3P sales

To demonstrate the dramatic profit expansion built into our forecast, Amazon would need to increase its share of 3P sales with higher margins. Although not explicitly stated in our model, there is an implicit requirement that the third company's net sales (currently about 50% of the first company's net sales) need to increase significantly. There is an assumption.

Assessing rationality: I think this is another important variable that requires careful consideration. Amazon has historically been the platform of choice for third-party sellers, but these sellers have faced challenges, including accusations that Amazon copies their products and uses sales data to promote their brands. There were several challenges faced. There has also been a complaint filed by the FTC regarding the same issue. Fundamentally, third-party sellers are becoming aware that reliance on one platform can be detrimental to their business in the long term. So we're also seeing collaborations with Walmart and other emerging e-commerce platforms. This could mean that Amazon may need to ease third-party sales share in order to retain/attract sellers. This will ultimately depress profits. Overall, I think it's hard to get forecasts in this space while increasing margins if necessary.

Margin expansion

This is an area where there have always been questions. In other words, show me the money. At some stage, Amazon will need to earn more in the e-commerce sector to justify its valuation. Although the North American division made some progress in 2023, the international division remains unprofitable. As discussed above, from keeping prices low for consumers to providing a competitive share of sales to third-party sellers, to investing in international markets where Amazon needs to show significant growth. There are several challenges in expanding margins. Our forecast calls for operating margins to increase to 15% (currently less than 2%) by the end of 2030.

Rationality rating: Given the issues above, we think this is a very optimistic variable in our forecast. Note that competitors such as Walmart (WMT) currently generate operating margins of around 4%. Amazon should be able to make more money than this, but it's also worth noting that Walmart doesn't face the same challenges as Amazon when it comes to international expansion.

Key points for investors

Despite the aforementioned challenges that I believe Amazon will face in meeting the expectations of the e-commerce sector, make no mistake, Amazon is a fascistic company backed by strong fundamentals. The e-commerce sector has a long road to growth, and other categories that are unforeseen today may also move online (for example, there is already a lot of attention on buying a car online without going to the dealership). ). My personal experience as an avid Amazon user is that general prices have increased over the past year, and I have other data to back this up. This is reflected in the improved profitability of Amazon's North American retail division. I used to go directly to Amazon and search for everyday items, but now I do general Google searches and look at other retailers. No one offers free and fast shipping like Amazon Prime, but many retailers have minimum basket strategies that can lead to free shipping (i.e., free shipping when you buy more than a certain amount from an online store). Masu). Like all mature organizations, Amazon faces the dilemma between maintaining/growing market share and increasing profits, and this will determine how Amazon follows the growth trajectory necessary to meet its valuation. It will definitely affect what you achieve. I believe investors need to closely monitor the growth and profitability of the e-commerce sector in the coming years. This is because even a slight deviation from the predictions here could lead to a deterioration in the stock price, making it a perfect entry point for long-term investors.

Amazon has several other growth drivers that could offset performance losses within its e-commerce division. AWS is the obvious candidate here, along with its growing advertising business. Recent developments in Generative AI and the potential for additional advertising revenue also provide an avenue for growth. I'll be covering these parts of Amazon's business in future articles.