TikTok has put plans to expand its fast-growing e-commerce business in key European markets on hold, focusing instead on growth in the United States, where it is battling divestment and anti-divestment laws.

The ByteDance-owned social media startup had planned to roll out its shopping platform in Spain, Germany, Italy, France and Ireland as early as July but has put that rollout on hold, the people said. The company has also frozen plans to bring its Shops feature to Mexico and Brazil, one of the people said. It is unclear if or when ByteDance might restart that process, the people added. The people asked not to be identified discussing private information.

The move may come as a surprise to many retailers in the region, but it reflects ByteDance's aim to establish itself in the U.S. and prove its value to local retailers and consumers. ByteDance executives want to focus on its most lucrative market, with 170 million monthly users, to head off a possible U.S. ban that has made some retailers hesitant to sign up to new platforms, the people said.

A TikTok spokesperson declined to comment on the paused rollout plans, saying the company is “responding to demand.” “We've seen the positive impact of TikTok Shops and are excited to continue experimenting with this new commerce opportunity,” the spokesperson said.

The company aims to increase U.S. product sales tenfold to $17.5 billion this year. Importantly, management recognizes that any major expansion into Europe could draw the same regulatory scrutiny as in the U.S., the people said.

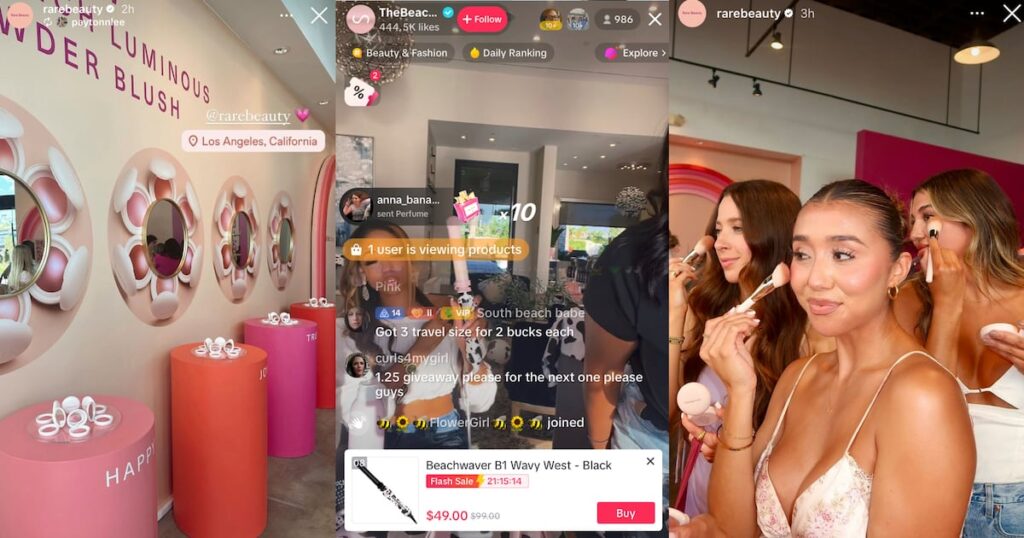

TikTok Shops, which combines addictive video content with impulse buying driven by visual fashion, is the app's fastest growing feature. Its combination of eye-catching videos, popular influencers and authentic commerce helps it differentiate from rivals like Instagram and YouTube and paves the way for it to take on Amazon. TikTok's template is ByteDance's Douyin, currently one of China's largest e-commerce platforms. Using this model, TikTok Shops has found success in Southeast Asia and debuted in the U.S. just in time for last year's holiday season.

It hasn't been all smooth sailing: TikTok Shop launched in the UK earlier this year to mixed reviews as Chinese exporters flooded the market with cheap goods, and TikTok has since relied on top local brands to help it enter the market.

In the United States, the bigger immediate threat is from Washington.

ByteDance filed suit in May against a bill signed by President Joe Biden that was an ultimatum to address national security concerns, banning TikTok if its Chinese parent company did not sell the app by Jan. 19. ByteDance argued that a sale was “commercially, technically and legally unfeasible.”

TikTok has in recent weeks ramped up subsidies and other incentives to jumpstart its U.S. e-commerce business, lowering the bar for creators who want to join its affiliate program from 5,000 to 1,000 followers. Affiliates can post videos promoting products sold in TikTok shops and receive commissions on sales.

Meanwhile, TikTok is facing a European Union investigation in France and Spain into whether a lighter version of the app could foster addiction. TikTok Lite promises to pay users cash through a points system for as long as they keep scrolling through content, a common marketing tactic in China.

Author: Huang Zheping

learn more:

ByteDance could shut down TikTok in the US if legal action fails

The algorithms that TikTok uses to operate are believed to be central to ByteDance's entire operation, making a sale of the app, including the algorithms, highly unlikely.