U.S. Customs and Border Protection (CBP) is struggling to keep up with the surge in low-value imports, especially from China, that are fueling the e-commerce boom. CBP processed 1 billion de minimis shipments in 2023, a 53% increase over 2022. Additionally, CBP processed an estimated 705 million through mid-2024. This sharp increase is straining CBP resources and raising concerns about security and fair trade.

In 2016, the United States increased the minimum threshold for import duties and taxes exemptions from $200 to $800 to promote the expanding e-commerce market and address CBP resource limitations. This change and the rapid growth of e-commerce led to a significant increase in low-value shipments, challenging CBP's inspection capacity. The Obama Administration viewed the increase as a measure to “foster international trade and stimulate economic activity.”

CBP is concerned that counterfeit goods, fentanyl, and other illegal items may be smuggled through these low-value channels. CBP estimates that more than 90% of import transactions into the U.S. use the de minimis rule, which accounts for 90% of CBP seizures of illegal narcotics, agricultural products, and counterfeit goods. Additionally, some argue that Chinese companies are using the de minimis system to evade tariffs and gain an unfair advantage over U.S. companies.

To address these concerns, CBP has recently suspended customs brokers that did not comply with regulations and is seeking more accurate data from all parties involved in the import process. Lawmakers are also considering several bills, including one that would limit de minimis benefits for imports from China (and other non-market economies), as well as implementing a “reciprocal” de minimis structure or eliminating the de minimis rule altogether. However, businesses are concerned that stricter regulations could increase costs and disrupt e-commerce markets.

Understanding the De minimis Threshold Loophole and CBP's Challenges

The demi-ministry rules, designed to simplify customs procedures for low-value goods, have become a target for companies trying to evade import tariffs, and critics say China in particular is exploiting the loopholes.

CBP is struggling to keep up with the surge in e-commerce due to staffing and technology limitations, and its reliance on limited data from carriers makes it difficult to identify suspicious packages. Other challenges include:

- There is insufficient oversight, control, and trade reciprocity for the millions of shipments that enter the United States every day.

- Existing loopholes make it impossible to trace and verify the contents of packages or check for intellectual property theft, forced labor, or products that are unsafe for consumers, making it easier to import harmful or illegal goods.

- Incorrect Manifestation: Misclassifying goods under customs regulations can lead to delays, incorrect valuation and even seizure.

- Misdelivery: Incorrect information on a cargo manifest can lead to earlier than expected delivery, creating logistical issues and potential security risks.

- Undervaluation: Deliberate undervaluation of imports to avoid paying the appropriate duties is a growing concern.

- Incorrect power of attorney: Incorrect assignment of power of attorney for customs clearance can cause delays and confusion.

- There is a huge disparity in the de minimis amount for imports to the US, which is $800 compared to $150 CAD in Canada, $7 in China, £135 in the UK and €150 in the EU. It should be noted that the upcoming EU customs modernisation is considering abolishing the de minimis amount.

How to handle the surge in e-commerce

Global Trade Experts The problem can be minimized Ensure complete and accurate data is maintained and reported, including:

- Accurate product description: Provides detailed descriptions of materials, uses, country of origin, etc.

- Harmonized Tariff System (HTS) Code Classification: Identify the correct HTS code for your product (10Number A widely used system (“commodity code (code number: 10000000)”) for classifying internationally traded products.

- Declared Value: You declare the full commercial value of your shipment, which should reflect the appropriate transaction price paid to the seller in accordance with the agreed upon transaction price formula.

- Proper Power of Attorney: Make sure you appoint a customs broker (if not self-declaring) to act on your behalf during customs clearance with a valid power of attorney.

_____________________________________________________________________________________________

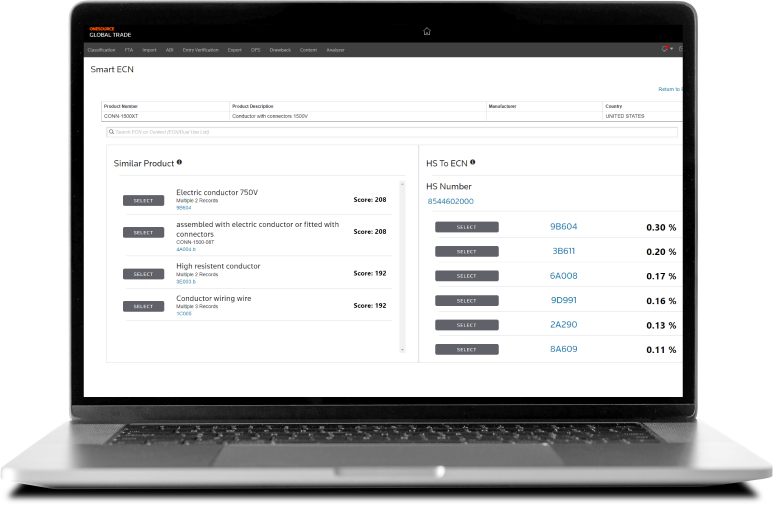

Automation Harmonized System (HS) Export Control Classification Number (ECCN) classification with accurate codes and tariff rates to maintain compliance

_____________________________________________________________________________________________

Where should I record this information?

While customs declarations serve as the official records for the authorities, much of this data is typically stored in additional systems for internal use and future reference. This includes:

- Global Trade Management System (GTM) System: It is designed to capture and store import data, validate shipments prior to entry and ensure data integrity.

- Product Database: Systems such as Global Catalogue (GC) can hold detailed product information such as materials, uses and country of origin, making it easier to accurately account for customs declarations.

Alternative solutions to minimal challenges are discussed.

- Minimal Restrictions for China: Congress is considering a proposal to eliminate minimum benefits on imports from China.

- Minimum Restrictions on All Non-Market Economies

- Improved data collection before shipment arrival: CBP is seeking faster, more accurate and complete data from all parties involved in the import process.

- Risk-Based Targeting: Implementing risk profiles for e-commerce merchants will allow CBP to focus resources on high-risk shipments. Discussions have arisen about allowing e-commerce platforms to participate in the CTPAT program, provided they meet certain requirements.

Stay up to date on minor changes

Minimum limits generally do not vary by product, but trade disputes can indirectly affect how limits are applied. Here's how to stay informed:

- Subscribe to industry news sources: Trade publications and logistics news provide insight into how trade disputes will affect e-commerce imports and De Minimis enforcement.

- Consult a trade law firm, trade consultant, or customs broker. For customized advice, seek guidance from a professional who specializes in customs compliance.

By following these strategies, companies can ensure their imports are de minimis compliant. Efficiently manage the proliferation of e-commerce while complying with minimal regulations.

The future costs of e-commerce imports

The future costs of e-commerce imports are uncertain. Balancing security concerns with promoting legitimate trade will pose a significant challenge for policymakers and trade compliance professionals.

Use of Global Trade Software : A turbulent trade environment demands comprehensive tax solutions for streamlined compliance. Comprehensive Product Suite ONESOURCE Global Trade empowers tax professionals to adapt to evolving regulations and facilitate seamless collaboration across departments, so organizations can remain compliant and continue to thrive in a changing global marketplace.

ONESOURCE Global Trade Solutions Overview