Tom Lee, founder and head of research at FundStrat Global Advisors, has once again voiced his convincingly bullish prediction for Bitcoin (BTC).

In a fascinating interview with CNBC, Lee predicted the potential for an impressive rally for Bitcoin, hypothesizing it could rise to a staggering $150,000 within the next 12 to 18 months. did.

This forecast suggests an increase of approximately 117% from current conditions, driven by Bitcoin's role as a safeguard against financial instability.

“I think Bitcoin could cross $150,000 within the next 12 to 18 months. But that's because the backdrop for BTC today is much more favorable.”

Lee highlighted three factors supporting his optimistic outlook, highlighting the growing demand for spot exchange-traded funds (ETFs) as a key driver.

According to Lee, the strong investment inflow into Bitcoin spot ETFs and the upcoming Bitcoin halving event are creating a ripe environment for Bitcoin's value to rise.

Due to the halving event, the new supply of virtual currencies is expected to decrease.

Lee specifically pointed to new inflows into Bitcoin spot ETFs like BlackRock, which recently gained nearly $800 million. He explained to CNBC that the increased demand seen with the introduction of new ETFs and reduced supply due to halvings, as well as the anticipated easing of monetary policy, is likely to support risk assets.

He also noted that the assets of these ETFs now exceed $28 billion, surpassing the assets of the Grayscale Bitcoin Trust ETF (GBTC) for the first time. This milestone demonstrates strong institutional interest in Bitcoin.

Mr. Lee further elaborated on the mismatch between supply and demand, which is expected to further exacerbate this imbalance, leading to higher prices, especially ahead of the Bitcoin halving event.

On the regulatory front, Lee expressed optimism. He suggested that Bitcoin may have already passed the toughest phase of regulatory challenges in the past 18 months.

He suggested that from his perspective, regulatory challenges to Bitcoin are unlikely to intensify further, given the intensity of regulatory actions the crypto industry has experienced over the past 12 to 18 months.

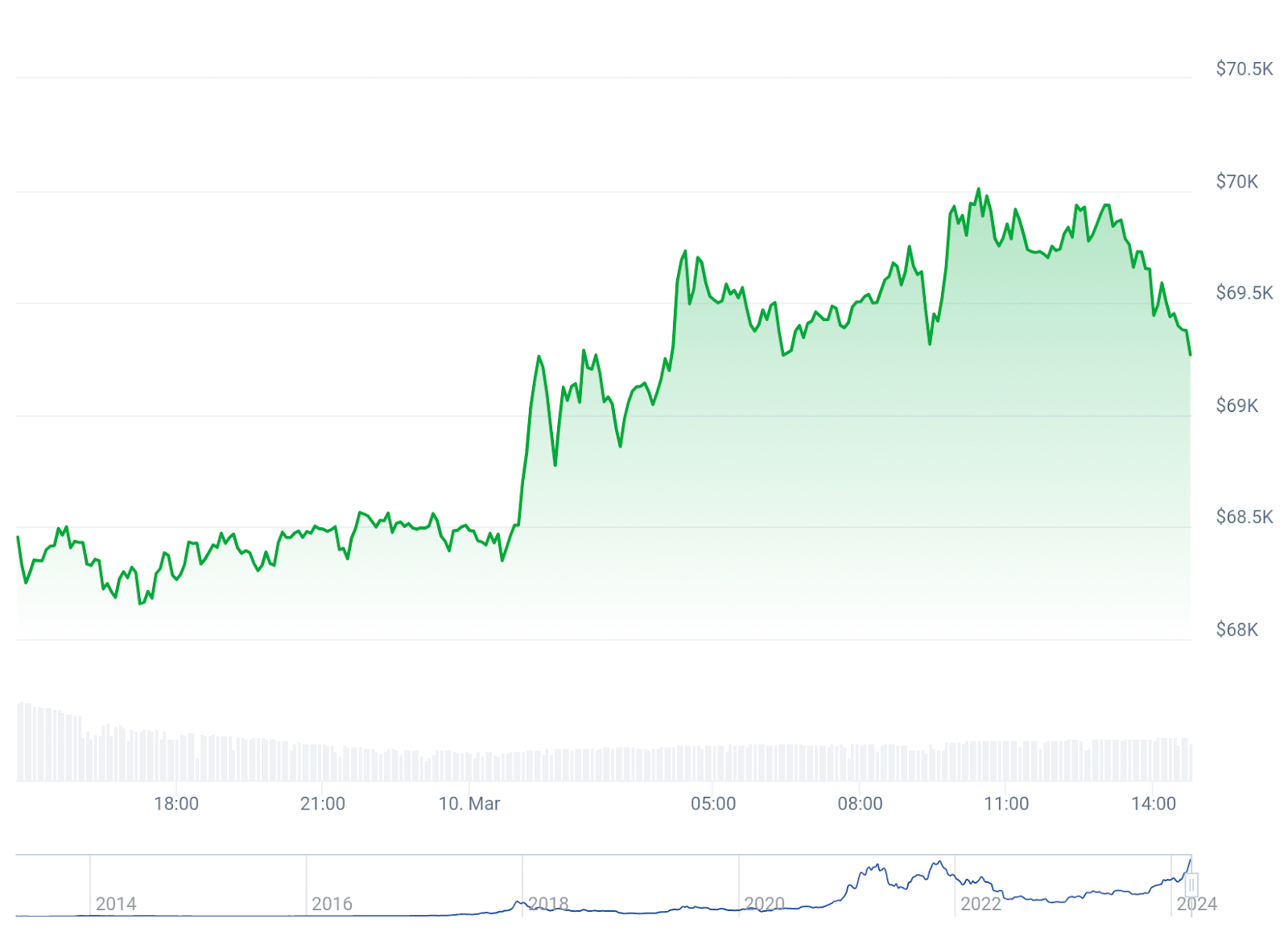

This prediction comes at a time when Bitcoin is showing signs of calming down after hitting a new all-time high of $70,083 on March 8th. Despite falling slightly below the $68,300 threshold, Bitcoin’s resilience remains remarkable.

At the time of writing, the coin's price has increased by 1.5% in 24 hours. According to CoinGecko data, Bitcoin was trading at $69,308. Trading volume for the period decreased by nearly 39%, ending the day at $31,576,168,688.

Lee's insights into Bitcoin's potential trajectory provide bullish investors with a shining lighthouse and a fascinating story in the dynamic world of cryptocurrencies.