Boutique investment firm Broyhill Asset Management has released its fourth quarter 2023 investor letter. You can download a copy of the same here. The past two years have been a mirror image for stock investors. Global stocks fell 18% last year, but rose 22% in 2022. Portfolio activity was very strong in the fourth quarter. Broyhill's fully invested managed funds have underperformed broad equity benchmarks year-over-year, but have avoided problems during the 2021 and 2022 declines, and their relative performance remains better than any long-term period. much higher. Additionally, you can check out the fund's top five holdings to learn about the best stocks for 2023.

Broyhill Asset Management featured stocks such as Ball Corporation (NYSE:BALL) in its Q4 2023 Investor Letter. Ball Corporation (NYSE:BALL), headquartered in Westminster, Colorado, is a supplier of aluminum packaging products. On February 16, 2024, Ball Corporation (NYSE: BALL) stock closed at $62.09 per share. Ball Corporation (NYSE: BALL)'s 1-month return is his 11.81%, and the company's stock has increased his 7.91% in value over the past 52 weeks. Ball Corporation (NYSE:BALL) has a market capitalization of $19.577 billion.

Broyhill Asset Management said the following about Ball Corporation (NYSE:BALL) in its Q4 2023 investor letter:

“Recent investments in this bucket include ball corporation (NYSE:BALL) Fidelity National Information Services, and Avantor. Ball Corporation was founded in 1880 and manufactures aluminum packaging for beverages, food, and other products. It's probably not the most exciting business in the world, but a glimpse into the company's performance provides a valuable lesson: an exciting business model is not a prerequisite for exciting performance. In fact, in many cases these factors appear to be inversely related. For the decade ending in 2020, Ball stock compounded 20% annually, outperforming the market average by nearly 6% annually. Since then, the company has underperformed, dropping about 60% from high to low as the industry struggles with overexpansion, aggressive pricing, and other challenges. With interest rates soaring, investors have increasingly focused on the leverage of Ball's balance sheet, which soared to 7.6x after acquiring Britain's Wrexham in 2016. The stock price multiple has collapsed from a high of nearly 30 times in fiscal 2020 to 2021 to a low of less than 15 times. Last year, management urged them to go on the offensive. In August, Ball announced its intention to sell its aerospace division to BAE Systems for 19.6 times EBITDA and repay its debt by up to 3 times, or the lower end of its target range, along with up to $2 billion in share buybacks. ”

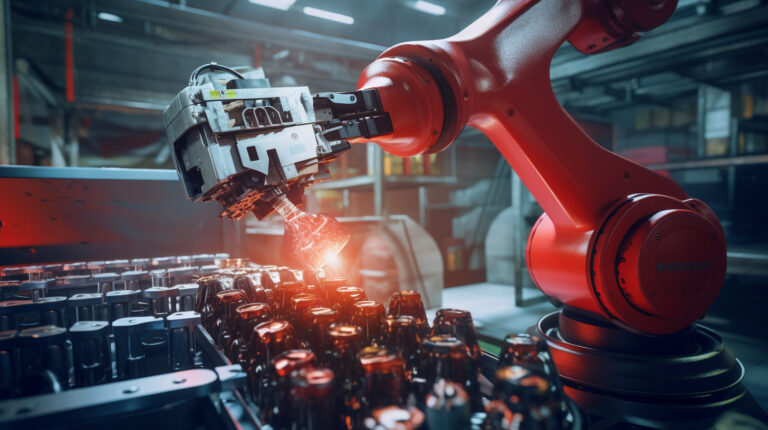

A high-speed robot arm carefully packs aluminum cans into cardboard boxes.

Ball Corporation (NYSE:BALL) isn't on this list of 30 most popular stocks among hedge funds. According to our database, at the end of the fourth quarter, Ball Corporation (NYSE: BALL) was held by 28 hedge fund portfolios, down from 36 stocks in the previous quarter.

We discussed Ball Corporation (NYSE:BALL) in a separate article and shared NZS Capital's view on the company. Additionally, for investor letters from hedge funds and other leading investors, please visit our Hedge Fund Investor Letters Q4 2023 page.

Recommended articles:

Disclosure: None. This article was originally published on Insider Monkey.