If you're not sure where to start when looking for your next multibagger, there are some important trends to look out for. First, let's take a look at the proven results. return One is growing capital employed (ROCE) and second is growing capital employed (ROCE). base of capital employed. This basically means that the company has a profitable endeavor that can be continuously reinvested, which is the nature of compound interest. So when we looked through, perdoceo education (NASDAQ:PRDO) ROCE Trends, We Like What We See.

About Return on Capital Employed (ROCE)

For those who aren't sure what ROCE is, it measures the amount of pre-tax profit a company can generate from the capital employed in its business. This formula for perdoceo education is:

Return on Capital Employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

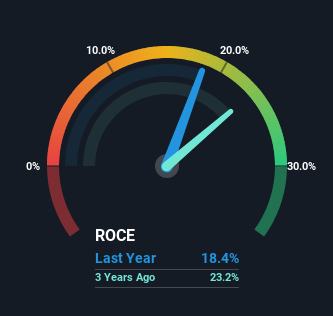

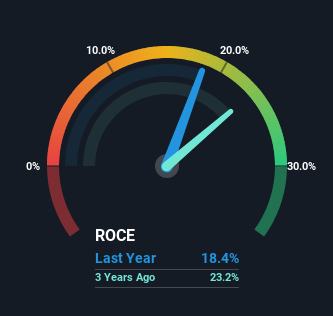

0.18 = USD 165 million ÷ (USD 1 billion – USD 111 million) (Based on the previous 12 months to December 2023).

therefore, Perdoceo Education's ROCE is 18%. While this is a standard return in itself, it is much better than the 7.6% generated by the consumer services industry.

Check out our latest analysis for Perdoceo Education.

Above you can see how Perdoceo Education's current ROCE compares to its previous return on equity, but history can only tell you so much. If you want, check out forecasts from the analysts covering Perdoceo Education. free.

What are the return trends like?

Return on capital is good, but hasn't changed much. The company has consistently achieved a return of 18% over the past five years, and during that time the capital employed within the business has increased by 133%. 18% is a fairly standard return, and there's some comfort in knowing that Perdoceo Education consistently earns this amount. Steady returns in this sector are unattractive, but if maintained over the long term, they often provide excellent rewards for shareholders.

Perdoceo Education's ROCE highlights

Ultimately, Perdoceo Education has proven its ability to reinvest capital appropriately at good rates of return. We think the market may be starting to recognize this trend, given that the stock has only increased 0.4% over the past five years. That's why it might be worth your time to look deeper into this stock and discover if it has more multibagger characteristics.

However, Perdoceo Education has some risks that we discovered 2 warning signs for Perdoceo Education What you might be interested in.

For those who like investing, solid company, check this out free List of companies with strong balance sheets and high return on equity.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.