Overview of the latest investment trends from Steven Cohen (Trades, Portfolio)

Steven Cohen (Trades, Portfolio)'s Point72 Asset Management recently increased its stake in Health Catalyst Inc (NASDAQ:HCAT), a prominent player in the healthcare data analytics space. On December 31, 2023, the company added 275,602 shares to its portfolio, reflecting a 7.10% change in its holdings. Although the deal has an impact of just 0.01% on the overall portfolio, it signifies Cohen's firm's increased focus on health care.

Steven Cohen (Trading, Portfolio) and Point72 Asset Management

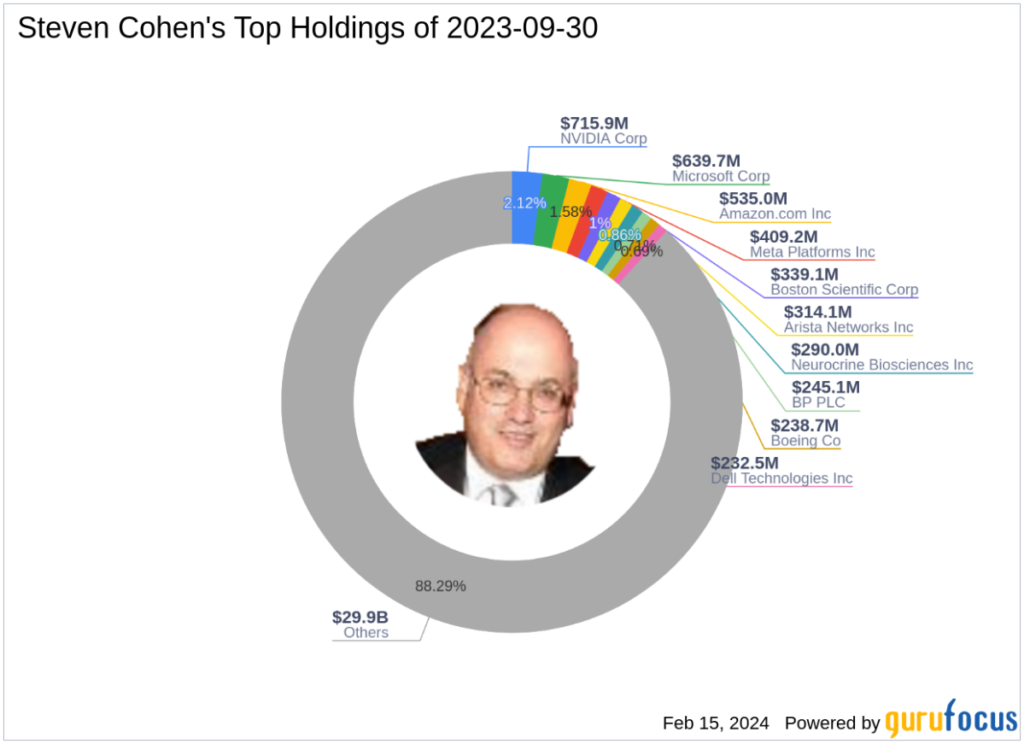

Stephen A. Cohen, Chairman and CEO of Point72, is a prominent figure in the investment world with a career spanning more than 40 years. His Point72, a multi-manager platform, is known for its long/short equity strategies with an emphasis on fundamental bottom-up research processes. The company's major holdings include giants such as Amazon.com (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT), and it has a strong inclination toward the technology and healthcare sectors. As of the latest data, Point72 manages his stock portfolio worth $33.83 billion.

Overview of Health Catalyst Inc.

Health Catalyst Inc provides critical services to healthcare organizations with a focus on data and analytics technology. Since his IPO on July 25, 2019, HCAT has been working to strengthen its healthcare delivery through its technology and professional services divisions. Despite market challenges, Health Catalyst maintains a market capitalization of $540,973,000, with its current stock price hovering around $9.4.

Steven Cohen's recent trade details (trades, portfolio)

The acquisition of additional shares of HCAT by the company of Steven Cohen (Trades, Portfolio) was effected at a transaction price of $9.26 per share. This move increases the company's total holdings in Health Catalyst to 4,159,454 shares, representing 7.20% of the company's stock. This transaction slightly strengthens the company's position in HCAT, which now represents 0.11% of its investment portfolio.

Health Catalyst market position and track record

Health Catalyst's current market position is reflected in its stock price, which has increased by 1.51% since the trading date. However, the stock has experienced a significant decline of 74.85% since its IPO. The stock price has increased modestly by 3.07% since the beginning of the year. In the highly competitive healthcare provider and services industry, HCAT's performance is closely monitored by investors.

HCAT's financial health and stock valuation

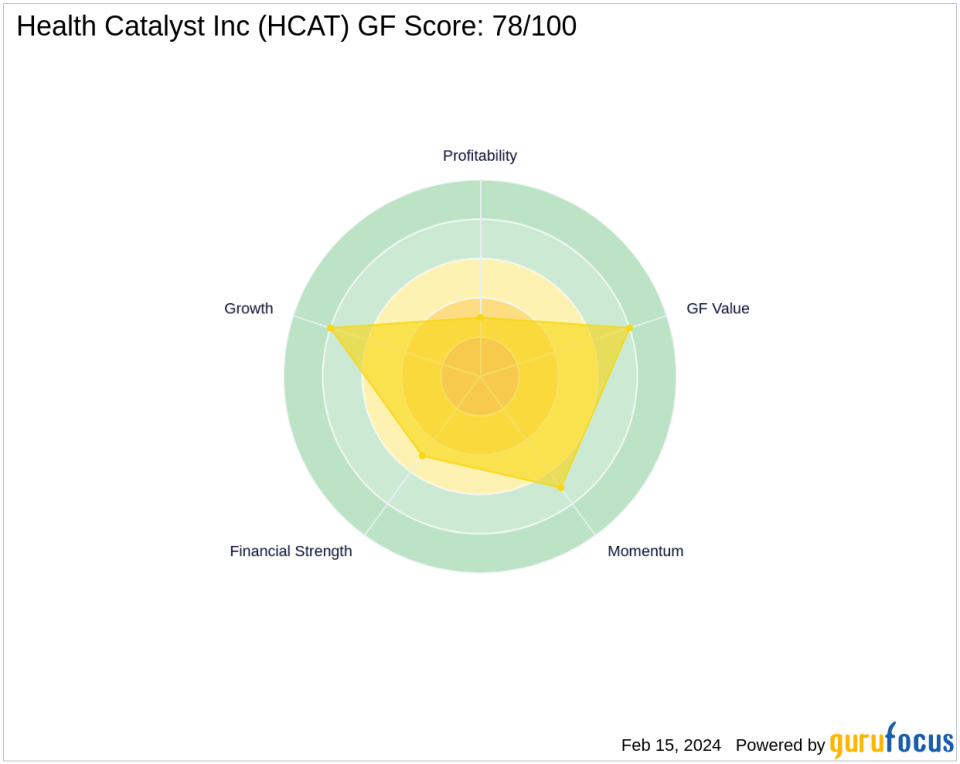

Health Catalyst's financial health is mixed, with a cash-to-debt ratio of 1.40, indicating some financial stability. However, the company's profitability remains a concern, with a profitability rank of 3/10. Stock valuation indicators such as GF Value Rank 8/10 suggest that the stock may be undervalued, but caution should be taken as it is designated as a “possible value trap.”

Comparing Health Catalyst performance metrics

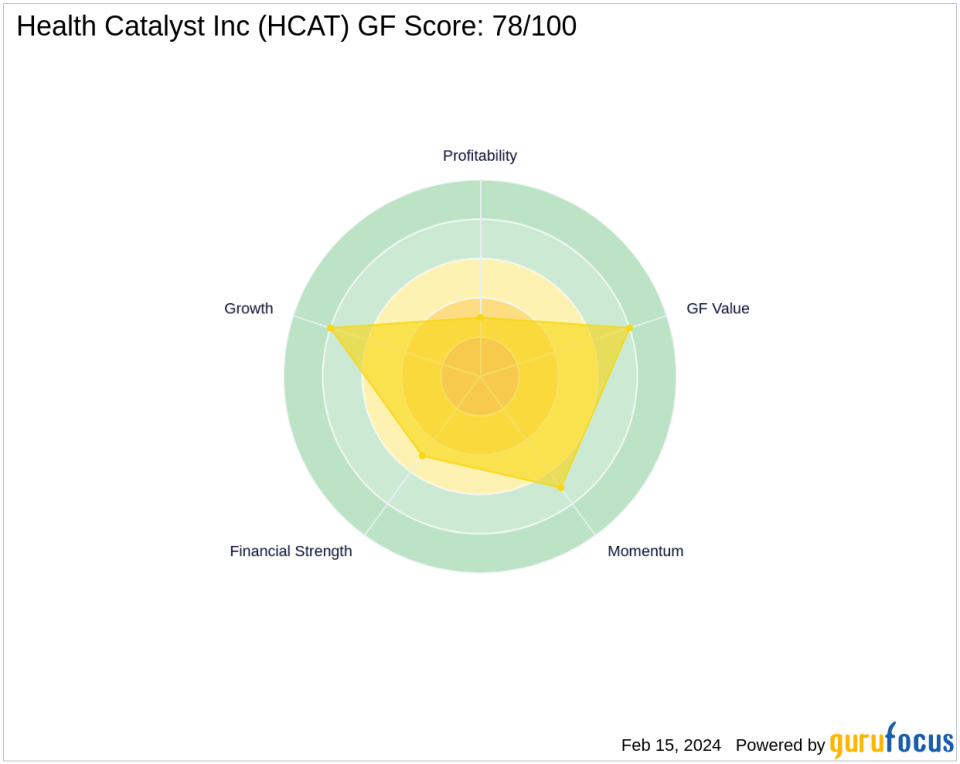

The HCAT GF score is 78/100, indicating an average performance potential. The company's financial strength and profitability are concerns, ranking it 5/10 and 3/10 respectively. However, his Growth Rank and his GF Value Rank are more promising at 8/10, respectively, suggesting some potential for future growth and value realization.

Implications for value investors

Steven Cohen (Trades, Portfolios)'s recent investment in Health Catalyst may be of interest to value investors, given the company's growth potential and current undervaluation. However, the risks associated with a 'potential value trap' designation should be carefully weighed against a company's profitability. While the deal would have minimal impact on Cohen's portfolio, it reflects a strategic interest in the healthcare analytics space and could have far-reaching implications for market watchers and investors alike.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.