Thanksgiving, and more specifically Black Friday, is the semi-official start of the holiday shopping season in the United States. And if history is any guide, much of this year's holiday shopping will be done online, and not just on Cyber Monday.

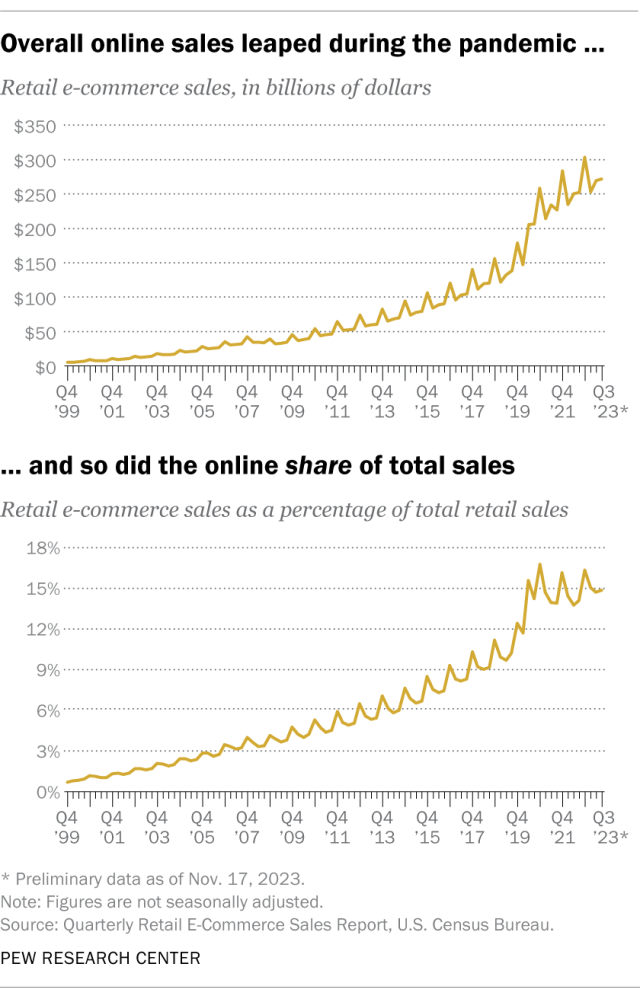

Like retail sales in general, online shopping definitely spikes in the fourth quarter of every year. For example, in 2022, online sales (or “retail e-commerce sales” in U.S. Census Bureau terminology) totaled $303.1 billion from October to December. That was 23.4% higher than his $245.6 billion quarterly average for the first nine months of this year. (The numbers in this analysis are not adjusted to account for seasonal variations.)

But it's not just sales that peak in the fourth quarter. share Its share of total retail sales also increases at the end of the year. For example, in the fourth quarter of 2022, online sales accounted for 16.3% of total retail sales, while the average for the first three quarters was 14.1%.

The fourth quarter of 2023 could be another big time for online shopping. Through the first three quarters of this year, his total retail e-commerce was $793.7 billion, representing his 14.9% of total retail.

Related: Phones are the norm for shopping, and influencers are key, especially for young people

As the 2023 holiday shopping season begins, Pew Research Center wanted to find out how important online sales are to total U.S. retail sales.

The primary custodian of such data is the U.S. Census Bureau, which has produced quarterly reports on “Retail E-Commerce Sales” since 2000. The estimates in this report are based on the same sample of 10,800 retail businesses that the Census Bureau uses for its Monthly Retail Trade Survey (MRTS). The MRTS sample is weighted and benchmarked to be representative of the entire population of over 2 million retail businesses.

It is important to note that bars and restaurants are not considered retailers in the department's study. Online travel services, ticket sellers, and financial services brokers and dealers are also excluded from coverage.

This analysis uses data that is not adjusted to account for seasonal variations. Third quarter 2023 numbers are provisional based on data published on November 17, 2023.

Online sales have grown over time

From 2000 to 2020, online sales growth followed a predictable pattern. The online share of retail sales spiked in the fourth quarter and has since declined, but has not fully returned to previous levels. It then rose again to an even higher level in the fourth quarter of the following year.

These gradual moves have increased the online share of total retail sales from 0.7% in the fourth quarter of 1999, when the U.S. Census Bureau began tracking online sales, to 12.4% in the fourth quarter of 2019. increased to %.

The coronavirus pandemic that swept the world disrupted that pattern, at least temporarily, starting in early 2020. Online sales soared as many brick-and-mortar stores closed and millions of Americans sheltered at home. For example, e-commerce sales totaled $205.3 billion in the second quarter of 2020, up 55% from $132.3 billion in the same period last year. In the fourth quarter of 2020, e-commerce accounted for 16.7% of total retail sales, still maintaining its highest share ever.

That percentage declined as stores reopened and consumers gradually resumed their previous shopping habits. However, the share of e-commerce in total retail sales remains well above pre-pandemic levels, suggesting that the COVID-19 outbreak has given online shopping a sustained boost. In the fourth quarter of 2022, 16.3% of retail sales were online, compared to his 16.1% in 2021.

Which retailers benefit most from online sales?

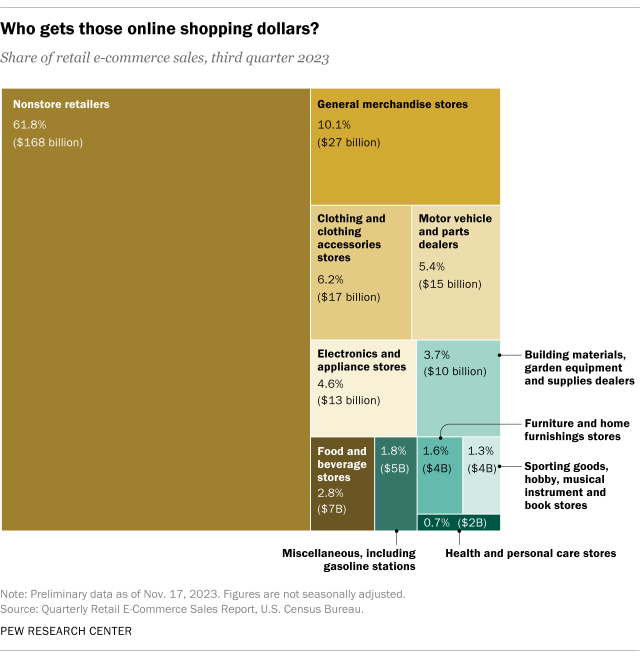

Retailers with the highest share of online sales tend to be those without physical stores.

Non-store retailers, as the Census Bureau calls them, accounted for nearly 62% of retail e-commerce sales in the third quarter of 2023, compared to just over 59% in the same period last year. E-commerce sales for non-store retailers rose 12.4% year over year, outpacing the online sales sector as a whole.

Among brick-and-mortar retailers, online sales increased 8.7% at general merchandise stores, 5.1% at food and beverage stores, and 4.7% at health and personal care stores.But online sales fell The rate was 1.6% for electronics and home appliance stores, 3.2% for automobile and parts stores, and 16.2% for furniture and interior stores.

What is the origin of the name Black Friday?

For years, there has been a widespread claim that Black Friday's name derives from its role in retailers' profitability. The idea was that most retailers operated in the red, or “in the red,” for much of the year and relied on holiday sales to make a profit, or “become profitable.”

However, the actual origin appears to be more mundane. Philadelphia police began calling the day after Thanksgiving “Black Friday” in the 1950s, as holiday shoppers flooded downtown, making the police's job even more difficult.