Joe McCann, CEO and CIO of crypto hedge fund Asymmetric, recently made a bold statement. statement X (formerly Twitter) predicts Solana's market capitalization to be $1 trillion. McCann's argument hinges on several key points detailing why he believes Solana has achieved product-market fit (PMF) as a “retail chain.” Contrasting this with Ethereum's challenges and perceived shortcomings for retail users.

Solana beats Ethereum

McCann criticized Ethereum for not being designed with retail in mind, arguing that its slow and expensive Layer 1 ( L1) Pointed out transaction. He says, “Ethereum is not a chain designed for retail. L1 is too slow and expensive, and L2 is (currently) a UX nightmare.”

New user friction, liquidity fragmentation beyond “40 L2”, and complexity associated with bridging are highlighted as major barriers to Ethereum adoption by broader retail users.

Looking to open source projects backed by companies like Coinbase's L2 solution, Base, McCann acknowledges that they have the potential to solve some of the UX issues. But he also points out that such projects have an inherent priority of serving corporate interests, often at the expense of the needs of the broader community.

Despite the criticism, he admits: “Most of a company's open source ends up contributing to company priorities…and it should be!” It emphasizes the complexity of finding balance with the mind.

McCann attributes Solana's rise to its ability to effectively serve the retail sector, particularly through its association with meme coins and speculative trading. He explains that Solana was originally a “blockchain at Nasdaq speed” due to its high throughput and low latency, and notes that the story is taking a pivotal shift towards retail.

He said: “The concept of The Chain for Retail™️ has never surfaced. Until now.” This change is largely due to support for Solana by the memecoin community and subsequent speculative trading, with a clear PMF relationship with retail users. is shown.

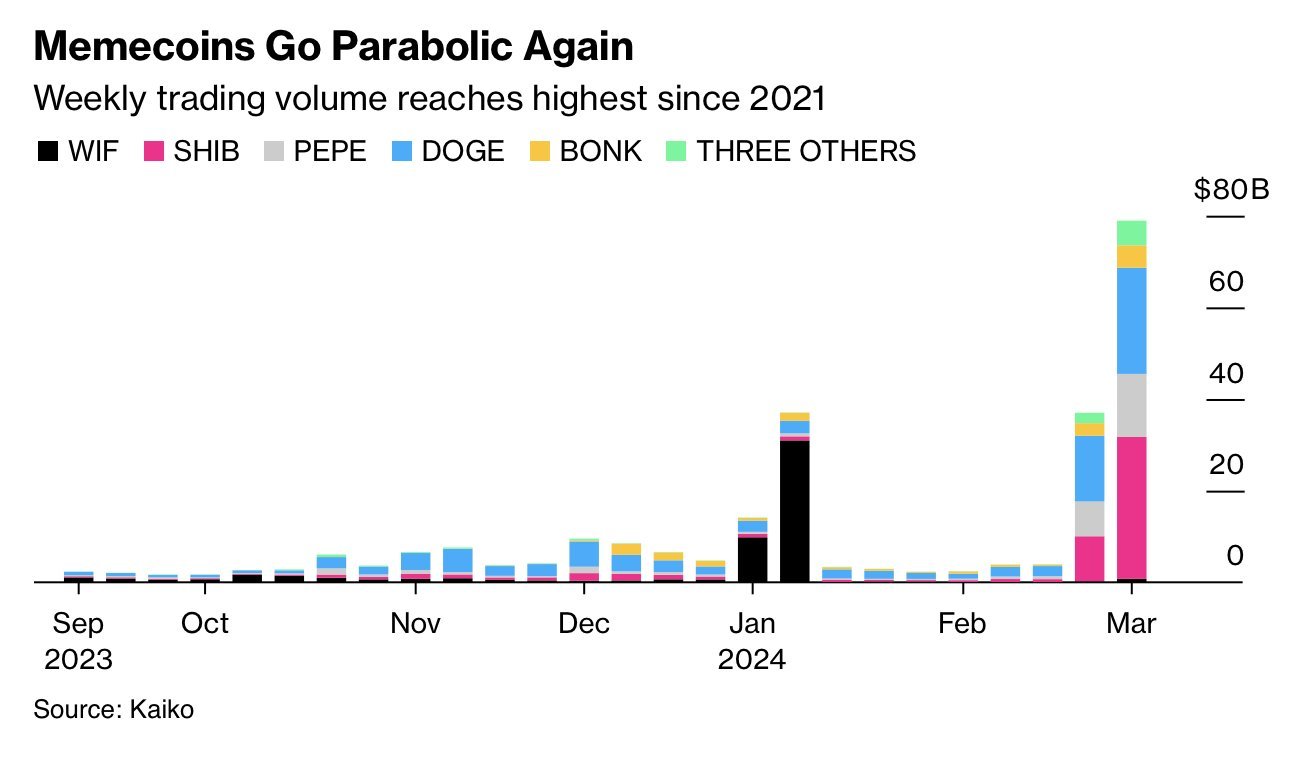

McCann specifically highlighted the explosion of meme coin speculation on Solana following the NFL season, saying, “Since the NFL season ended, there has been an explosion of meme coin speculation… BONK and WIF join Solana. “I am doing it,” he pointed out. […] Thousands are created every day and trading volume is exploding. ”

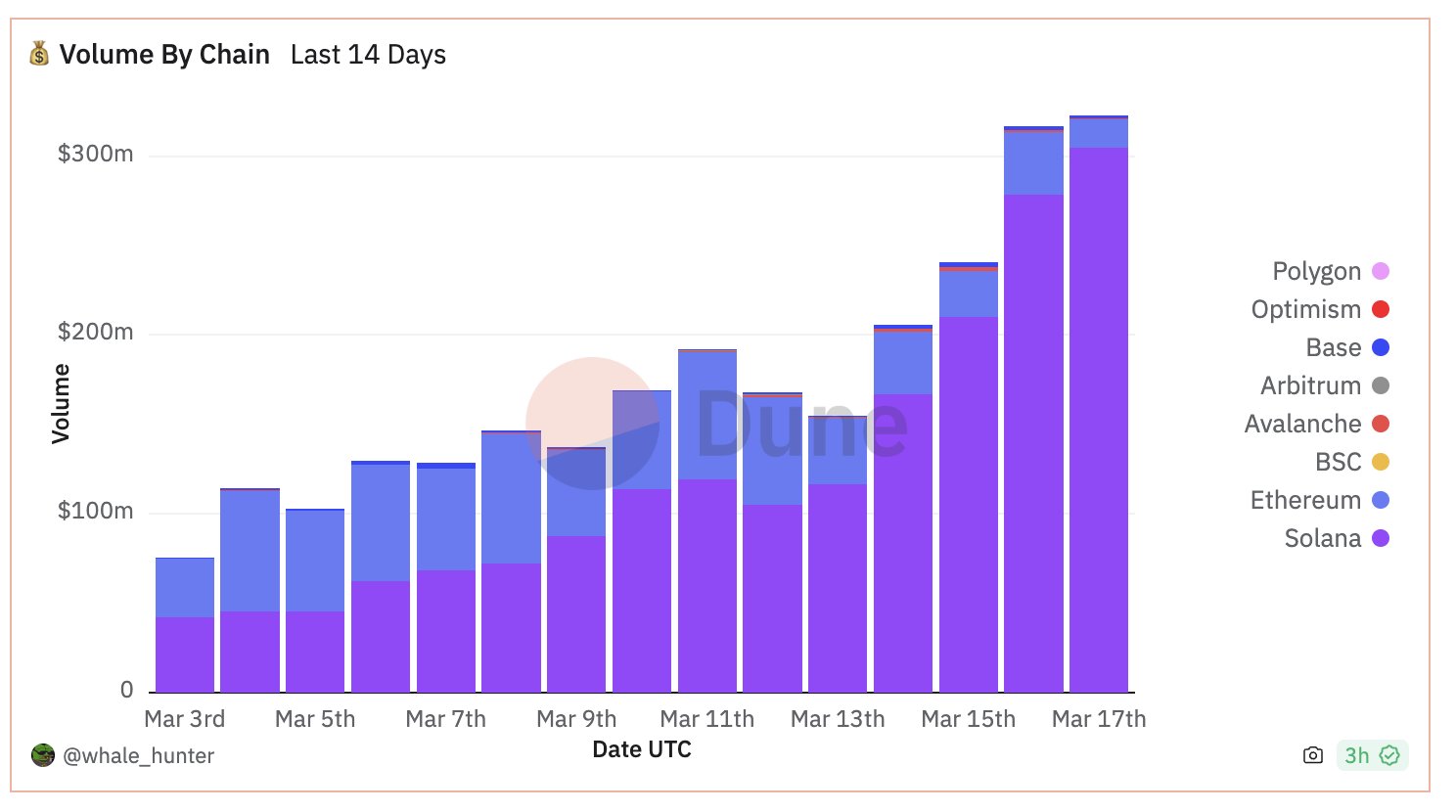

The widespread creation and trading volume of these coins on Solana is considered evidence of their attractiveness and usefulness to retail speculators. Notably, the majority of meme coins are on Solana rather than Ethereum.

“Trading bots, aka the “Robinhoodization of cryptocurrencies,” are driving a large portion of trading due to their…excellent UX. […] And most of those bots are trading meme coins on Solana. Solana is now consistently reversing Ethereum in DEX volume, but for some reason SOL is still 1/4th of Ethereum's value, compared to 1/8th just a few days ago,” McCann said. said.

He contrasts Solana's market cap with Ethereum's market cap and uses relative valuations to argue for Solana's growth potential. With Ethereum valued at just under $500 billion and Solana valued at approximately $115 billion, Solana's path to a $1 trillion market cap presents a nearly 10x growth opportunity, far exceeding Ethereum's potential. He suggests that this means.

“$1 trillion from ETH is 2x. $1T from SOL is almost 10x. Which horse would you bet on? Obviously the fastest one,” McCann concluded, adding that the retail-friendly ecosystem and meme coins We summarized our bullish outlook for Solana based on strong activity around the core.

At the time of writing, Solana's price was $201.27.

Featured image from Euronews, chart from TradingView.com

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC's opinion on whether to buy, sell, or hold an investment, and investing naturally involves risk. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.