After an initial trial, authorities have acquitted South Korean crypto traders accused of engaging in arbitrage between foreign and domestic exchanges. They allegedly sought to take advantage of the price difference known as the kimchi premium between Korean exchanges and overseas exchanges.

Prosecutors argued that the price difference ranged from about 3% to 5%, leading to profits of about $3.2 billion.

South Korean crypto trader solves the problem

According to local reports, a judge ruled that traders should register to conduct trading activities between domestic and foreign exchanges. However, this registration requirement is difficult to enforce.

“If the defendants' actions are considered 'settlements between South Korea and foreign countries,' companies conducting such activities should register with the Ministry of Economy and Finance for trade settlements.”

Basically, the traders took advantage of the price difference between cryptocurrencies on Korean crypto exchanges and foreign crypto exchanges.

Korean exchanges consider cryptocurrencies to be more expensive. This is because there are few investment opportunities with high returns in Japan.

This phenomenon is known as kimchi premium, but when the price decreases it is called kimchi discount.

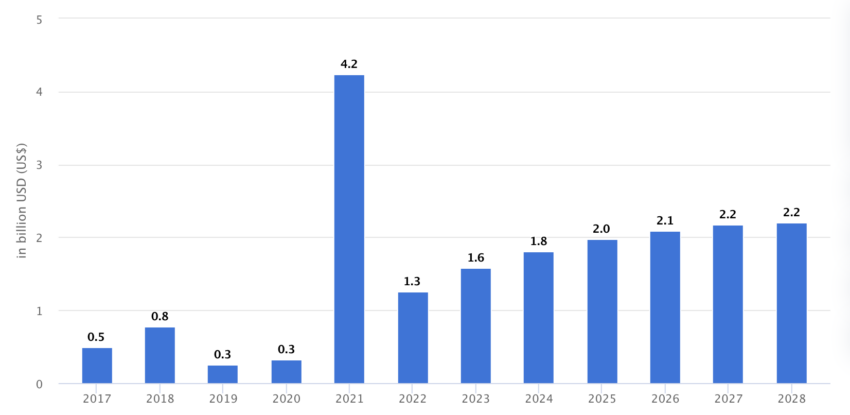

In 2021, South Korea's crypto revenue reached a peak of $4.2 billion. This reflects Bitcoin's historic rise to around $65,000 on global exchanges.

Looking to the future, Statista predicts that domestic crypto revenue will reach $2.2 billion by 2027.

Furthermore, the diligence of bank employees was also severely investigated in the trial. It states that 16 individuals made large profits by exploiting the price difference between his two exchanges.

“Bank employees appear to have processed remittance transactions in most cases without verifying whether the transactions described in the foreign exchange remittance applications actually existed.”

Read more: Top 7 crypto exchanges with the lowest spreads in 2023

The court declared that, despite the prosecution's appeal, there was insufficient concrete evidence to prove violation of the law.

“Therefore, even if this case is found not guilty, it cannot be said that it violates Supreme Court precedent.”

However, the clarity of regulations within South Korea remains unclear. On February 7th, BeInCrypto reported that the Virtual Asset Protection Act will not come into effect in South Korea until July 2024.

Cryptocurrency traders within the Korean government

Once these regulations are in place, traders who conceal important information or participate in market manipulation or fraud may be subject to penalties. This includes the possibility of life imprisonment.

In December 2023, BeInCrypto reported that cryptocurrencies are gaining popularity among South Korean parliamentarians.

Read more: 11 Best Altcoin Exchanges for Cryptocurrency Trading in January 2024

According to a study conducted by the Anti-Corruption and Civil Rights Commission, only eight members owned 24 types of crypto assets as of 2022.

However, by 2023, the number of members has increased to 17, and they now hold 107 types of crypto assets. This number accounts for nearly 6% of all South Korean National Assembly members.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.