There is no doubt that you can make money by owning shares of unprofitable companies. For example, biotechnology companies and mining exploration companies often lose money for years before achieving success with a new treatment or mineral discovery. But while history celebrates the rare successes, the failures are often forgotten. Does anyone remember Pets.com?

Considering this risk, I decided to consider the following. tanami gold (ASX:TAM) shareholders have cash burn to worry about. In this article, we define cash burn as the amount of cash a company spends each year to fund growth (also known as negative free cash flow). First, we compare its cash burn to its cash reserves to calculate its cash runway.

Check out our latest analysis for Tanami Gold.

How long is Tanami Gold's cash runway?

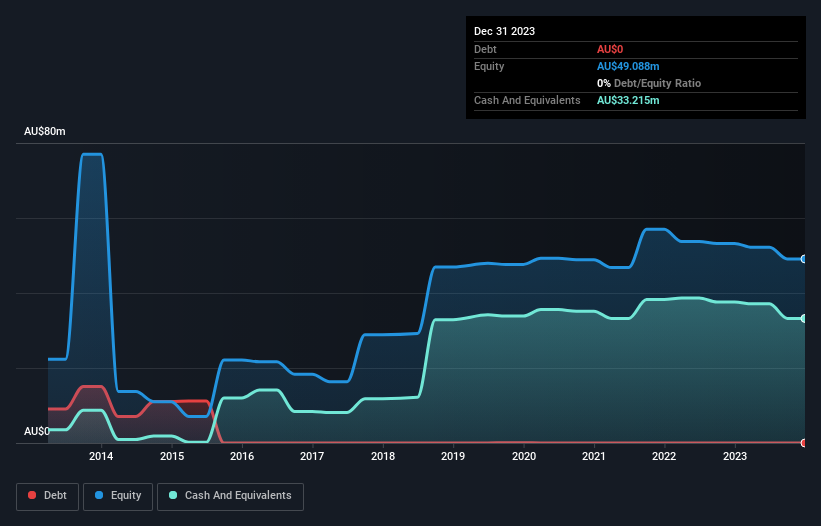

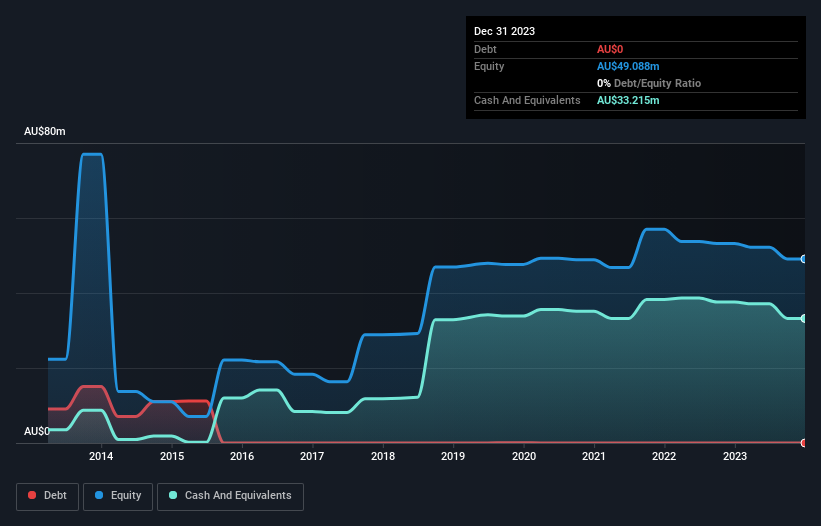

A company's cash runway is the amount of time it takes to use up its cash reserves at its current cash burn rate. As of December 2023, Tanami Gold had cash of his A$33m and was debt-free. Importantly, its cash burn in the trailing twelve months was AU$6m. In other words, it had a cash runway of approximately 5.6 years as of December 2023. This is just one measure of its cash burn situation, but it certainly gives us the impression that holders have nothing to worry about. You can see how its cash balance has changed over time in the image below.

How will Tanami Gold's cash burn change over time?

We consider Tanami Gold to be an early stage business as it is not currently profitable. So while we can't look at sales to understand growth, we can look at changes in cash burn to see how spending is trending over time. His cash burn rate has increased by 25% in the last year, and it appears the company is gradually increasing its investment in the business over time. That's not necessarily a bad thing, but investors should be mindful of the fact that it shortens the funding runway. Tanami Gold's actual operating income is low, which makes us a little worried. We prioritize most of the stocks on this list of stocks that analysts expect to grow.

How difficult will it be for Tanami Gold to raise more capital for growth?

While Tanami Gold has solid funding sources, its cash burn trajectory may have some shareholders thinking ahead to when the company might need to raise more cash. The most common ways for publicly traded companies to raise more money for their operations is by issuing new shares or taking on debt. Companies typically sell their new stock to raise cash and fuel growth. By comparing a company's annual cash burn to its total market capitalization, we can roughly estimate how many shares it would have to issue to run the company for another year (at the same burn rate).

With a market capitalization of AU$39m, Tanami Gold's cash burn of AU$6m represents about 15% of its market value. As a result, we'd venture that the company could raise more cash for growth without too much trouble, even at the cost of some dilution.

Are you worried about Tanami Gold's cash burn?

As you can probably tell by now, we're not too worried about Tanami Gold's cash burn. For example, we think the company's cash runway suggests that it's on the right track. Although the increase in cash burn was not significant, the other factors mentioned in this article more than compensate for this metric's weaknesses. Based on the factors mentioned in this article, we think the company's cash burn situation deserves some attention from shareholders, but we don't think it's anything to worry about. Apart from this, we investigated various risks affecting the company and found the following: 3 warning signs for Tanami Gold (Two of which are a bit concerning!) You should know.

of course Tanami Gold may not be the best stock to buy.So you might want to see this free A collection of companies with a high return on equity, or a list of stocks that insiders are buying.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.