Sylvia Zeng, head of south China research at JLL, said logistics facilities in the Gulf region had “withstood the headwinds” of a surge in new supply. She added that southern China recorded single-digit vacancy rates, while other cities recorded double-digit vacancy rates.

China's overall net absorption in 2023 will increase by 44% year-on-year to 7.22 million square meters, exceeding the peak in 2021, despite a 21.8% rise in vacancy rate due to an unprecedented influx of 12 million square meters of new properties. This was the second highest level after. According to international real estate consulting firm CBRE,

Thanks in part to strong demand from e-commerce companies, logistics warehouses are one of the most valuable assets in the commercial real estate space for institutional investors such as GLP China Holdings, ESR Group, and Warburg Pincus. The sector is also seen as a low-risk option even when there are headwinds in the market.

Last month, ESR Group, one of the world's largest real estate asset management companies, purchased 126,000 square meters of land in Zengcheng District, Guangzhou City to develop a supply chain center.

“[Cross-border e-commerce platforms] “From production to purchasing to export, we are leveraging the advantages of the Greater Bay Area's 'all-in-one' chain for global expansion,” Zeng said.

“We see that they all choose the Greater Bay Area as their key.” [cross-border] Our network in China…is inseparably linked to our unique strategy of “Factories of the World'' and our “Small Lot, Short Cycle'' model. ”

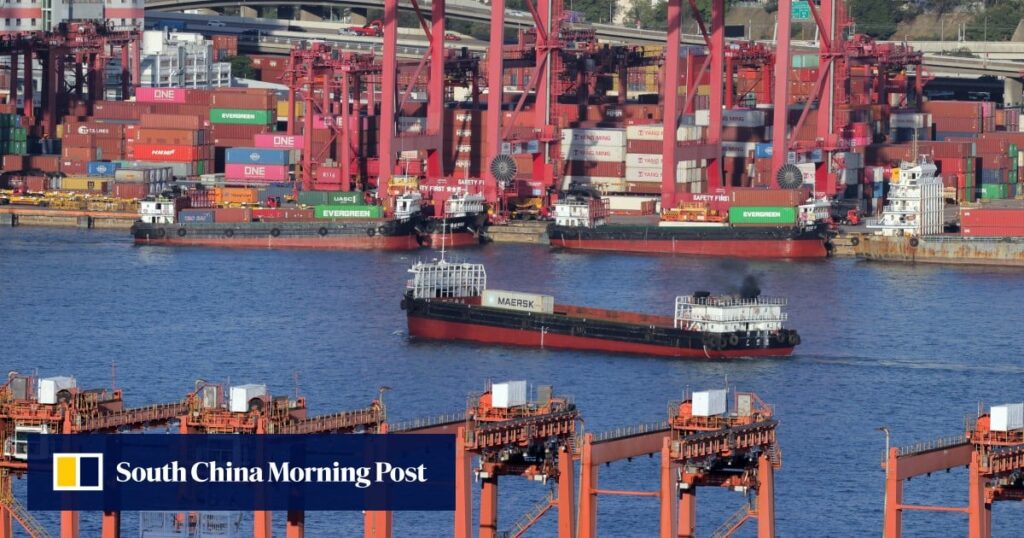

The World Factory concept refers to a Bay Area manufacturing cluster with more than 50,000 manufacturers located near Hong Kong's free port, able to enjoy both rapid transportation and attractive labor costs.

The volume of orders from these companies will consume nearly all of the new warehouse space in the area upon launch, Zeng said.

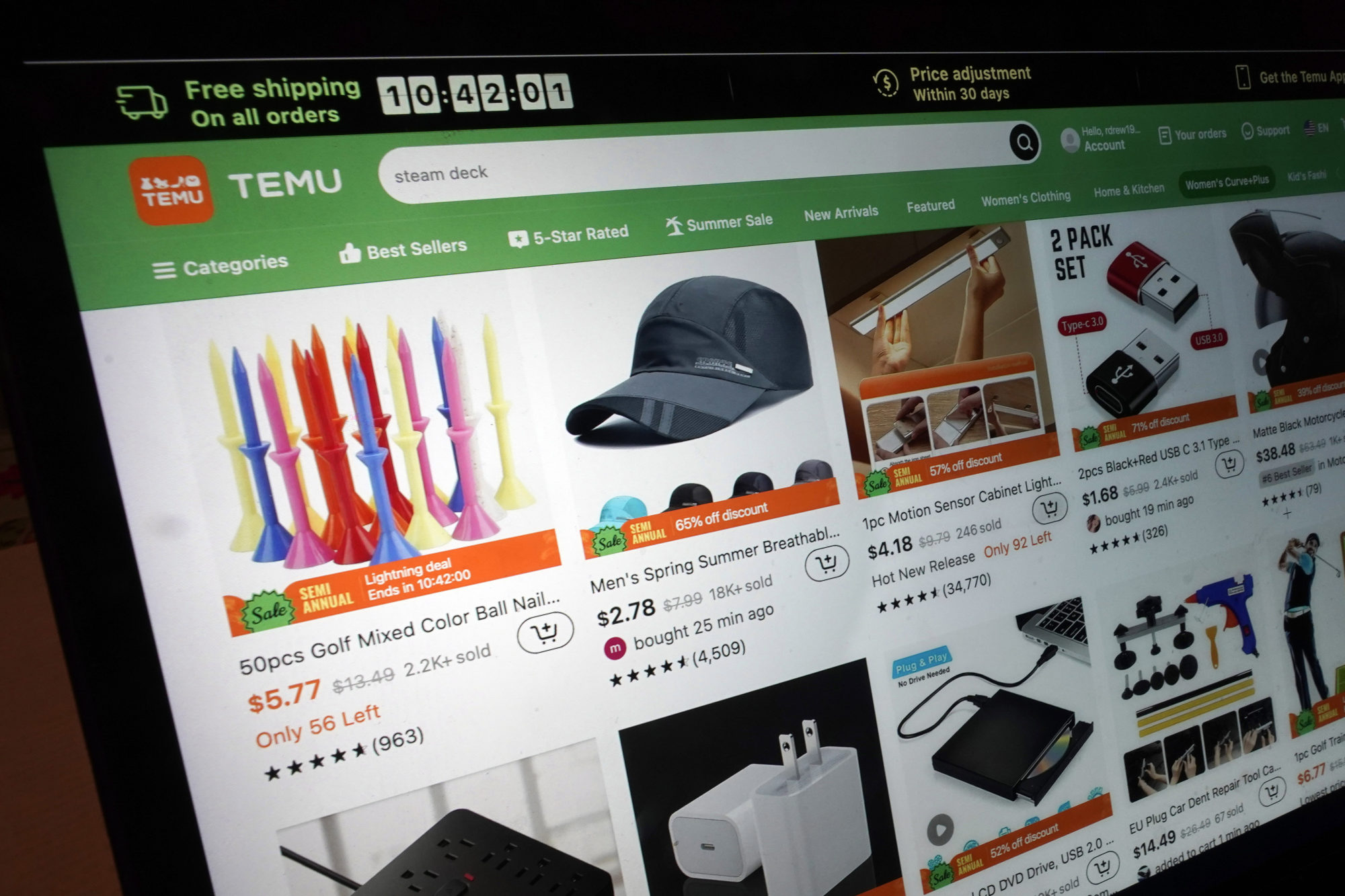

According to data compiled by CBRE, Temu, Shein, AliExpress, and TikTok Shop had the fastest growth in gross merchandise value in 2023 in five years, each adding at least $10 billion.

Cross-border e-commerce companies will lease approximately 3.5 million square meters of new logistics space in 2023, a fivefold increase from 2022, according to CBRE. It added that about 1.5 million square meters of warehouses have been pre-leased by the company so far this year.

“Demand in Foshan and Guangzhou is becoming more and more active,” said Weilong Deng, head of advisory and transaction services, industrial and logistics department at CBRE South China. For example, he cited a 137,000 square meter warehouse in Guangzhou that the e-commerce giant leased in the first quarter. He did not name the company, but Chinese media reports said it was Tem Corporation.

Four of the five projects under development in Foshan are pre-leased, Deng added.

The voracious appetite for space stems from the so-called fully commissioned or fully managed model pioneered by Temu and widely adopted by other companies. In this model, the platform company handles pricing, warehousing, logistics, sales, and returns. According to CBRE, this model requires a high-quality warehouse with sufficient space to handle not only storage but also packaging and shipping.

On the other hand, a “semi-managed” model, where experienced sellers who have their own warehouses or are able to deliver goods themselves, are responsible for operations and post-sale logistics, also increases the demand for warehouse space from such sellers. authorities said it would increase.

For example, Alibaba Group's AliExpress and Cainiao Logistics added that their inventory increased 600% year-on-year in January when they launched this model.

Looking ahead, CBRE analysts led by Sam See said in a report that the domestic logistics warehouse market will “transition” to an era of balance between supply and demand in 2024. The consultancy firm predicts that in 2024, the net absorption of logistics warehouses will be about 7.5 million square meters, and China's overall vacancy rate will fall to 20%.