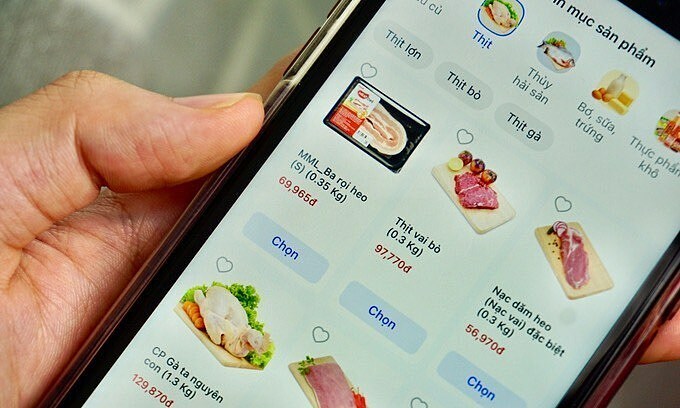

E-commerce has grown rapidly in Vietnam in recent years.Photo courtesy: VnExpress/Vienton

Online sellers of goods that do not comply with their tax obligations are likely to be banned from leaving Vietnam.

The possible ban was discussed at a meeting held late last week by the General Administration of Taxation to consider how to compensate for tax losses from e-commerce.

Currently, if the revenue from an online business exceeds VND100 million (US$4,000) per year, sellers must pay value-added tax and personal income tax.

However, tax authorities My Xuan Thanh said it is not easy for tax authorities to fully identify revenues and taxpayers, distinguish between different types of income, and manage business transactions and cash flows.

He said the ministry will continue to increase taxation on e-commerce, including publishing in the media a list of online product sellers who are liable to pay taxes and banning them from leaving the country.

Last year, 74 overseas sellers paid more than VND8 trillion, while domestic organizations and individuals paid VND536 billion.

According to the Ministry of Industry and Trade, the retail e-commerce market will grow by 25% from 2022 to $20.5 billion last year.

According to Statista, a German online platform specializing in data collection and visualization, Vietnam ranks among the top 10 countries in the world for e-commerce growth.