Finding a business with significant growth potential isn't easy, but it's possible if you focus on a few key financial metrics. First, let's take a look at the proven results. return One is growing capital employed (ROCE) and second is growing capital employed (ROCE). base of capital employed. Simply put, this type of business is a compound interest machine, meaning you are continually reinvesting your earnings at an ever-higher rate of return. Speaking of which, I noticed some big changes. raffles education Let's take a look at (SGX:NR7)'s return on equity.

Return on Capital Employed (ROCE): What is it?

In case you aren't familiar, ROCE is a metric that measures how much pre-tax profit (as a percentage) a company earns on the capital invested in its business. This formula for Raffles Education is:

Return on Capital Employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

0.012 = S$11 million ÷ (S$1.2 billion – S$270 million) (Based on the previous 12 months to June 2023).

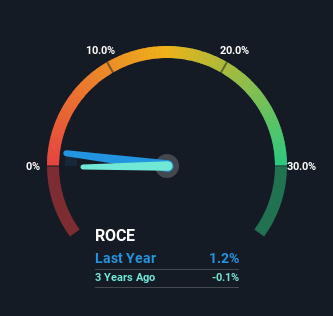

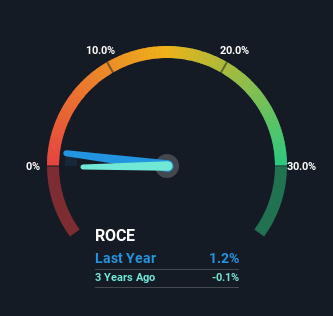

therefore, Raffles Education's ROCE is 1.2%. In absolute terms, this is a poor return, even below the consumer services industry average of 9.0%.

Check out our latest analysis for Raffles Education.

Although the past does not represent the future, it can be helpful to know how a company has performed historically. That's why I created this graph above. Click here to learn more about past earnings. free A graph detailing Raffles Education's earnings and cash flow performance.

What are the return trends like?

Shareholders will be relieved that Raffles Education is back in the black. The business was previously unprofitable, but he has now turned things around and is making a profit of 1.2% on his capital. Although profits increased, the amount of capital used by Raffles Education remained flat throughout this period. That said, while efficiency gains are no doubt attractive, it would be useful to know if the company has any future investment plans. Because ultimately, there are limits to business efficiency.

What we can learn from Raffles Education's ROCE

In summary, we are pleased to see that Raffles Education has been able to improve efficiency and earn a higher rate of return on the same amount of capital. There may also be an opportunity here, as the stock is down 44% over the past five years. Therefore, it seems warranted to investigate this company further to determine whether these trends continue.

In the end, we found that 2 warning signs for Raffles Education Please note (1 is a bit worrying).

If you want to find solid companies with high earnings, check this out. free List of companies with good balance sheets and good return on equity.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.