First Trust Skybridge Crypto Industry and Digital Economy ETF (NYSEARCA:CRPT) has been doing very well, riding the crypto bull market and posting a blistering 196.1% rise over the past year. But while this ETF deserves praise for its outstanding performance, I'm currently bearish on the ETF due to two warning signs lurking beneath the surface: extreme exposure to volatile stocks and high expense ratios. A workaround is being taken for this reason.

What is the CRPT ETF strategy?

Before we discuss the concerns, let's briefly review the CRPT strategy. According to fund sponsor First Trust, CRPT “aims to provide exposure to companies that SkyBridge views as driving innovation around cryptocurrencies, crypto assets and the digital economy.”

The fund was established in September 2021 and has assets under management (AUM) of $51.7 million.

CRPT invests in companies from all aspects of the cryptocurrency industry. This includes Coinbase (Nasdaq: Coin), Bitcoin (BTC-USD) Miners like Marathon Digital (Nasdaq: Mara) and the Riot platform (Nasdaq: Riot), and semiconductor stocks such as Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD) (its graphics processing unit chip is used by miners to mine Bitcoin).

This includes the meta platform (Nasdaq:Meta) and the alphabet (NASDAQ:Google), have different opinions regarding cryptocurrencies, even though cryptocurrencies are not a major part of their respective businesses.

The truth is that CRPT does a very good job of covering all bases and casting a wide net when it comes to investing in companies involved in cryptocurrencies. The question isn't really what you're investing in, but rather how much you're investing in some holdings, as explained below.

Massive exposure to just 2 stocks

CRPT holds 31 stocks, making it a highly concentrated ETF with the top 10 holdings accounting for 91.5% of assets.

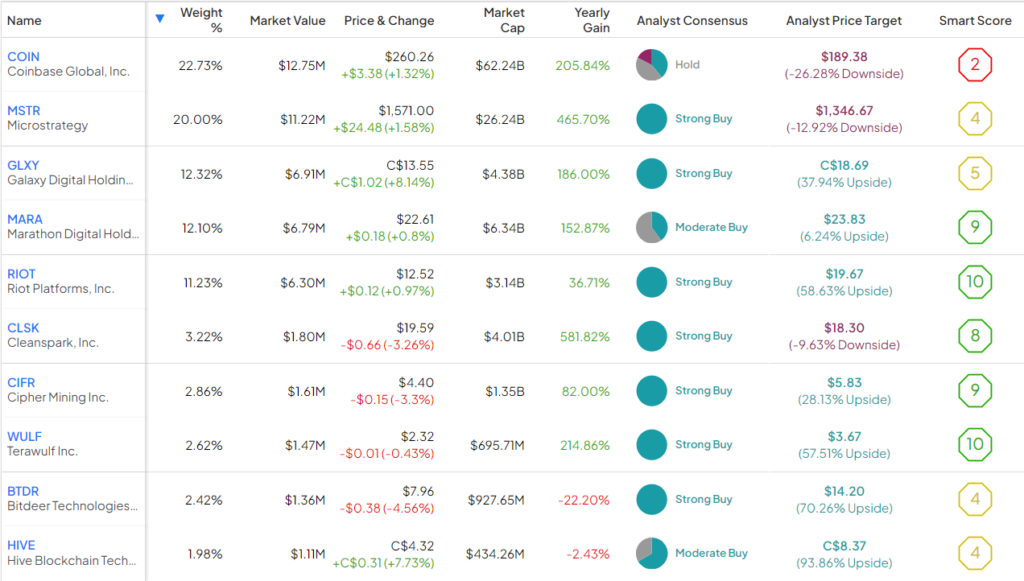

Below is an overview of CRPT's top 10 holdings using TipRanks' holdings tool.

Not only do the fund's top 10 holdings account for more than 90% of its assets, but its top two holdings alone consist of Coinbase and Microstrategy (NASDAQ:MSTR), accounting for a whopping 44.7% of the fund.

To be fair, Coinbase and Microstrategy have been great stocks over the past year, as rising crypto prices have driven their stock prices up significantly. Coinbase is up 205.8% over the past year, while MicroStrategy is up 465.7%.

Although these stocks have performed well, investors should be aware that they are still highly volatile stocks and typically fall significantly when Bitcoin prices decline.

TipRanks' Smart Score system isn't enthusiastic about either of these stocks, giving Coinbase a Smart Score of 2, equivalent to Underperform, and MicroStrategy, giving it a Smart Score of 4, equivalent to Neutral. Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score of 1 to 10 based on eight market factors.

It's easy to forget by now, since we're in the midst of a crypto bull market, that these stocks underperformed in 2022 as crypto prices plummeted and CRPT fell 80.8% in the same year. That was just recently.

CRPT may do well when the cryptocurrency market is strong, but the next time it slumps, investors may need to flee.

Zooming out even further, not only is over 44% of the fund dedicated to just these top two holdings, but 78.4% is dedicated to just the top five holdings, including volatile Bitcoin mining stocks . There's no way around the fact that it's extremely concentrated in just a few stocks and therefore volatile.

very high expense ratio

Another concern with CRPT is that it is an expensive ETF with an expense ratio of 0.85%. This is significantly higher than the average expense ratio of all ETFs (currently 0.57%). This 0.85% expense ratio means that the investor pays an annual fee of $85 on his $10,000 investment.

These fees can really add up over time. For example, if the fund continues to earn 5% annually and maintains its current expense ratio, an investor who invested his $10,000 in the fund would pay a whopping $1,049 in fees over 10 years. Become. It is important for investors to always be aware of fees, as paying such high fees can erode the principal of a portfolio over time.

If ETFs continue to perform as well as they have over the past year, most investors won't mind paying higher fees. But if ETFs underperform again, as they did in 2022, these high fees will be an added hit.

Is CRPT stock a buy, according to analysts?

Turning to Wall Street, CRPT has a Moderate Buy consensus rating, based on 27 Buy, 5 Hold, and 0 Sell ratings assigned over the past three months. CRPT's average price target of $15.56 implies an upside potential of 11.6%.

Bottom line: Be careful

CRPT deserves much credit for its strong performance over the past year. While I'm bullish on the crypto market in general (if crypto prices continue to rise, ETFs may continue to do well for a while), I'm bearish on CRPT as a whole. Because CRPT is dominated by just two volatile stocks and not dominated by smarts. Score: Coinbase and MicroStrategy. This leaves investors with a lot of potential downside risk.

Additionally, this fund is very expensive, with an expense ratio of 0.85%, which is well above average.

While the fund has performed well over the past year, investors should keep in mind that it has fallen more than 80% in 2022 during a long period of declining crypto prices.

Investors have many other options for gaining exposure to the cryptocurrency space. They can invest directly in cryptocurrencies such as Bitcoin and Ethereum (ETH-USD) or BlackRock's iShares Bitcoin Trust (NASDAQ:IBIT) or ARK Invest's ARK 21Shares Bitcoin ETF (Bat:ARKB), the price is a fraction of that of CRPT. In fact, many of these ETFs are waiving fees for the time being as they compete to attract capital, which is understandable for investors.

For those who specifically want to invest in crypto-related stocks of the kind that CRPT invests in, there are lower-cost options with more diversification and less concentration, such as the Fidelity Crypto Industry and Digital Payments ETF (NASDAQ:FDIG). FDIG is also characterized by a large Coinbase position, but it should be noted that overall the top 10 stocks account for 62.9% of the more manageable assets, and its expense ratio is less than half that of CRPT. be.

disclosure