Last November, as much of the luxury e-commerce sector was plummeting, MyTheresa CEO Michael Krieger remained optimistic.

For the quarter ended Sept. 30, 2023, the luxury online retailer achieved another consecutive quarter of net sales growth, maintaining the record it has maintained since its IPO in 2021, outperforming its competitors.The same day, Farfetch abruptly announced it would not release its usual quarterly financial results, confirming the company's dire situation that would lead to its fire sale to South Korean retailer Coupang a few weeks later.

Asked on a conference call with investors and analysts how MyTheresa could prepare for the future as the situation worsens, Krieger said the company would continue to focus on its most premium clients, who it has pampered with one-of-a-kind events and exclusive merchandise.

“These efforts have allowed us to compete not on price or discount, but on novelty and exclusivity, and combine that with great service to our best customers,” Krieger says. “It's an approach that has allowed us to thrive in a market where most people have contracted.”

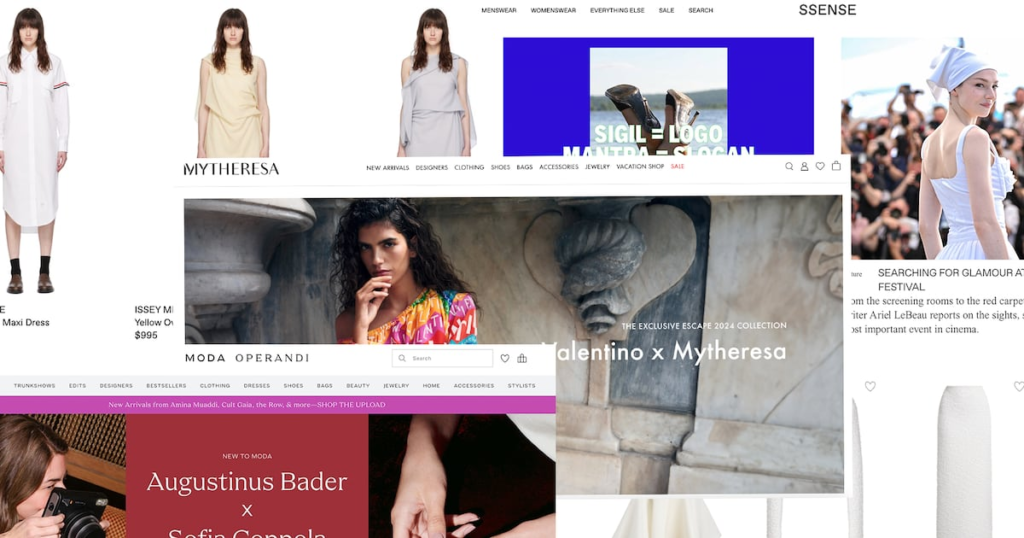

MyTheresa is one of the few multi-brand luxury e-commerce retailers, including Moda Operandi and sSense, that has continued to forge ahead despite the upheaval rocking the industry.Farfetch's woes are supplemented by the sale of struggling Matches Fashion to Frasers Group in December, only for it to close just months later.Yuke's Net-a-Porter is up for sale by owner Richemont after a deal to sell the loss-making retailer to Farfetch fell through.

The survivors were not unscathed. Essense, known for its long-term sales, cut staff at the start of 2023 due to slowing growth. Sales from January to May fell 17% from a year ago, according to Ernest Analytics, which analyzes credit-card data. Moda Operandi said in a statement to Bank of Financial Report that it saw no year-over-year growth in 2023 as demand flattened.

Still, both companies appear to be on firmer footing than their peers. MyTheresa continues to report strong sales. Sense and Moda Operandi are privately held companies and don't have to disclose their financials. Sense still claims to be profitable on its own site, but didn't acknowledge profitability for BoF. Moda Operandi said sales so far in 2024 are positive compared with last year and 2022, and that its resort and spring 2024 inventory had its highest sales ever at full price. It's not yet profitable, but expects to be in the “very near future,” CEO Jim Gold said in an emailed statement.

Experts say these multi-brand companies are doing a lot of things right, including speaking to specific customers and curating product assortments for them, as well as executing retail fundamentals like customer service and controlling costs and margins.

Customers, Content, and Curation

While online retailers have historically been forced to compete on price, which has led to a vicious cycle of discounting, Ssense, Mytheresa and Moda Operandi have prioritized curation and a focus on specific customers to differentiate their offerings: Gen-Z for Ssense, high-spending customers for Mytheresa and fashion show fans for Moda Operandi.

Moda Operandi’s virtual trunk show, for example, offered pre-orders for Xemena Kamali’s debut Chloe collection, drawing a shopper who is perhaps similar to the site’s founder, New York socialite Lauren Santo Domingo. That appealed to influencer-favorite basics brand Frankieshop, which collaborated with the retailer on a capsule and pop-up shop in May.

“The woman they serve is confident. Why? Because she orders in advance,” says Gaëlle Drebet, founder of Frankie Shop.

Miteresa has launched a series of exclusive capsule collections tailored to the lifestyles of its wealthy clientele – past partners include Valentino, Dolce & Gabbana and Brunello Cucinelli – while ESSENS sees itself as a home for emerging designers.

“Our main goal is to [our shopper] “Customers who already know the cool brands know we'll get it first,” says Brigitte Chartrand, vice president of women's clothing buying at Ssense. “'Of course it's at Ssense' is essential to our work.”

E-retailers use content and events to draw shoppers to their sites and keep them there, which is becoming increasingly expensive as advertising costs rise and very difficult because tab switching is so easy.

“Curators don't just curate 'things' – they curate the venue and make things available to the audience,” says Tom Bettridge, Ssense's head of creative and content. “We choose things and we speak to the audience, bringing specific people there.”

For Sense, that person knows what minimalist Japanese brand AURALEE is all about and is willing to try Rick Owens' inflatable boots. Sense publishes editorials online, most recently a paean to life wearing a Vaquera skirt with pink panties sewn on the outside, and fills Instagram with memes to encourage comments and shares. Bettridge said the content is aimed at engaging with a specific customer, rather than attracting a broad one. The same is true on the merchandising side, Chartrand said. Buyers are focused on picking designers and products that appeal directly to customers. The company is also trying to fill gaps in its offering by introducing its own take on categories such as bridal.

MyTheresa's engagement with its top customers often takes place offline. The company hosts special events for its top clients, like a trip to the Italian Riviera with Dolce & Gabbana or a private viewing of a New York Ballet rehearsal, making them feel like they're part of an exclusive club. In return, they pay: Top shoppers, who typically spend more than six figures on clothes a year, account for almost 40% of sales, the company told BoF in January.

“Spending two days with a customer creates the ultimate relationship: an emotional connection, and because we sell luxury goods, that emotional connection is invaluable,” Isabel May, then-chief customer experience officer at MyTheresa, told BoF in January (May has since left the company to join LVMH).

Retail Fundamentals

Even online, the old principles of retail still apply: retail is inherently a service business, especially when it comes to luxury goods. Moda Operandi says one factor that has worked in its favor is its emphasis on personal shopping, exceptional customer service and intimate relationships over promotional digital marketing.

One source, speaking on condition of anonymity, said struggling companies were ignoring retail fundamentals of variety and customer service, placing too much emphasis on balance sheets rather than on offering the kind of service that would make shoppers happy to pay full price.

Even the numbers they looked at may have been wrong.

“We’ve all been fascinated by the big growth trend because ultimately, we’re all chasing money. If valuations are a multiple of gross sales, then you want more. [GMV] “First and foremost, we have Stefano Martinetto, CEO and co-founder of Tomorrow, a platform for brand growth and development,” said.

This approach may have worked when money was cheap, investors were pouring in cash, and shoppers of all income levels were spending on luxury items, but it proved unsustainable when market conditions changed.

Ariel Ohana, founder of investment firm Ohana & Co., which advised beauty retailer Violet Grey on its sale to Farfetch in 2022, said companies that prioritize unit economics and profits over growth at all costs are likely to be more resilient.

“The paradox is, these companies are in high-end products, but they're not high-margin businesses,” Ohana said. “When you're not in a high-margin business, a lot of your success is dependent on operational excellence, which is cost control.”

Moda Operandi, for example, said it has been cutting unnecessary costs across technology, marketing and distribution in a bid to become more efficient.

Of course, luxury retail is not a cheap business, so there are high costs involved, but those costs should ideally be spent on improving the customer experience. In contrast, Farfetch has been embroiled in a number of costly ventures that don't necessarily benefit customers, such as its acquisition of New Guards Group.

The Road Ahead

Pressures to scale can compound issues, especially when it comes to maintaining margins and curation.

“Many strategies are [that make e-tailers early successes] “It's often at odds with the notion of scaling your business,” Ohana said. “Scale means more branding and less curation, more customers and a wider target audience.”

There are new challenges in the market. Consulting firm Bain & Company predicts that luxury sales will grow 1-4% in 2024, compared with 8% growth in 2023. Larger players are taking more of their e-commerce operations in-house, taking sales away from multi-brand retailers, which at the same time face rising customer acquisition costs. To succeed, multi-brand e-retailers need to clarify their value proposition and market to the next generation of shoppers, said Federica Levato, senior partner and EMEA fashion and luxury leader at Bain & Company.

Additionally, there are still unresolved questions about how many retailers the market can support and how big they can get: Too many retailers could lead to retailers cannibalizing each other or a perpetual race to the bottom on prices.

“It's been the case that a rising tide floats all boats, but when the tide goes out, who's staying afloat?” said Brian Ehrig, a partner in Kearney's consumer practice.