It's easy to see why investors are attracted to unprofitable companies. For example, his software-as-a-service business Salesforce.com lost money for years while recurring revenue grew, but if you've owned the stock since 2005, you're sure would have worked very well. But while the successes are well known, investors should not ignore the large number of unprofitable companies that burn through all their cash and go bankrupt.

you should Tirana resources (ASX:TYX) shareholders worried about cash burn? In this article, we define cash burn as the amount of cash a company spends each year to fund growth (also known as negative free cash flow). Define. First, we compare its cash burn to its cash reserves to calculate its cash runway.

Check out our latest analysis for Tirana Resources.

Does Tirana Resources have long-term funding scope?

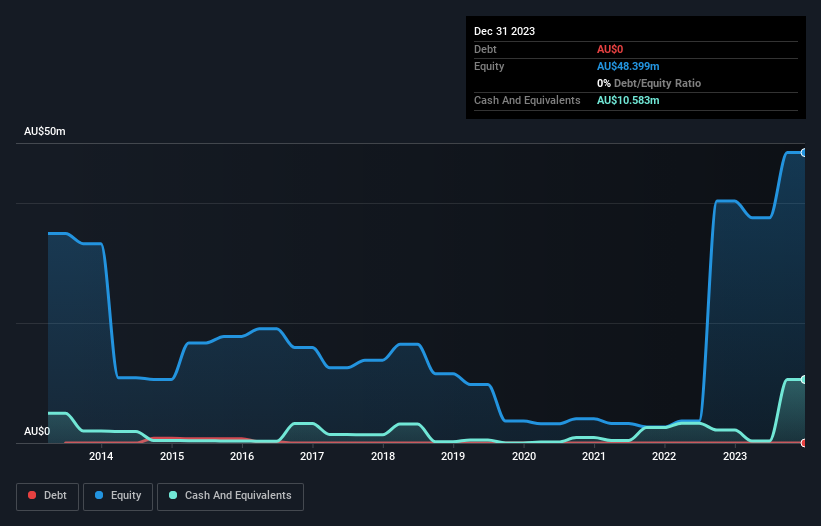

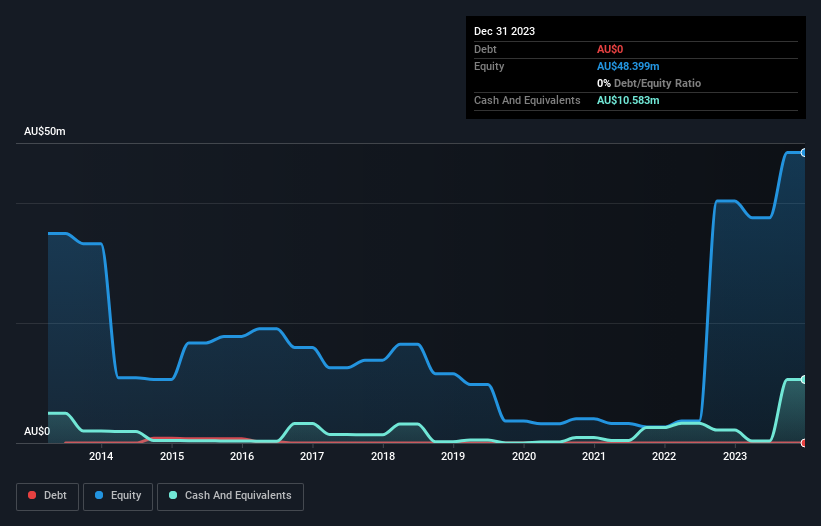

A company's cash runway is calculated by dividing its cash holdings by its cash burn. As of December 2023, Tirana Resources had A$11 million in cash and no debt. If you look at last year, the company used up his A$5 million. So the cash runway from December 2023 was approximately 2.1 years. Perhaps this is a wise and sensible runway length. The image below shows how its cash balance has changed over the past few years.

How has Tyranna Resources' cash burn changed over time?

It's great to see that Tyranna Resources is already starting to generate revenue from its business, but with revenue of just AU$24,000 last year, we don't think it's generating significant revenue at the moment. Therefore, in this analysis we will focus on how its cash burn is tracking. Soaring cash burn of 149% year over year is certainly testing our nerves. Generally speaking, this type of spending growth rate does not last long before it causes balance sheet weakness. Tirana Resources has little real operating income, which makes us a little worried. We prioritize most of the stocks on this list of stocks that analysts expect to grow.

How easily can Tyranna Resources raise cash?

Tirana Resources has solid funding sources, but its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. do not have. The most common ways for publicly traded companies to raise more money for their operations is by issuing new shares or taking on debt. Companies typically sell their new stock to raise cash and fuel growth. By looking at a company's cash burn compared to its market capitalization, insight into how much shareholders will be diluted if the company needs to raise enough cash to cover another year's cash burn. It can be obtained.

Tirana Resources has a market capitalization of A$36 million, so its cash burn of A$5 million equates to about 14% of its market value. As a result, we'd venture that the company could raise more cash for growth without too much trouble, even at the cost of some dilution.

Are you worried about Tyranna Resources' cash burn?

Although the increasing cash burn makes us a little concerned, we have to mention that we thought Tirana Resources' cash runway was relatively promising. Cash burn companies are always on the risk side of things, but after considering all the factors we've discussed in this short article, we're not too worried about their cash burn rate. Apart from this, we investigated various risks affecting the company and found the following: 4 warning signs for Tirana Resources (One of them is a concern!) You should know.

of course, You may find a great investment if you look elsewhere. So take a look at this free A list of companies that insiders are buying, as well as this list of growth stocks (as predicted by analysts).

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.