Institutional investors increasingly sought exposure to the cryptocurrency in the first quarter of this year, following the launch of several US-based spot Bitcoin exchange-traded funds (ETFs) in January.

A study by CoinShares Digital Fund Manager revealed that these institutional investors have significantly increased their digital asset allocation, reaching 3% of their portfolios. This is the highest level since the survey began in 2021.

Many of these investors believe that distributed ledger technology has increased their exposure to digital asset investments.

Moreover, they are now recognizing that digital assets offer superior value and there is a growing demand for investing in BTC as a means of decentralization.

Bitcoin presents the most convincing growth prospects.

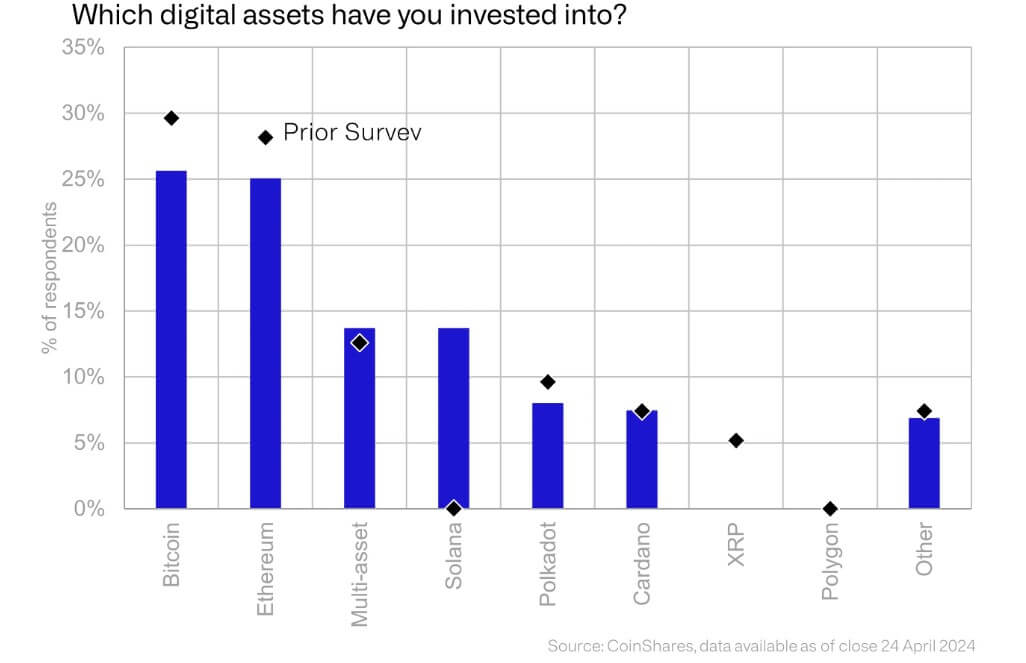

Institutional investors' portfolios primarily include Bitcoin, making it the most sought-after digital asset among this demographic. According to James Butterfill, head of research at CoinShares, more than a quarter of respondents said they had exposure to BTC via spot ETFs in their portfolios.

After Bitcoin, Ethereum remains in second place, although investor interest has declined since the last survey.

BTC and ETH remain the digital assets with the most attractive growth prospects, investors say.

Nevertheless, investor enthusiasm for Solana has grown, as evidenced by the increase in its allocation to 14%. This increase is primarily driven by a select group of key investors who are expanding their holdings in the fast-growing blockchain network, which has seen rapid growth in price and adoption over the past year. .

While other alternative digital assets have struggled, XRP stands out for its steep decline. None of the investors surveyed mentioned holdings.

barriers to investment

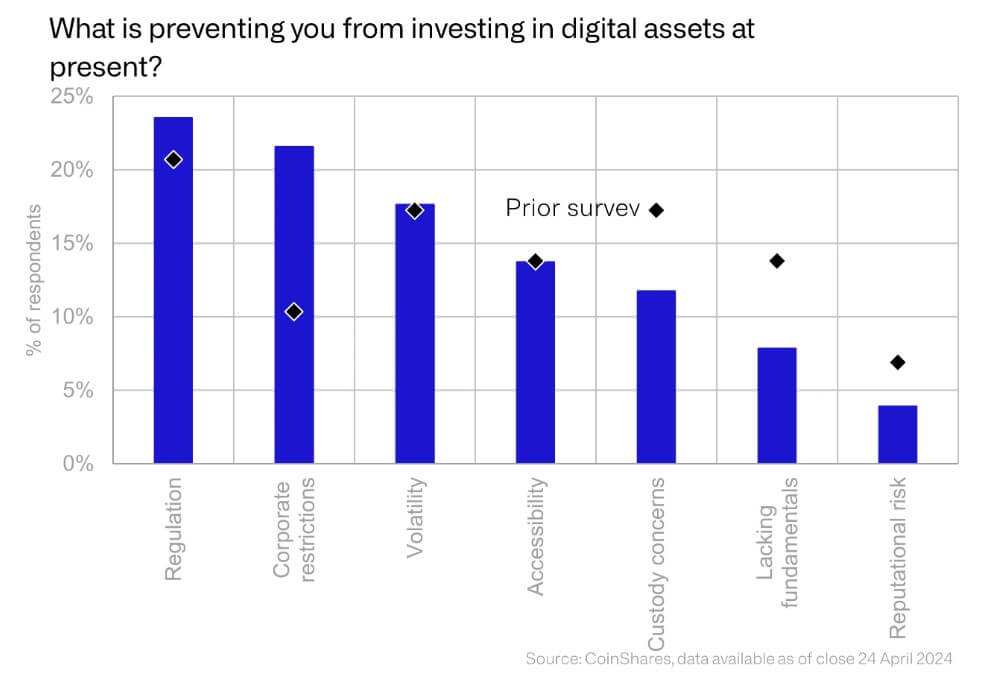

Despite increasing exposure to digital assets and the emergence of Bitcoin ETFs, many investors still struggle to access this asset class.

CoinShares research showed that regulatory concerns remain the biggest barrier for most investors. The emerging industry has faced regulatory scrutiny, particularly in the US, where financial regulators such as the SEC have filed several lawsuits against major companies such as Binance and Coinbase.

Meanwhile, the inherent volatility of emerging sectors remains a significant concern for some investors. However, custody issues, reputational risk, and lack of fundamental investment case are becoming less of an issue.