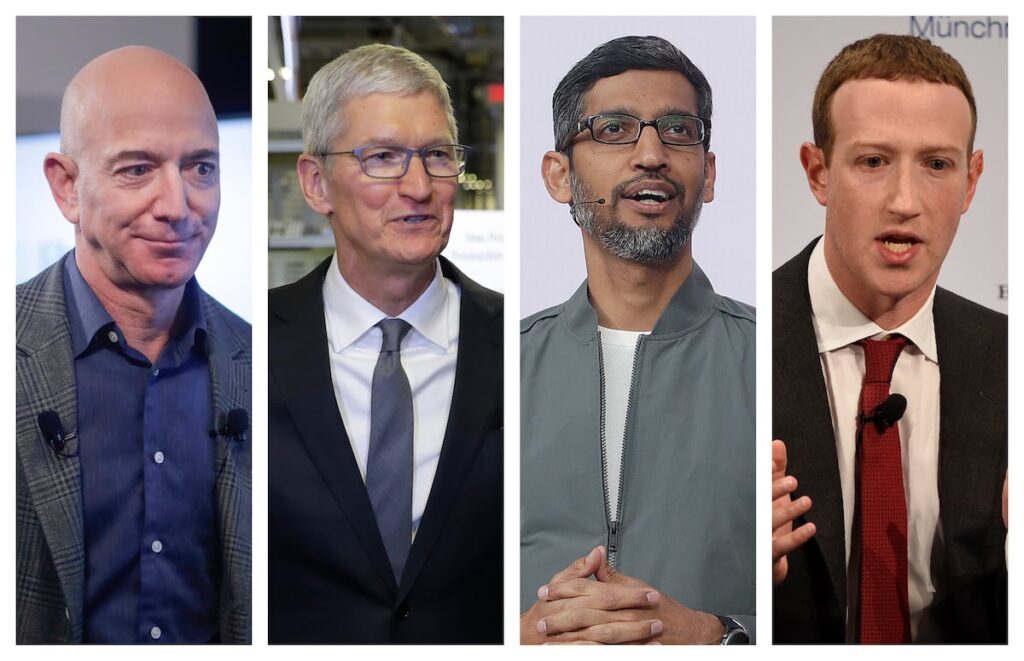

Despite regulatory pressures, the dominance of technology companies is increasing. Authorities in the United States and Europe have launched an offensive to end monopolistic practices deemed illegal. But on the other hand, digital giants are becoming increasingly bankable companies, benefiting from a new golden goose: artificial intelligence. Profits at Alphabet, Apple, Amazon, Microsoft and Meta soared 38% in the first quarter to $92.037 billion.

Nvidia joins the five major tech companies. Nvidia operates on an irregular fiscal calendar and is scheduled to release its February-April financial report on May 22, which is also expected to show record sales and profits. The stock market value of these six companies has reached a combined $13 billion, reaching an all-time high on the back of their performance.

Apple enjoys a huge market share in high-end smartphones. Google has no rivals in the search engine and online advertising space. Amazon dominates e-commerce. Microsoft, Operating Systems. Meta has an enviable position within social media such as Facebook, Instagram, and WhatsApp. Meanwhile, Nvidia holds a new monopoly in high-performance processors. Each continues to siphon juice from their respective markets and add new divisions.

Another similarity is that all six companies are working on artificial intelligence, which requires significant investment to maintain their market position. Microsoft is leading the pack thanks to its partnership with OpenAI. Cloud computing businesses as well as their own products incorporate varying levels of artificial intelligence. Alphabet, caught off guard by generative artificial intelligence, is rapidly regaining the ground it lost in its server business. Amazon is a pioneer in recognizing cloud data and computing as a big business, but it also leverages artificial intelligence for commercial products, inventory management, and even route optimization. Meta leveraged his AI to successfully attract users to his social media platform and improve ad management. Apple is the wild card behind in generative artificial intelligence, but it is incorporating certain AI-powered features and apps into its products and services. Nvidia, which counts other companies as customers, is the biggest beneficiary of the new technology gold rush.

Alphabet, profit leader

The only company that didn't break records in the first quarter was Apple. Revenue fell 4% to $90.753 billion and profit fell 2% to $23.636 billion, hampered by declining iPhone sales and chain supply chain delays. The company faces regulatory pressure related to its app stores and lawsuits over illegal monopolistic practices in the U.S. smartphone market. The Justice Department accused the company of protecting the iPhone's dominant position by cutting off its technology ecosystem to competitors.

Tim Cook's Alphabet was the profit leader with a 57% increase to $23.662 billion, as improved marketing and server growth led to a 15.4% increase in sales. Sundar Pichai's company has been hit with multimillion-dollar sanctions from the European Union and faces two lawsuits from the US Department of Justice. One, concerning the search engine market, is scheduled to be decided next Friday in Washington, DC. The other case, related to digital advertising, is being heard in court. Amazon, on the other hand, took the lead in terms of sales, recording a growth of $143.313 billion, which corresponds to a significant increase of his 12.5%. Profits tripled to $10.431 billion. Although the e-commerce business makes up the bulk of CEO Andy Jassy's company, cloud computing and advertising businesses (commercial platforms and streaming services) are also key drivers of growth. The Federal Trade Commission (FTC), headed by Lina Khan, accused Amazon of monopolistic practices that “raise prices, degrade quality, and stifle consumer and business innovation.”

Revenue and profit increased more than expected, driven by business demand for Microsoft's cloud and AI services. Profits at the Satya Nadella-led company rose 17% to $61.858 billion in the first quarter of the calendar year, a third higher than in the fiscal year. Net income increased 20% to $21.939 billion. After overcoming hurdles in the Activision acquisition, the partnership with OpenAI is now under the scrutiny of both the Department of Justice and the FTC.

The only bad performance in the market was due to the meta, but not due to the numbers per se. Sales at the company founded and run by Mark Zuckerberg rose 27% to $36.455 billion in the first quarter. Still, after fiscal austerity in 2023, it raised spending and investment estimates based on AI, surprising the market. The outlook for the second quarter was also disappointing. Separate from the lawsuit over the impact of social media on minors, the FTC also sued Mehta in 2021 for undermining competitiveness in its acquisitions of Instagram and WhatsApp, and that proceeding is still ongoing. It is. The FTC hopes to take the case to court later this year.

So far, no fines, lawsuits, investigations or regulatory changes have been able to slow the tech giant's unstoppable growth. Big technology companies have become monopolies in the digital age thanks to the innovation and global success of their products and services. They're all competing for a piece of the AI pie.

sign up Get more English news coverage from EL PAÍS USA Edition with our weekly newsletter.