On Thursday, the bitter legal battle between the crypto industry and the Securities and Exchange Commission intensified as ConsenSys, a major backer of the Ethereum blockchain, filed a lawsuit against the agency in Texas federal court. The complaint seeks to avert an impending SEC lawsuit against the company over features of the popular MetaMask wallet, but it also argues that Ethereum's digital token, Ether, is not one of the biggest legal challenges facing the crypto industry. asks the court to resolve one of the uncertainties. Security.

In a 34-page legal filing, ConsenSys argues in dramatic language that the SEC's efforts to assert jurisdiction over Ethereum are illegal and a threat to broader blockchain technology. ing.

“The SEC’s unlawful usurpation of power over ETH would be a disaster for the Ethereum network and ConsenSys. All ETH holders, including ConsenSys, would be in violation of securities laws if they transfer ETH on the network. be feared,” the complaint states. “This would halt the use of the Ethereum blockchain in the United States and cripple one of the internet’s greatest innovations.”

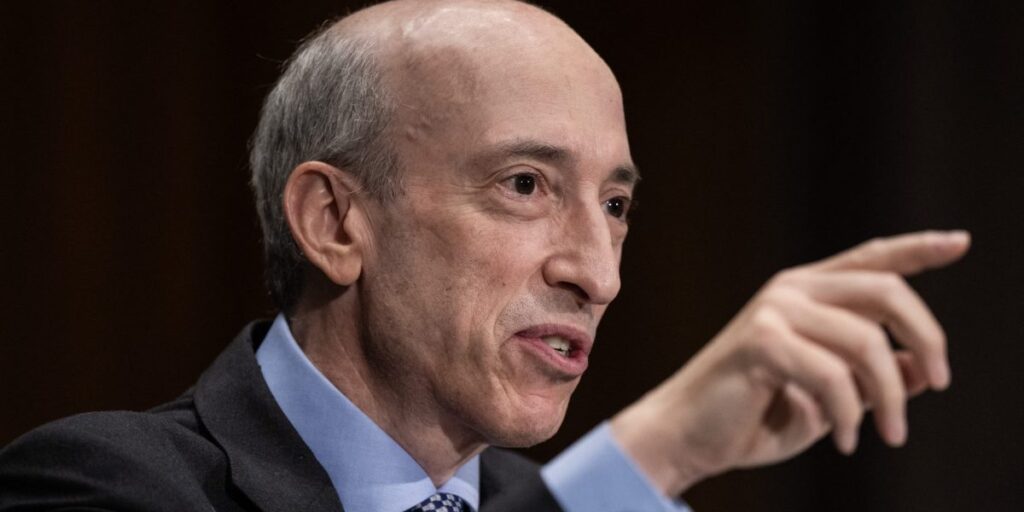

The new lawsuit comes as SEC Chairman Gary Gensler pursues an aggressive enforcement campaign against major players in the cryptocurrency sector, including Coinbase and Uniswap. In recent weeks, the campaign has issued a flurry of subpoenas to companies and developers seeking documents related to their transactions with the Ethereum Foundation, a nonprofit organization that supports blockchain development.

Gensler's tactics have angered many in the cryptocurrency industry who are frustrated that the SEC has not provided clear rules or created a regulatory model that describes the distinct characteristics of blockchain technology. It's set. Gensler disputed this, arguing that existing securities laws are clear and sufficient and that the crypto industry refuses to abide by them.

The debate over Ethereum has become particularly heated since the SEC has repeatedly indicated in the past that blockchain tokens like Bitcoin are not securities and therefore outside its jurisdiction. This includes a landmark speech in 2018 in which a senior official said Ethereum was “well decentralized,” and the regulator’s decision last year to allow Ethereum futures trading (which implicitly implied that Ethereum was a commodity). (which we have approved) is included. Meanwhile, a video surfaced in 2018 in which Gensler himself, as a private citizen, told a hedge fund that Ethereum was not a security.

However, these precedents have not deterred Gensler, who appears to be using Ethereum's recent feature known as staking as the basis for his latest legal activity.

Warning notices and preemptive actions

ConsenSys' complaint filed Thursday reveals that the SEC issued a so-called “wells notice” earlier this month. This is a formal letter warning that the SEC intends to sue the company, often leading to a swift settlement. The complaint added that in a related call, the SEC told ConsenSys that MetaMask was operating as an unlicensed broker-dealer.

According to ConsenSys, the SEC objects to MetaMask offering a means to stake Ethereum on behalf of users. Staking is a relatively new process in Ethereum that was introduced across the blockchain in September 2022, replacing energy-intensive mining with a system of validators pledging collateral to become trusted validators. I did.

In an interview with luck, ConsenSys founder Joe Rubin called the theory that staking turned Ethereum from a commodity to a security “ridiculous.”

“The act of staking is actually just giving up a security bond so that they can receive compensation for contributing labor and resources to help operate the Ethereum protocol. We're trying to turn it into some kind of investment contract,” Rubin said.

The SEC did not respond to requests for comment. luck Regarding litigation or the authorities' views on the legal status of staking.

Rubin also said Gensler's legal position is an attempt to halt the growth of cryptocurrencies overall, with the SEC blocking the company's application to launch an Ethereum spot ETF following the huge popularity of Bitcoin ETFs. He also said it looked like he was trying to justify what he was doing.

“They're trying to regulate technology based on its merits, which the SEC shouldn't be doing. They're trying to stifle some kinds of innovation. And what they're trying to do is probably Because we think spot ETFs are a floodgate that will bring a lot of capital into our ecosystem,” Rubin said.

ConsenSys' lawsuit, filed in Texas, is consistent with the crypto industry's broader strategy to ultimately fight legal appeals in the U.S. Court of Appeals for the Fifth Circuit. The circuit has shown more skepticism about agency actions than other courts, and if the industry wins a favorable ruling, it will likely launch a full-scale appeal to the Supreme Court.

It is currently unclear what will happen if the SEC elects to file its own lawsuit to follow up on the Wells notice rather than resolve the matter with ConsenSys in Texas court.

The complaint itself asks the court for a number of additional rulings, in addition to declaring that Ethereum is not a security. These include a declaration that MetaMask is not a broker-dealer and that the SEC violated the Administrative Procedure Act and the Constitution's due process guarantees. It is also seeking an injunction to prevent the SEC from investigating Ethereum as a security.