Generally speaking, it's usually not a big deal if one insider buys shares. However, if multiple insiders are buying, e.g. American Public Education, Inc. (NASDAQ:APEI), is sending a positive message to its shareholders.

While we are by no means saying that investors should make decisions solely based on the actions of a company's directors, we believe it is perfectly logical to monitor the actions of insiders. .

See our latest analysis on American public education

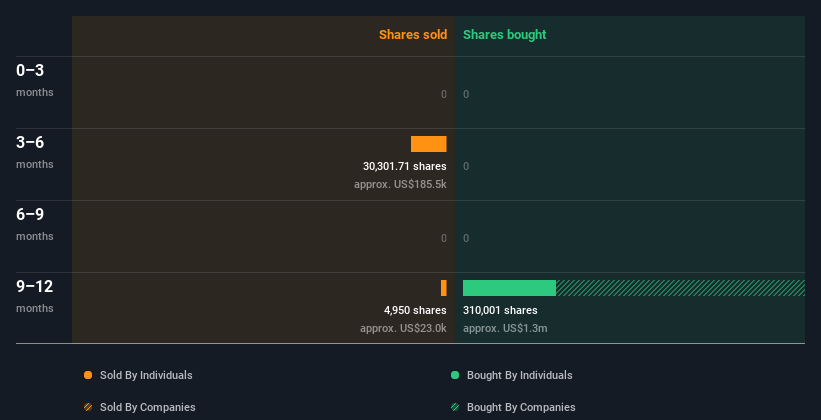

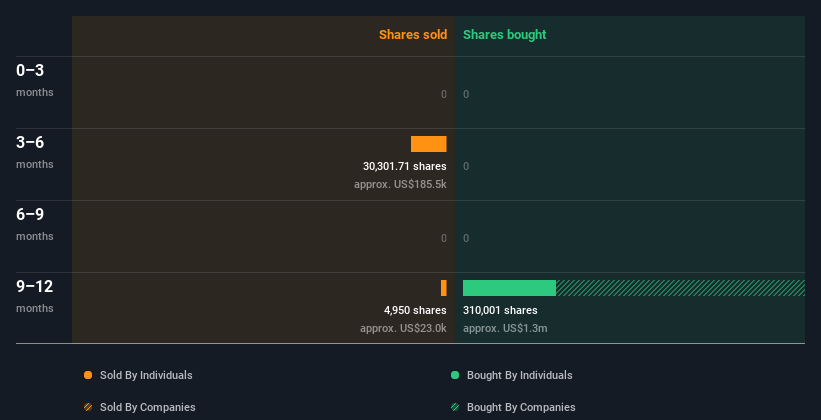

American public education insider trading over the past year

The biggest purchase by an insider in the last twelve months was when Independent Director Granetta Blevins bought US$102,000 worth of shares at a price of US$3.95 per share. While we like to see insider buying, we note that this large purchase is well below the recent price of US$10.75. This occurred at a lower valuation, so it doesn't tell us much about whether insiders find today's price attractive.

We're happy to note that in the last year, insiders paid US$315,000 for 79,000 shares. However, they sold 35.25,000 shares for US$213,000. In total, American public educators bought more than they sold last year. The graph below shows insider transactions (by companies and individuals) over the last year. You can click on the graph below to see the exact details of each insider transaction.

There are plenty of other companies where insiders are buying up shares.I think that's probably the case. do not have I want to miss this free A list of growing companies that insiders are buying.

Does American public education boast high insider ownership?

If you are a common shareholder, it may be worth checking how many shares are held by company insiders. Typically, the higher the insider ownership, the more likely it is that insiders are incentivized to build the company for the long term. According to our data, it appears that the American public educator owns 3.7% of the company's shares, worth about $7.2 million. We generally like to see higher levels of insider ownership.

So what does this data suggest about America's public education workforce?

The fact that insider trading in American public education is non-existent these days certainly doesn't bother us. However, insiders have indicated that interest in the stock has increased over the last year. The deal is fine, but it would be even more encouraging if U.S. public education officials bought more of the company's stock. We like to know what's going on with insider ownership and transactions, but we also always consider what risks a stock faces before making any investment decisions.You want to know, what we found One warning sign for American public education. We highly recommend that you take a look.

However, please note: American public education may not be the best stock to buy.So take a look at this free List of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are individuals who report their transactions to the relevant regulatory body. The Company currently only accounts for open market transactions and private dispositions of direct profits, and does not account for derivative transactions or indirect profits.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.