Soleil Boughton, Chief Legal Officer of Hims & Hers Health, Inc. (NYSE:HIMS) sold 23,081 shares of the company's stock on February 15, 2024, according to a recent SEC filing. This transaction was part of a series of sales by insiders over the past year, with a total of 218,440 shares sold and no stock purchases.

Hims & Hers Health Inc is a telemedicine company offering a modern approach to health and wellness. The company's platform connects consumers with qualified medical professionals to ensure they receive quality medical care for a variety of conditions related to primary care, mental health, sexual health, dermatology, and more. Hims & Hers aims to make health care more accessible and convenient through telehealth services and personalized treatment plans.

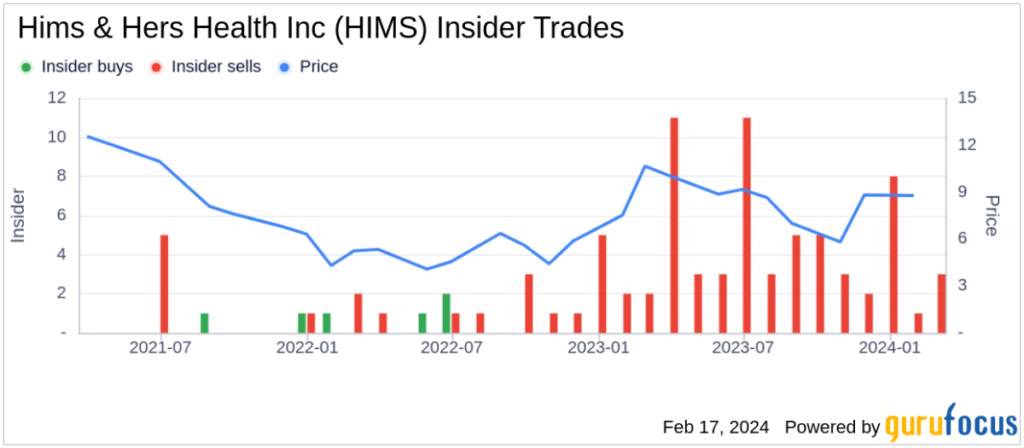

Hims & Hers Health Inc's insider trading history shows a pattern of insider selling, with 59 insider selling and no insider buying over the past year.

On the day of the most recent insider sale, Him's & Hers Health Inc. stock was trading at $10.01, giving the company a market cap of $2.126 billion.

Its Price to GF Value ratio of 0.82 and GuruFocus Value of $12.16 indicate that Hims & Hers Health Inc is considered moderately undervalued.

GF Value is a proprietary intrinsic value estimate by GuruFocus and is calculated based on historical trading multiples, GuruFocus adjustment factors related to the company's past performance, and future performance estimates provided by Morningstar analysts. will be done.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.