On March 12, Roman Sterlingov, a Russian-Swedish man, was accused of operating Bitcoin Fog, a service that authorities say was used by criminals to launder hundreds of millions of dollars worth of money. He was convicted by a federal jury in Washington, D.C., of money laundering conspiracy and other violations. with ill-gotten gains.

The conviction was hailed by the U.S. Department of Justice as a victory against crypto-based crimes, but Sterlingoff's lawyers say the case against him was flawed and plans to appeal. claims. They argue that the early science used to gather evidence against him was not fit for that purpose.

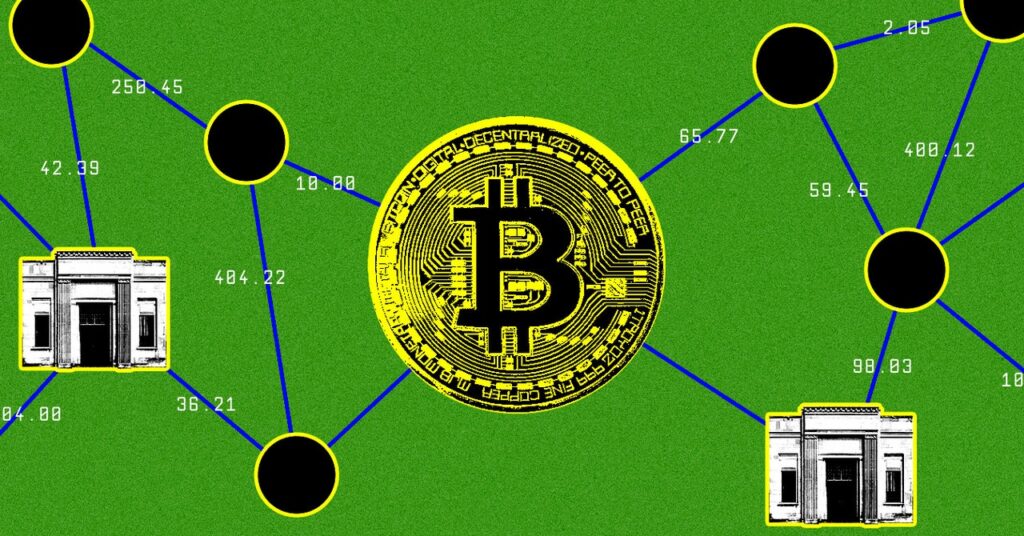

The Justice Department investigation used blockchain forensics, a technology that allows investigators to scrutinize public trails of cryptocurrency transactions to map the flow of funds. Deputy U.S. Attorney Lisa Monaco said in a statement that the Department of Justice “meticulously tracked Bitcoin through the blockchain” to identify Sterlingoff as the pseudonymous administrator behind Bitcoin Fog. “

Bitcoin and other cryptocurrencies have had an unfair reputation for being harder to trace than traditional money, but evidence collected this way has led to the arrest of many criminals over the past decade. I did. Blockchain forensics was crucial to the trial of Ross Ulbricht, the founder of the infamous Silk Road market. However, in the Bitcoin Fog case, the defense spotlighted this investigative method, effectively putting virtual currency tracking on the court's behalf on their client's behalf. Thor Ekeland, Sterlingoff's legal adviser, said the case was “the first of its kind.” “Blockchain forensics is something completely new, so no one has tried it before.”

Prior to Mr. Sterlingoff's trial, his lawyers asked the presiding judge to request a hearing from blockchain forensics experts using software from a company called Chainalysis, which speeds up the tedious process of scrutinizing blockchains. asked to determine the admissibility of the evidence. He ruled that the evidence was admissible.

The decision was characterized by Chainalysis CEO Michael Gronagar as an endorsement of his company and its methods. “We are currently the only company in the world that has been given the seal of approval for its ability to interrogate blockchain and create evidence,” he says. But Ekeland said he plans to work with Starlingoff to appeal both the guilty verdict and the judge's ruling on the validity of blockchain forensics. Ekeland argues that Sterlingoff's conviction is the latest example of the unfortunate phenomenon in which “newly emerging junk science leads to unjust convictions.”

Chainalysis's Beth Bisbee, Chainalysis's former head of U.S. investigations, disputes that characterization. “The evidence the government presented to the jury showed exactly the opposite,” said Bisbee, who testified as an expert witness at the trial. “Our methods are transparent, tested, reviewed, and reliable.”

Nutsec threat

Until it was shut down by US law enforcement in 2021, Bitcoin Fog provided a service known as cryptocurrency mixing or crypto tumbling service. Funds belonging to many political parties are pooled, jumbled, and disgorged into brand new wallets, concealing the origin of the coins held in each. Mixers were originally promoted as a way to increase the level of privacy that cryptocurrencies can offer consumers, but they have easily been used for money laundering purposes. Bitcoin Fog was one of the first mixers to appear in 2011 and has become “the longest-running Bitcoin money laundering service on the darknet,” the Justice Department said.

The US government has cracked down on cryptocurrency mixers in recent years, considering them a threat to national security. After crushing Bitcoin Fog, the US Treasury sanctioned another mixer, Tornado Cash, in 2022. The following year, it took down another Mixer, ChipMixer, and charged its founder with money laundering. To identify the individuals behind these operations, investigators needed to track the cryptocurrencies.