![SHEIN's website features actor Kim Yoo-jung, the first global ambassador for its sub-brand Daisy. [SCREEN CAPTURE]](https://koreajoongangdaily.joins.com/data/photo/2024/06/25/0a90cabb-8282-4675-8237-3ee726eb694f.jpg)

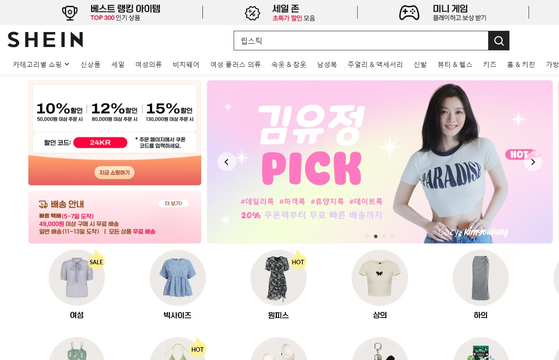

SHEIN's website features actor Kim Yoo-jung, the first global ambassador for its sub-brand Daisy. [SCREEN CAPTURE]

New entrants, Chinese e-commerce and social media companies such as SHEIN and TikTok, are entering the South Korean market as online retailers in South Korea are losing money and more people in the country are buying from overseas sites.

Its emergence comes at a time when Google-owned YouTube has entered the world's fifth-largest e-commerce market by revenue, further squeezing the position of local operators such as Coupang and Lotte.

SHEIN appointed actor Kim Yoo Jung as the first global ambassador for its sub-brand “Daisy” on June 20, formalizing its entry into the Korean market. The company established a Korean subsidiary in December 2022, began social media marketing in August last year, and launched its Korean website in April.

On June 19, Google entered the Korean e-commerce market with the introduction of the world's first YouTube Shopping feature, which allows viewers to purchase products directly from video descriptions.

Last December, the US internet giant pumped 260 billion won ($187 million) into Cafe24, the South Korean e-commerce platform behind YouTube Shopping feature, in an attempt to gain a foothold in South Korea's fast-growing online retail market.

TikTok is also preparing to launch the TikTok Shop in South Korea. The service, which integrates shopping functionality into its existing platform, has expanded to Malaysia, the Philippines, Thailand, the United States and the United Kingdom since launching in Indonesia in 2021.

The TikTok Shop generated $20 billion in global sales last year and is expected to reach $50 billion in sales this year.

The company applied for a trademark for TikTok Shop in South Korea in December last year.

As Chinese online trade companies make inroads into the domestic market, direct online sales from overseas in South Korea are declining, worsening the trade deficit.

Industry analysts attribute the deficit to the aggressive low-price strategies of Chinese platforms making Korean products less competitive in the global market, as well as a sharp decline in demand for Korean products in China, which was once a major market for “reverse direct purchasing.”

In Korea, direct purchasing occurs when domestic consumers purchase goods directly from overseas. Conversely, reverse direct purchasing occurs when overseas consumers purchase Korean goods directly from domestic open markets or online commerce markets. These transactions allow domestic companies to sell their products globally.

South Korea's online shopping market, excluding duty-free shops, had a trade deficit of 5.9 trillion won last year, nearly double the 2.85 trillion won in 2019, according to online shopping trend data released by Statistics Korea on Thursday.

The trade deficit is calculated by subtracting the amount of direct purchases from overseas from the total inward direct purchase sales excluding duty-free shops.

The widening deficit is due to an increase in online purchases by Koreans at overseas shopping malls, while overseas sales of domestic products decline.

South Korea's online direct purchasing market grew from 3.6 trillion won in 2019 to 6.68 trillion won in 2023. This growth was driven by Chinese companies such as AliExpress and Temu's aggressive expansion into the South Korean market by leveraging low-price marketing strategies.

Meanwhile, the amount of reverse direct purchases decreased from 784.8 billion won to 752.9 billion won during the same period.

By product type, clothing and fashion products, which had the largest number of orders from overseas, fell from 302.9 billion won in 2019 to 208.8 billion won in 2023.

Sales of household and automotive products fell to 20.3 billion won from 48.3 billion won, while home appliances, electronic products and communication equipment fell to 21 billion won from 31 billion won.

“In other countries, consumption of relatively expensive Korean clothing items is declining due to the increase in low-priced products from Chinese online commerce providers such as Temu and Shein,” said Ha Myoung-jin, director of the policy support office at the Korea Online Shopping Association.

By region, the decline in consumption of Korean products was most noticeable in China, where sales from direct purchases to China plummeted from 210.4 billion won in 2019 to 154.6 billion won last year.

Meanwhile, sales to Japan increased from 189.3 billion won to 227.5 billion won, and sales to the United States also increased from 186.6 billion won to 240 billion won during the same period.

Orders from China for Korean clothing and fashion-related products, which was the largest category, fell sharply to 33 billion won, from 77.8 billion won in 2019. Cosmetics, which had the second highest sales in 2019, also fell from 59.4 billion won to 23.1 billion won.

“Beauty trends in China have changed before and after COVID-19. The time when Chinese consumers blindly purchased Korean cosmetics has passed because Chinese brands are offering high-quality products,” said an official at a South Korean online platform company.

According to Chinese market research firm iiMedia Research, the number of new cosmetics manufacturers in China is set to surge from 940,000 in 2016 to 3.67 million in 2022.

The decline in sales from reverse direct purchasing is also due to the so-called patriotic consumption trend among China's younger generation, which favors domestic brands over foreign products, as well as a cooling of consumer sentiment due to the slowdown in the domestic economy.

Industry experts see the United States and Japan as alternative markets to China. The share of reverse direct purchases to China is expected to decrease from 29% in 2020 to 21% in 2023. In contrast, the United States will be the largest market with 32%, followed by Japan with 30%.

By product type, sales increases for records, videos, musical instruments, etc. are notable. Album sales, which were approximately 89.4 billion won in 2019, are expected to increase significantly to 181.7 billion won in 2023. This is due to the rapid growth of the K-pop record market.

Although domestic demand for cosmetics in China decreased, the total amount of reverse direct purchases of cosmetics increased slightly from 159.8 billion won to 167.9 billion won.

“Currently, consumption of low- to mid-range Korean cosmetic brands is increasing, especially among the younger generation in the United States,” said Chang Joon-gi, secretary-general of the Korea Cosmetic Association.

Lee Woo-rim, Choi Hye-jin [choi.haejin@joongang.co.kr]