UK international remittance market

DUBLIN, April 10, 2024 (Globe Newswire) — “Business and investment opportunities in the UK international remittances market – analysis with transaction value and volume, remittances to and from key countries, and consumer statistics. – Q1 2024” report has been created.add to ResearchAndMarkets.com Recruitment.

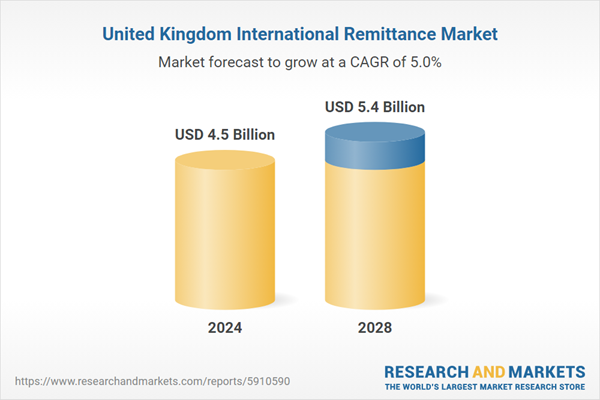

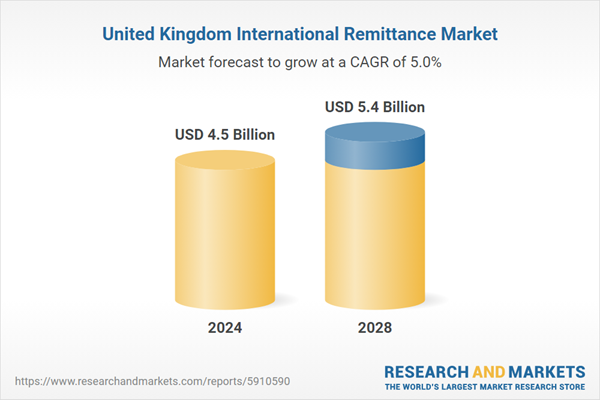

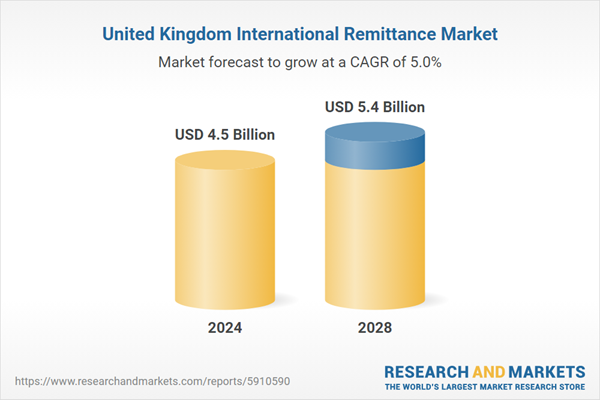

The UK international inbound remittance market will grow by 7.8% in 2023 to reach USD 4.45 billion in 2024. During the forecast period (2024-2028), the market size is expected to register a CAGR of 5.0%, increasing from USD. It will reach USD 4.13 billion in 2023 and USD 5.41 billion in 2028.

The UK remittance outflow market will grow by 3.5% in 2023 and reach USD 11.46 billion in 2024. The market size is expected to register a CAGR of 2.2% over the forecast period (2024-2028), increasing from USD 11.07 billion in 2023 to reach USD 12.52 billion by 2028. Masu.

The UK remittance industry is expected to record steady growth over the medium term. The growing global diaspora population in the UK is expected to drive industry growth in 2024. The market is poised for growth in the medium term, with new players entering the market. This trend is predicted to gain further momentum in 2024, resulting in the creation of new remittance channels.

However, domestic companies are looking to expand their global footprint to accelerate growth. To strengthen their positions in the global market, these companies are building strategic partnerships and launching new and innovative products to simplify the remittance process. Overall, the publisher maintains positive growth prospects for the UK remittance market over the next three to four years.

Payment service providers are introducing new products to simplify money transfers for users.

As the competitive environment in the UK and global money transfer industry continues to grow rapidly, payment service providers are launching new products to simplify money transfers for users around the world.

In January 2024, Revolut announced the launch of a mobile wallet that gives customers the option to quickly and easily send money abroad. The launch of remittance services using mobile wallets aims to eliminate the risks associated with traditional remittances. This includes amounts owed by banks.

Revolut users in the UK and most European countries within the European Economic Area (EEA) will now be able to use their mobile wallets to send money to Bangladesh through bKash and Kenya through M-Pesa. Additional wallet routes will be introduced soon. By offering benefits such as instant money transfers, greater ease, less friction and greater choice, Revolut aims to enter the fast-growing money transfer industry in the global market in the medium term.

UK-based company enters into strategic partnership to further strengthen position in global remittance sector

The global remittance market is expected to register significant growth over the next three to four years. To enter high-growth sectors, UK-based companies are forming alliances to strengthen their positions in global markets.

Paysend, a card-to-card and international payments platform, partnered with Western Union in October 2023. The partnership aims to make cross-border remittances smoother and more efficient. Paysend's integration with Western Union provides users with an improved experience when sending money directly to their Visa and Mastercard debit cards through Western Union's digital solutions.

The companies have also launched a test program to enable remittances from the US and UK to Pakistan, and from the UK to Spain. Paysend plans to expand this service to more countries in the medium term. The company also partnered with Visa in September 2023 to launch remittance services in Mexico, a rapidly growing market.

From a short to medium term perspective, the issuer expects more UK-based fintech companies to enter into strategic partnerships in a bid to capitalize on growth opportunities in global markets. This will boost the competitive environment and sector growth over the next three to four years.

Start-ups are entering the money transfer industry to serve the African diaspora in the UK

More companies are entering the remittance market, and the industry is expected to grow steadily over the next five years. In the UK, this trend is predicted to continue further into his 2024.

UK-based Nigerian fintech company FinREMIT has announced that it will launch an app in December 2023. With this, the company aims to capture market share in the growing remittance corridor between the UK and Nigeria. The company is particularly supported by the UK government and aims to transform remittance processes, with a particular focus on improving remittances to developing countries in sub-Saharan Africa.

The rapidly growing competitive environment is expected to drive innovation in the UK remittance market in 2024. This will then drive growth in the sector in the medium term.

Reasons to buy

-

Comprehensive and up-to-date information: This report provides comprehensive and up-to-date information on the UK international money transfer market, including market size, growth trends, transaction value, transaction volume, average amount per transaction. Market share analysis by transfer channels, consumer segments and key countries.

-

Understand the competitive landscape: Get an overview of the competitive landscape through market share data of key players in the market.

-

Actionable insights for businesses and investors: This report provides data-centric analysis for businesses and investors operating in the UK remittances market. This helps you identify new opportunities, assess risks, and make informed business decisions.

-

Future Market Growth Forecast: This report provides future market growth forecast, which enables companies and investors to plan and strategize effectively.

Key attributes:

|

report attributes |

detail |

|

number of pages |

130 |

|

Forecast period |

2024 – 2028 |

|

Estimated market value in 2024 (USD) |

$4.5 billion |

|

Projected market value to 2028 (USD) |

$5.4 billion |

|

compound annual growth rate |

5.0% |

|

Target area |

England |

range

International inbound market opportunity trend analysis in the UK

Market share of major UK companies

International inbound market opportunity trend analysis by channel in the UK

-

Digital (transaction value, transaction volume, average amount per transaction)

-

Mobile (transaction amount, transaction volume, average amount per transaction)

-

Non-digital (transaction value, transaction volume, average amount per transaction)

International remittance analysis of UK consumer profiles

-

Analysis by age group of callers

-

Analysis by sender income

-

Analysis of callers by occupation

-

Analysis of beneficiaries by occupation

-

Analysis by purpose

International remittance flow analysis in the UK (from country to state/region)

-

Market opportunities by major sending countries (transaction value, transaction volume, average amount per transaction)

-

Market Share by Transfer Channel by Key States/Regions

International outbound market opportunity trend analysis in the UK

International Outbound Market Opportunity Trend Analysis by Channel in UK

-

Digital (transaction value, transaction volume, average amount per transaction)

-

Mobile (transaction amount, transaction volume, average amount per transaction)

-

Non-digital (transaction value, transaction volume, average amount per transaction)

International remittance analysis of UK consumer profiles

-

Analysis by age group of callers

-

Analysis by sender income

-

Analysis of callers by occupation

-

Analysis of beneficiaries by occupation

-

Analysis by purpose

International remittance flow analysis in the UK (state/region to country)

-

Market opportunities by major sending countries (transaction value, transaction volume, average amount per transaction)

-

Market Share by Transfer Channel by Key States/Regions

For more information on this report, please visit https://www.researchandmarkets.com/r/ilfvnw.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900