new york

CNN

—

For the first time in nearly 30 years, parts of Donald Trump's business empire have been made public. Trading started on a high note, but the enthusiasm subsided considerably after the closing bell, and the stock ended well below the day's high.

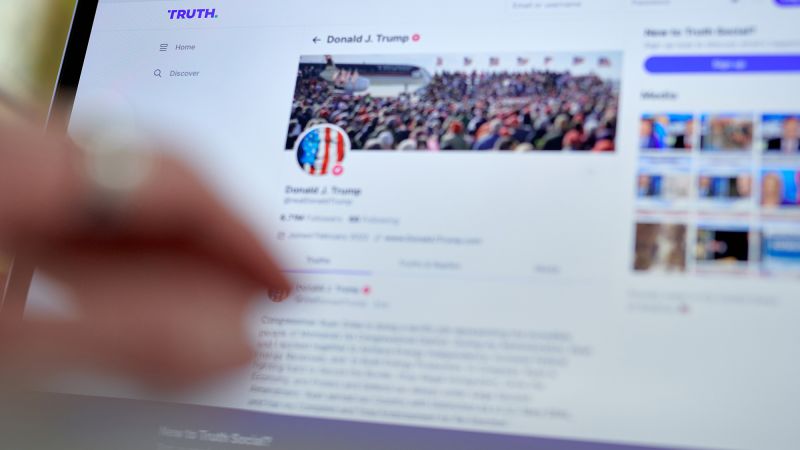

Trump Media & Technology Group, owner of the troubled social media platform Truth Social, will make its long-delayed public debut as a publicly traded company under the ticker symbol “DJT” at the opening bell on Tuesday. started its journey.

The stock price soared about 56% to $78, and trading was temporarily halted due to the volatility. Trump Media's stock price stabilized at around $70, but then skyrocketed. By the closing bell, Trump Media closed at $57.99, up a modest 16% from the day.

Despite the late selloff, Wall Street still values Trump Media at a staggering $11 billion, but experts warn that this price tag is not tied to reality.

Shares of Digital World Acquisition Corp., the shell company that became Trump Media on Tuesday morning, have soared more than 200% so far this year. That includes a 35% jump on Monday after the deal closed. Shares soared again at the start of trading on Tuesday. It was the first opportunity for investors to trade shares under the new DJT ticker after the merger.

The surge in stock prices comes despite the fact that Trump Media is running out of cash. accumulating losses. And its flagship product, Truth Social, is losing users.

“This is a very unusual situation. Stock prices are almost disconnected from fundamentals,” said Jay Ritter, a finance professor at the University of Florida's Warrington School of Business who has studied initial public offerings (IPOs) for more than 40 years. said.

Ritter said the closest equivalent would be so-called meme stocks like GameStop and AMC, which have soared as retail traders flocked to them during the coronavirus outbreak. Trump Media is probably worth about $2 a share, far from its closing price, he said. The price is $58.

“The underlying business doesn't seem to have much value. There's no evidence that this will be a large, highly profitable company,” he said. “We're pretty confident that the stock price will eventually fall to $2 a share, and could even fall below that if the company burns through the merger proceeds.”

This staggering valuation is a huge windfall for Trump, who owns an overwhelming 79 million shares.

At Tuesday's opening price of nearly $78, the stock is worth nearly $6 billion, but lockup regulations likely prevent President Trump from selling or even borrowing from those shares anytime soon. The value of Trump's stock ended at $4.6 billion at the final bell.

Trump Media earned just $3.4 million in the first nine months of last year, according to filings. The company lost $49 million in that period.

Still, the market values Trump Media at about $11 billion.

For context, Reddit had 160 times more revenue than Trump Media, yet its IPO last week valued it at just $6.4 billion. (Reddit had $804 million in revenue in 2023, while Trump Media's annual revenue was about $5 million.)

“At these levels, it seems unrelated to underlying performance,” said Matthew Kennedy, senior IPO strategist at Renaissance Capital. “After all, valuations tend to rely on fundamentals, which means this stock is definitely at risk of crashing.”

“There's no way to square the current stock price with what would be a reasonable valuation for this company,” Michael Ohlrogge, an associate professor at New York University School of Law, told CNN.

Truth Social faces real challenges and remains dwarfed by its competitors.

Truth Social had just 494,000 monthly active users in the U.S. across iOS and Android as of February, according to Similarweb statistics provided to CNN. This is a fraction of his 75 million posts on X (formerly Twitter) and his 142 million posts on Facebook.

Even Threads had more than 10 times as many monthly active users as Truth Social in February, according to Samelweb.

Not only that, but Truth Social is shrinking. According to similarweb statistics, the number of monthly active users decreased by 51% in February compared to the same month last year. Truth Social had 648,000 unique visitors to his website, down 20% from the previous year.

Kennedy described Trump Media as a “meme SPAC,” alluding to both its astronomical valuation and the fact that it was created through a merger with a special acquisition company (SPAC).

“Stocks that trade with momentum can fall quickly,” he said.

Jonathan Macy, a law professor at Yale University, told CNN last week that stocks in the digital world are “obviously in a bubble.”

Of course, history has shown that bubbles can always expand further, and it is very difficult to pinpoint exactly when they will burst.

That means Trump Media stock could continue to soar for some time, even if the rally isn't backed up by fundamentals. In theory, it's possible that a rival company or wealthy individual could buy Trump Media even at these price levels, but Ritter said that's highly unlikely.

“We've already seen with other meme stocks that even if they eventually return to levels that reflect their fundamental value, that process can take quite a long time,” said New York University's Ohlrogge. ” he said. “With the enthusiasm that President Trump's supporters have for this stock, there is good reason to think this stock could continue at a very inflated price for much longer.”

Matthew Tuttle, CEO of Tuttle Capital Management, told CNN that Trump Media's value is probably not close to what the market values it.

“But that doesn't really matter,” he said.

Tuttle noted that SPACs have a history of skyrocketing on the first day of trading, and he bet on options that would pay off if the stock price soared.

“Because this is what it is and it’s Trump, there are people who expect this to work.” [on Tuesday,]” He said.

But Tuttle advised retail investors to be extremely careful when trading Trump Media, noting that the implied volatility was “insane.”

Mr. Tuttle said he sold his Digital World stock but still held an option that would pay him out if the stock price skyrocketed. “Stay out of that,” he said. “Normally I wouldn't touch this with a 10-foot pole. But I'm not playing for a lot of money and I've already made a lot of money doing this. I could wake up tomorrow and trade for $1. If you did, that would be fine.”

Beyond reputation concerns, there are other risks to Trump Media.

For example, the future of this company is closely tied to the future of one person: Trump.

“Donald Trump is the chairman, the largest shareholder, and the most popular user, so there are risks that are unique to a key man. He's one man, and he's 77 years old,” Kennedy said.

Not only that, Trump is facing felony charges in multiple concurrent cases.

Trump Media pointed to the risks in the SEC filing, saying: “Donald J. Trump is the subject of numerous legal proceedings, the scope and scale of which are unprecedented for a former U.S. president and current presidential candidate. An adverse outcome in one or more of the ongoing legal proceedings could adversely affect TMTG and its Truth Social platform.”

Not only is Trump himself facing reputational issues, but his companies have a history of bankruptcies.

The last Trump company to go public in 1995, Trump Hotels and Casino Resorts, used the same DJT ticker symbol. The company went bankrupt in 2004 and was delisted from the New York Stock Exchange.

Trump media even highlighted Trump's bankruptcy history as a risk in SEC filings.

“A number of companies associated with President Trump have filed for bankruptcy. There is no guarantee that TMTG will not go bankrupt either,” the company said.

Another question is what will happen if the lock-up restrictions on Mr. Trump and other key insiders are lifted in the coming months.

Mr. Trump's legal problems could give him reason to sell his stake, which would threaten Trump Media's stock price.

Other insiders, such as SPAC sponsors, could also sell.

Like other social media businesses, Truth Social faces pressure to grow its user base, grow its advertising business, and build out subscription services.

These challenges are complicated by a polarized political landscape, with at least some parts of the country skeptical of President Trump's moves.

Kennedy said Trump Media's listing in many ways represented a “multibillion-dollar bet” on Trump's second term and return to the White House, which would benefit Trump's social media networks. Stated.

“If he wins in November, Truth Social will likely become the president's primary communication channel,” Kennedy said. “That's the bet here.”

Professor Ohlrogge of New York University agrees that this election could be a real turning point for the company.

“If Trump loses the 2024 election, stock prices will plummet,” he said. “If he wins, he could probably stay in that high position for a lot longer, maybe even longer.”