iHeart Podcast Awards 2024

Mike Beard, Nexstar's president and chief operating officer, said that as a sports fan, trying to switch between streaming and linear TV “makes you want to pull your hair out.”

This “less than ideal” user experience explains why 60% of viewership Citing an internal investigation, the executive said it was being aired on local stations rather than Prime Video. Beard, who joined Nexstar last summer after a long career at Fox, made the comments Tuesday at Deutsche Bank's Media, Internet and Telecom conference.

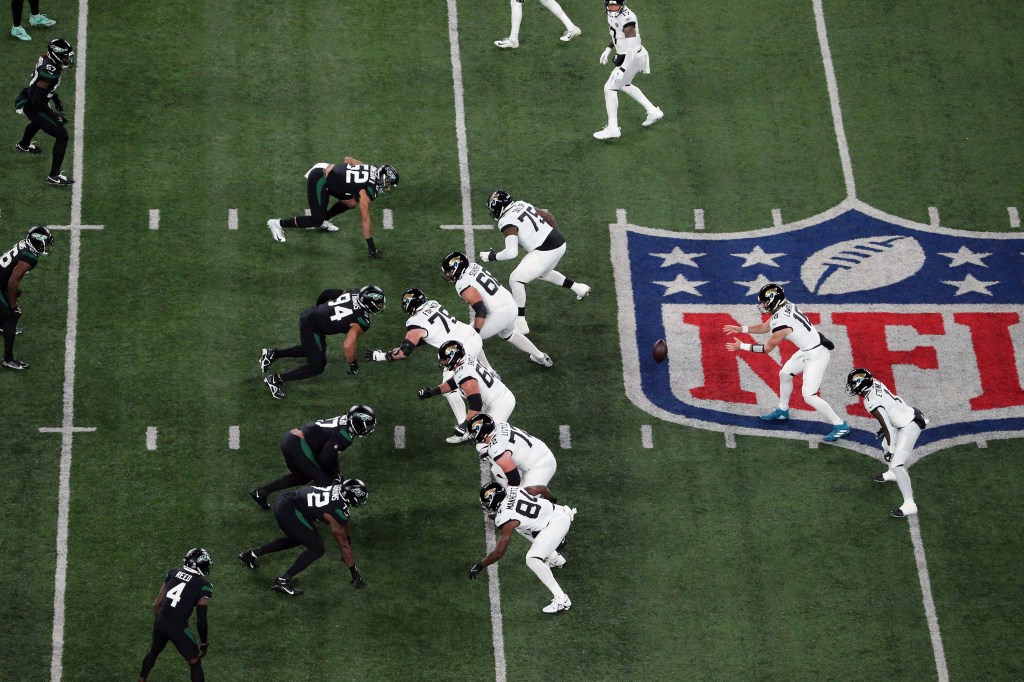

Under the terms of the NFL's media rights agreement, games broadcast on streaming or cable TV will also be available for free over-the-air through local television stations in the home markets of the two competing teams. This is the second year of Prime Video's 11-year contract. thursday night footballrecorded a 24% increase in total viewers in its second season.

“People often talk about it as if Amazon has a monopoly on these games,” Beard said. However, he continued, “If you look at the ratings in the local market, people tend to vote more heavily on going to the broadcast than on Amazon Prime to watch that game. Our research shows that on average, approximately 60% of viewers in both teams' markets choose the broadcast over Amazon Prime, despite Prime's steady promotion across other NFL television broadcasts. It will be.

Nexstar owns the largest portfolio of local television stations in the United States and also has a controlling stake in the CW broadcast network.

Beard elaborated on his leanings toward broadcasting, returning to the living room experience.

“You see a timeout on the TV, a player gets injured on the field, whatever it is. You want to change the channel, see what's going on in another game, check something out,” he said. spoke convincingly, as if speaking from personal experience. “You have to click six times to switch from Amazon Prime. Then you have to go back and change the input on your TV. By the time it's over, you want to pull your hair out. And then another match is on and you're done.” If you're trying to do it when you're there and you want to go back and forth, God help you. The user experience is not ideal at all.”

Across its portfolio, Nexstar has sought to leverage its scale in local television as well as building sports programming on the CW. In Southern California, the company reached a deal with the NBA's LA Clippers for a limited game schedule and television broadcasts. A select number of teams are launching similar experiments to replace the broken regional sports network model, which is increasingly marred by the remnants of cable TV's peak more than a decade ago. The Clippers' RSN partner, Bally Sports, is operated by Diamond Sports Group, which declared bankruptcy last year after struggling to keep up with dramatic changes in viewership and technology.

“Right now, everything impacting RSN is completely in flux,” Beard said. “If I knew what the future of that business was going to be, I would figure out a way to bet on it, because it's totally uncertain.”

Under the Clippers' deal, 15 games will be broadcast on Nexstar's KTLA-TV this season, and 12 to 15 games per year going forward. Although this table represents only a “clear minority” of the team's 82-game regular-season schedule, Beard said, “When those games are broadcast, we get about 100% greater ratings than we do on RSN.” will be held at KTLA.''

The executive said it would be “perfectly logical” for teams to consider moving away from the hefty fees traditionally paid by RSNs, but for simple economic reasons the transition is unlikely for the time being. He acknowledged that it would be uneven. Clippers owner Steve Ballmer, the billionaire owner, said he has the “resources and foresight to see the wisdom” of the change, but “it remains to be seen whether all other teams will approach it the same way.” No,” Beard said. Not everyone has the financial wherewithal to make the decision to forego a big check for reach. That's part of the tension there. ”

Asked about the sports streaming bundle that Disney, Fox and Warner Bros. Discovery announced earlier this year, Beard noted that it faces a number of challenges before it can be brought to market. Hurdles include regulatory scrutiny, technology and subscriber acquisition, and the day-to-day operations of joint ventures, which are often difficult in the media business. If the product were to be released, Beard said, “We would welcome it.” Nexstar stations broadcast sports on his 24/7 network. He can opt into a bundle consisting of 14 linear feeds and receive paid transportation fees.

Beard said he doesn't see that as a threat to Nextsar's core business, as the joint venture partners expect millions of code nevers to sign up in the low single digits. Instead, he said, “It will be a great opportunity to introduce viewers to our stations that they may not be familiar with right now.”