To find multibagger stocks, what are the fundamental trends in companies? First, let's look at proven results. return One is growing capital employed (ROCE) and second is growing capital employed (ROCE). base of capital employed. If you see this, it usually means the company has a good business model and plenty of opportunities for profitable reinvestment. With that in mind, the trends we see are: grand canyon education (NASDAQ:LOPE) looks very promising, so let's take a look.

What is return on capital employed (ROCE)?

For those who have never used ROCE before, it measures the “return” (pre-tax profit) that a company generates from the capital employed in its business. Analysts use the following formula to calculate Grand Canyon Education.

Return on capital employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

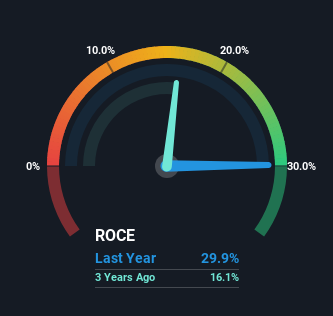

0.30 = USD 249 million ÷ (USD 930 million – USD 97 million) (Based on the previous 12 months to December 2023).

therefore, Grand Canyon Education's ROCE is 30%. Not only is this an impressive return, but it's also higher than the average return of 7.2% for companies in a similar industry.

See our latest analysis on Grand Canyon Education.

In the chart above, we measured Grand Canyon Education's previous ROCE against its previous performance, but the future is probably more important. If you're interested, take a look at our analyst forecasts. free Grand Canyon Education Analyst Report.

ROCE trends

Grand Canyon Education did not disappoint in terms of ROCE growth. This figure represents a 34% increase in return on equity over the past five years. This is not a bad thing because it shows that for every dollar invested (capital employed), the company is getting more money out of that dollar. When it comes to capital employed, the company is actually using 33% less than it did five years ago, which could indicate that the business is becoming more efficient. If this trend continues, businesses may be becoming more efficient, but they are shrinking in terms of total assets.

Grand Canyon Education ROCE Key Points

In summary, it's great to see that Grand Canyon Education was able to turn things around and earn higher profits with less capital. Investors may not be impressed by the favorable underlying trend yet, as the share price has returned only 3.9% to shareholders over the past five years. With that in mind, I'd like to take a closer look in case this strain has more characteristics that could allow it to thrive over the long term.

Grand Canyon Education looks impressive, but it's not worth the infinite price tag. LOPE's intrinsic value infographic helps you visualize whether it is currently trading at a fair price.

High returns are a key element of strong performance. free A list of stocks with solid balance sheets and high return on equity.

Valuation is complex, but we help make it simple.

Please check it out grand canyon education Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.