The US Securities and Exchange Commission (SEC), led by Gary Gensler, has requested a budget of $2.6 billion for fiscal year 2025. This large sum is intended to increase SEC oversight of the crypto sector.

The proposed budget highlights the agency's efforts to expand its workforce, targeting more than 5,000 positions to better police digital assets and emerging technologies.

Why does the SEC want to attack cryptocurrencies?

Gensler emphasized that the budget will be offset by transaction fees, ensuring a deficit-neutral approach. Specifically, the SEC plans to strengthen its examination division by creating 23 new roles in 2025. This move directly addresses the complexity of the crypto market.

“We have seen the wilds of the crypto market, where compliance violations are rampant and investors are putting their hard-earned assets at risk in a highly speculative asset class. “Rapid change also means the potential for fraud increases. As law enforcement officers in the field, we must be able to deal with bad actors,” the SEC wrote.

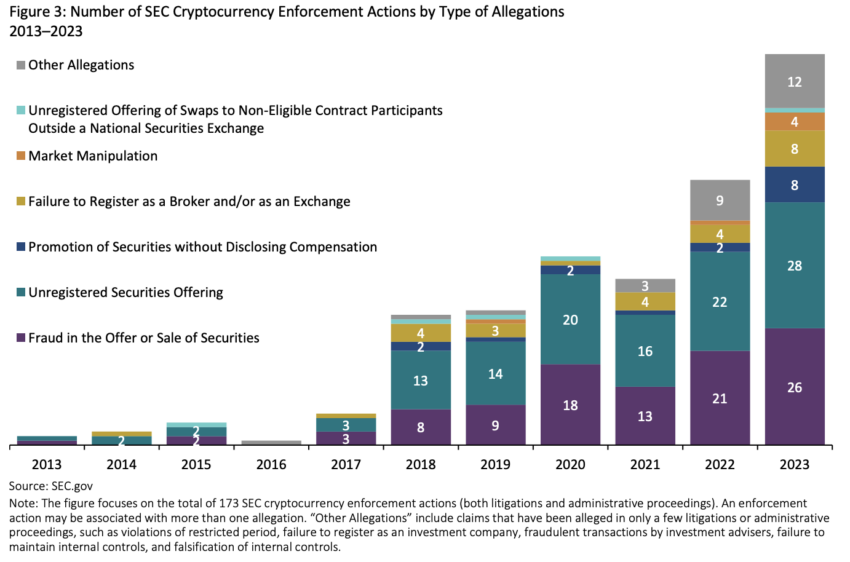

Under Mr. Gensler's watch, the SEC adopted a strict regulatory stance. He has also filed high-profile lawsuits against prominent cryptocurrency exchanges such as Binance, Kraken, and Coinbase, focusing on trading in unregistered securities.

As a result, the SEC's strict actions have led to a record number of enforcement actions and strengthened the regulatory atmosphere in the cryptocurrency industry.

Read more: Who is Gary Gensler? Everything you need to know about the SEC chairman

Additionally, the SEC is actively pursuing legal efforts to classify Ethereum, the second largest cryptocurrency, as a security. This effort includes extensive requests for documentation from companies that interact with the Ethereum Foundation. As a result, the SEC's proactive strategy aims to better understand and manage the crypto environment.

However, the virtual currency industry is not sitting idle. It has aggressively sought regulatory clarity and pushed back against the SEC's stricter measures.

For example, organizations such as the Crypto Council for Innovation (CCI), Paradigm, and the Chamber of Digital Commerce advocate for precise regulations that address the unique aspects of cryptocurrencies.

In response to these challenges, the political influence of the cryptocurrency sector is increasing. Increased lobbying and significant funding of pro-crypto political campaigns reflects the industry's determination to foster a regulatory environment that supports innovation and ensures consumer protection.

Read more: Cryptocurrency regulation: What are the advantages and disadvantages?

The legal battle continues, with Texas-based cryptocurrency firm Resilex and the Crypto Freedom Alliance of Texas taking the stand against the SEC. Specifically, they argue that the SEC's broad classification of digital assets as securities oversteps its regulatory authority and stifles innovation.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.