Apple (AAPL) made headlines with another big announcement…

As you all know, the tech giant just kicked off its annual Worldwide Developers Conference this week, and this year's focus wasn't exactly surprising.

Apple has narrowed its focus on artificial intelligence (AI) — or, as the company likes to call it, Apple Intelligence.

The company says Apple Intelligence will be coming to its iOS operating system “soon,” and it should deliver on nearly everything Apple originally promised for its Siri voice assistant.

In other words, Apple Intelligence will allow Siri to become what it was meant to be: a virtual assistant, able to get information and perform tasks across multiple apps.

Most interestingly, Apple announced a partnership with OpenAI, which as you may know is the technology company behind the hit AI chatbot ChatGPT.

The partnership will give Siri access to ChatGPT, and Apple said that users with paid ChatGPT accounts will be able to access these features through Siri.

Apple also said it plans to eventually connect with so-called “large-scale language models,” the AI technology behind ChatGPT.

It all sounds pretty grandiose, but Apple is no doubt making this announcement knowing Wall Street is watching.

Given this big news, you'd think AAPL stock would skyrocket in the coming weeks and months, so today we're taking a closer look at what Power Gauge has to say about the stock…

The main event of Apple's conference was about as polished as you'd expect, and the company is trying its best to pitch these new AI features as something special. wonderful.

But folks, Apple still faces a harsh reality.

Many of the announced features are things that Alphabet's (GOOGL) Google has already built into its mobile operating system for years, while others are of the “we'll figure it out someday” variety.

Now, to be fair, that's the purpose of Apple's annual developer conference: to get third-party developers interested in iOS tools.

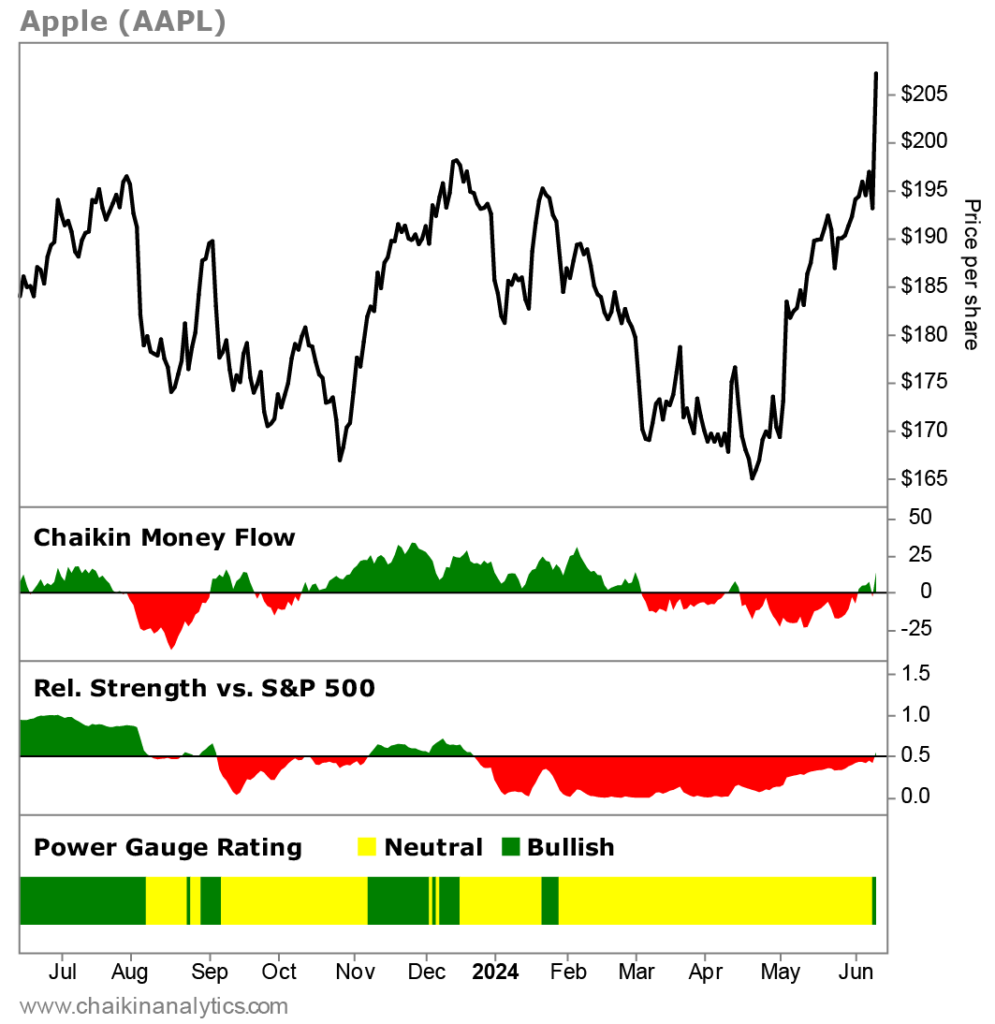

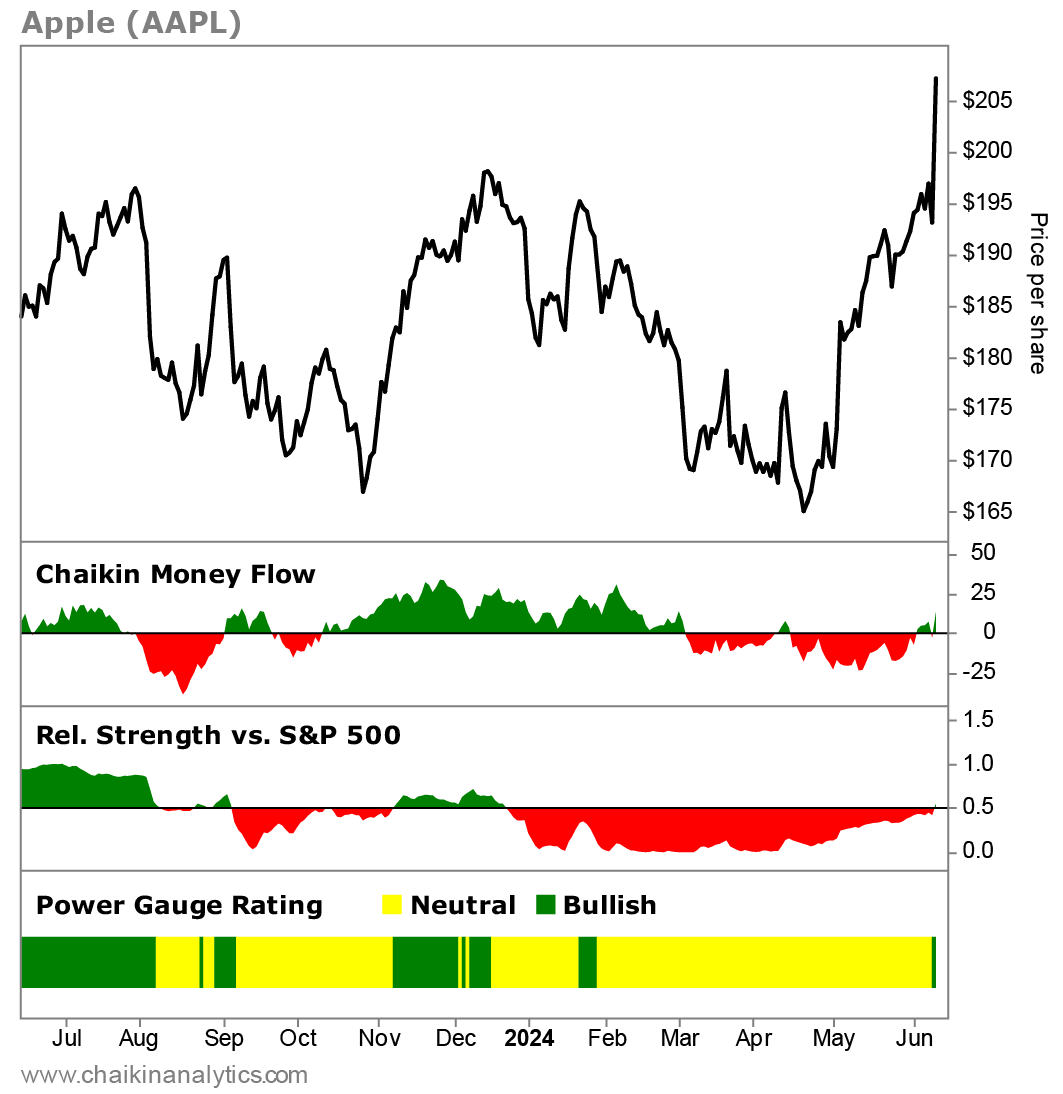

Still, it looks like Apple is playing catch-up, and it's showing in its stock price. Let's start with a one-year stock chart using Power Gauge data…

As you can see, Apple shares have remained roughly flat for most of 2024. However, AAPL shares surged earlier this week following the AI announcement and are now up about 11% this year.

Meanwhile, the tech-heavy Nasdaq 100 Index is up about 16% this year, while the broader S&P 500 Index is up about 14% over the same period.

Simply put, Apple is still lagging behind the market's massive gains this year.

Is the launch of Apple Intelligence the start of a shift? Indeed… and we are witnessing what may just be the beginning of it.

Look at the panel below the price chart…

This is our Power Gauge rating. We take into account over 20 different factors, including financial, technical and expert analysis, and combine it all into one rating. Ratings range from “Very Bearish” to “Very Bullish.”

As you can see, Apple has moved into “bullish” territory for the first time since the beginning of the year. However, you'll also notice that it has struggled to maintain a “bullish” rating through much of the past 12 months.

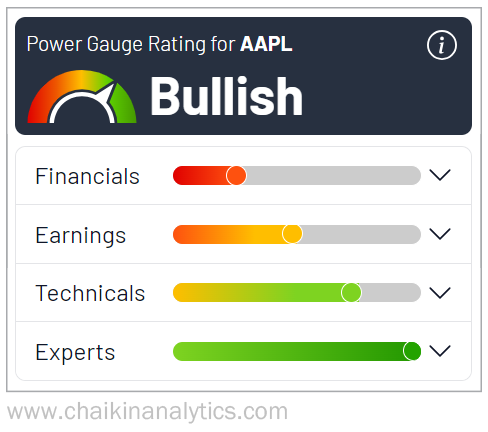

And a look at the power gauge shows the company has some work to do. Check out this screenshot of our system…

The recent move into “bullish” territory has been driven by improving expert and technical categories.

But as you can see, the company has plenty of room for improvement in the financial and revenue areas that Power Gauge evaluates.

So Apple spoke up. The company said it was committed to AI. And Wall Street listened.

Now Apple needs to deliver results that directly contribute to growth.

And we'll have to wait and see if that's enough to maintain the “bullish” rating or even bump the company up into strong territory on the power gauge. I'll be keeping an eye on this stock.

Good investment,

Vic Lederman