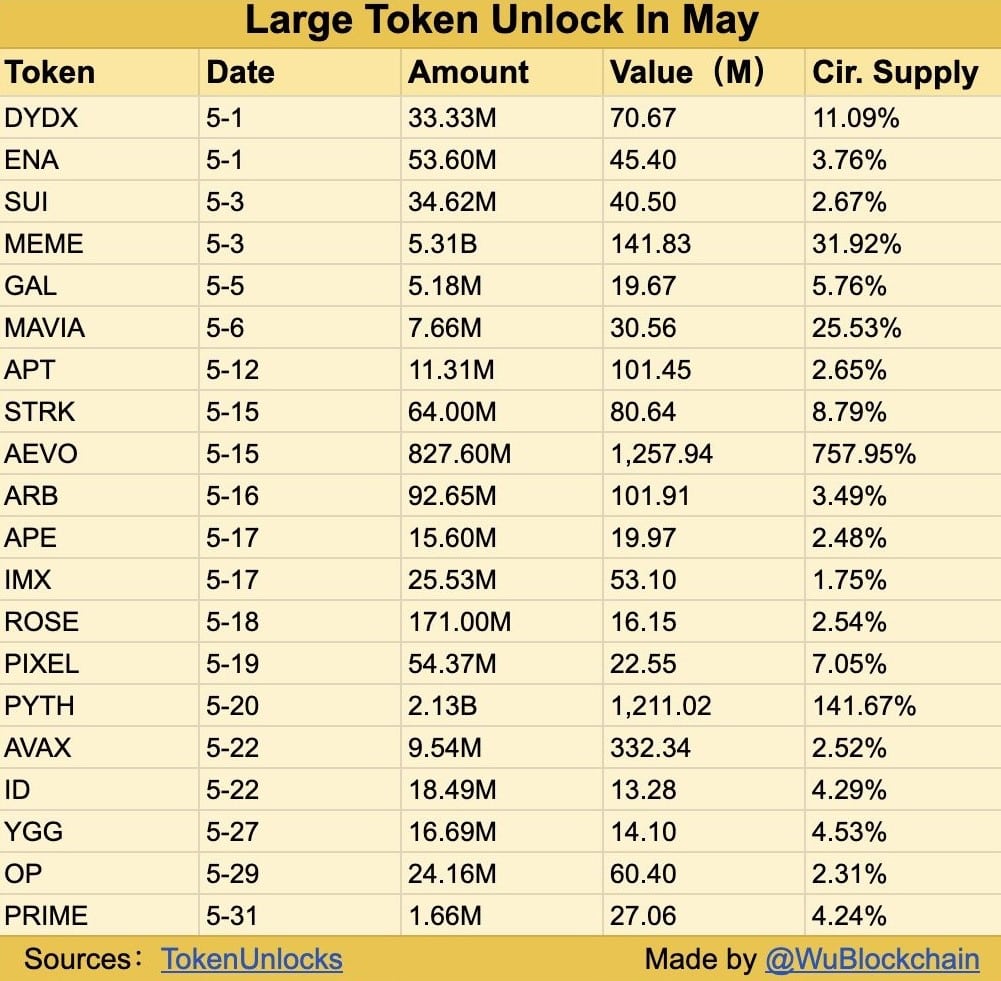

Data from TokenUnlocks reveals that around 19 crypto projects plan to put at least $10 million worth of coins into circulation this month.

In the cryptocurrency industry, projects sometimes avoid putting the maximum supply of their tokens on the public market. This practice is common for protocols that raise funding through venture capitalists and independent investors.

A portion of the token supply is subject to a vesting schedule known as a lock-up period. During this period, investors and contributors will not be able to liquidate their crypto assets or sell them on exchanges, although some protocols will allow staking and yield generation of fixed tokens.

19 major cryptocurrencies unlocked this month

Of the 19 projects unlocking approximately $3.66 billion in tokens this month, two protocols stand out. Pyth Network (PYTH), an oracle service provider, currently plans to release approximately 2.13 billion tokens to the market, worth an estimated $1.2 billion. According to TokenUnlocks, his PYTH tokens in circulation will more than double the supply.

Despite the large release, tradable PYTH tokens remain far from the total supply of Pyth, which is close to 10 billion per CoinMarketCap.

More than 827 million Aevo (AEVO) tokens will be unlocked within 10 days this month, increasing the protocol's available supply by more than 7x. Aevo offers options and perpetual and pre-launch trading capabilities on a decentralized exchange. The maximum supply of AEVO is 1 billion units, but only 110 million units are in circulation. The market value of the AEVO tokens scheduled to be unlocked is over $1.2 billion.