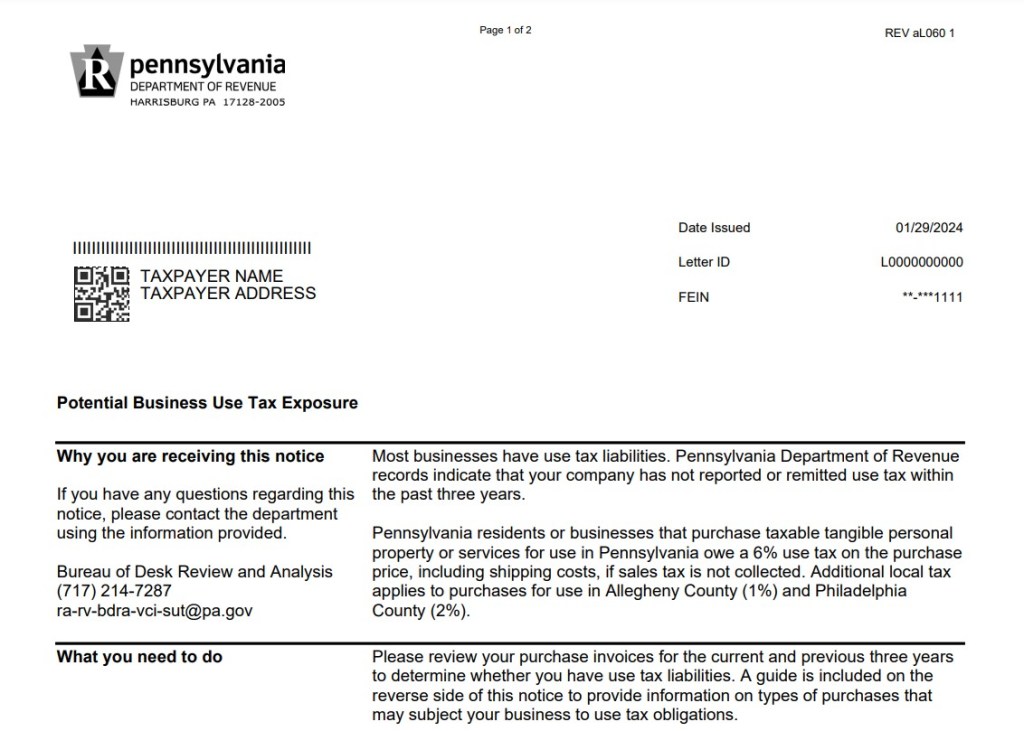

The first page of potential business use tax forms sent by the Pennsylvania Department of Revenue to businesses that may pay state use taxes. (Courtesy of Pennsylvania Department of Revenue)

For some businesses in Pennsylvania, finding an unexpected tax form in the mail can be a shock.

But according to the state Department of Revenue, the form in question (the Potential Business Use Tax Exposure form) ensures that businesses pay legally required taxes on applicable purchases, including out-of-state purchases. It is said that it is just a way to achieve this goal.

“These notices are really an education and advocacy tool,” said Kendra Martin, deputy director of communications for the state Department of Revenue. “We aim to inform Pennsylvania businesses about use taxes and their responsibilities to pay them.”

State use tax is the equivalent of sales tax, and in Pennsylvania, a 6% fee is typically paid at the point of sale.

If a Pennsylvania resident or business makes a purchase that is not subject to applicable sales tax or is taxed at a rate less than 6%, tax will be imposed on the use of the product or service.

According to Lou Palladino, director of state and local tax for Herbein + Co. Inc., this may be the case if the item is purchased online or out of state, or if the seller is not required to charge sales tax. It is said that there is.

“If you buy something in Delaware, which doesn't have a sales tax, and you bring that product back to Pennsylvania, you have to pay use tax,” Palladino said.

Items that are exempt from state sales tax are also exempt from use tax.

Use taxes are not new. It was first imposed in Pennsylvania in 1953 and is also imposed in every other state that has a sales tax.

Paladino pointed out that buyers who purchase products out of state are not expected to pay each state's sales tax.

“If the state collects 5% and Pennsylvania's tax rate is 6%, yes, you have to declare use tax, but you get a credit for (paying) 5%, so Pennsylvania has 1. %,'” Palladino said.

He said use taxes are required by law to be paid on all qualifying purchases, no matter how small the amount owed.

For businesses and individuals, use tax is due on the 20th of the month of purchase, Martin said.

According to a Frequently Asked Questions page on the department's website, the Department of Revenue uses regular audits, self-assessment programs, complaints, investigations, and a list of out-of-state purchases from vendors in other states to help businesses that owe use taxes. has been identified.

Underreporting use taxes can result in an audit by the department.

Failure to pay use taxes will result in penalties and interest, which can exceed 30% of the tax amount, the bureau said.

“Obviously, if you leave it alone for a long time, the interest rate goes up,” Palladino said. “I don't want to ignore you.”

He noted that states may choose to waive penalties in certain cases, such as when a business owner was not truly aware of the need to pay use taxes.

A potential business use tax return form is sent to businesses that have not reported use taxes for three years.

“Most businesses have some kind of tax liability to report and remit,” Martin said. “If use tax is not reported, we often send a notice to the business asking the owner to review the purchase invoice and determine if use tax is owed.”

If the business receiving the form determines that it does not owe use tax, no further action is required.

Palladino noted that a 2018 U.S. Supreme Court decision removed the requirement that sellers be physically located in a state where sales tax can be collected and processed.

And in 2019, Pennsylvania enacted a law requiring sellers with annual sales of more than $100,000 to collect sales tax. This means that online sellers with a large enough presence in the state must charge sales tax.

As a result of these rules, businesses and residents are facing far fewer situations in which they are required to pay use taxes than they were before 2019, Paladino noted.

“Compared to five years ago, it's far more likely (now) for someone to buy something online and be charged sales tax at that point,” Palladino said.

Businesses that owe use taxes can file and pay at the Department of Revenue's online tax hub at mypath.pa.gov.

Businesses that regularly owe use or sales taxes but do not have a sales or use tax account can register for one on the Department of Revenue's website.

Individual residents who owe use tax can also file a use tax return on the Department of Revenue's website or report and pay using the PA Individual Income Tax Return line.