How to pay for education is a hot topic for Vermonters and state legislators, and a significant increase in property taxes will hit people's pockets. This is because part of the cost of education is covered by property taxes, which raises the question of whether education funding should be considered. This is also all happening since voters rejected an unprecedented amount of school funding. Some are marching to vote for a second or even third time. “The past six months have been excruciatingly difficult for public education in our state,” said Jeff Francis, executive director of the Vermont Association of School Superintendents. “We know that there were 30 rejections on the school budget. We know that there were seven or eight revotes, none of which were successful,” the House Ways and Means Committee said. , at one point spent a week rethinking how the education system is funded. A complete overhaul, giving state spending control over local governments, was met with mixed reactions. The idea behind it was that giving states control over spending would prevent future overspending and similar situations, something school associations were strongly opposed to. ” There were a lot of questions, and the questions were very important. The pace of the process was so fast that we didn't have to react,” Francis said. Although the commission ultimately sided with the school groups and backed out, saying it was too hasty, the Scott administration was intrigued. “It would have been an out-of-year change, but it was an interesting change,” said state Tax Commissioner Craig Borio. In any case, the idea would not have affected the present, and the government considered things like deferring payments on Friday morning. “That would give us an opportunity to reduce the surge this year and give districts time to plan how to deal with the postponement,” Borio said. Returning to the longer term, all ideas need to be considered, so a study is planned to strengthen spending control by states and take away spending from local governments. “The bill, which has a revised funding formula, was recognized by the committee as requiring additional guardrails and fiscal controls. The formula is very complex and can be difficult to determine on a district-by-district basis. Yes,” Borio said. Lawmakers are also considering how school budget questions should appear on Town Meeting day ballots. For example, it includes additional property tax increases if approved and compares the year's spending to previous years for transparency. The bill is expected to be finalized on Tuesday.

How to pay for education is a hot topic for Vermonters and state legislators, and a significant increase in property taxes will hit people's pockets. This is because part of the cost of education is covered by property taxes, raising the question of whether education funding should be considered.

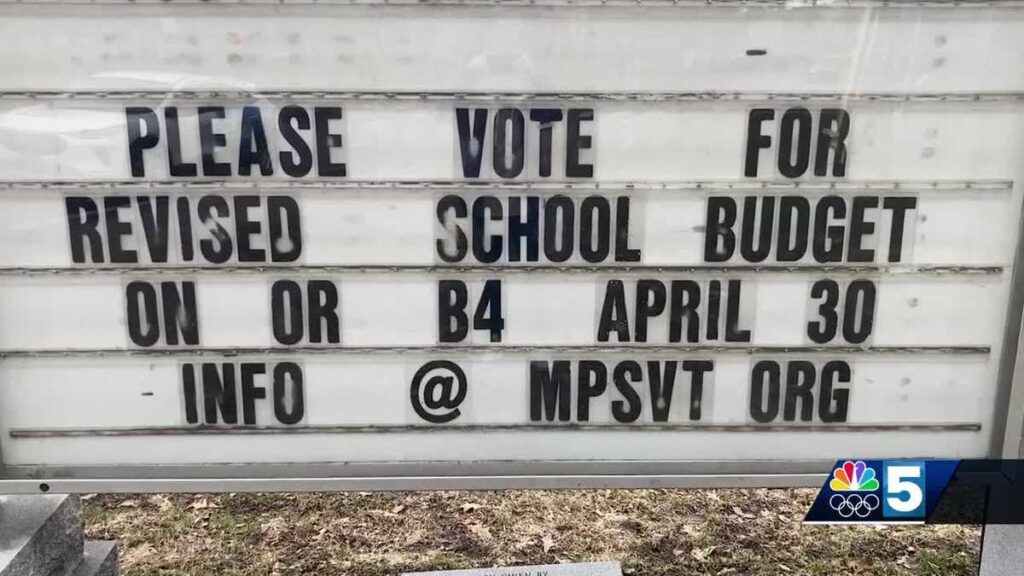

All of this is also happening because, since March, we have seen an unprecedented amount of school budgets rejected by voters for the second and even third time.

“The last six months have been excruciatingly difficult for public education in our state,” said Jeff Francis, executive director of the Vermont Association of School Superintendents. “We know that there were 30 no votes on the school budget, but we also know that there were seven or eight re-votes and none of them were successful.”

The House Ways and Means Committee spent a week reconsidering how the education system is funded, at one point overhauling the education system and giving states control over local governments, which drew mixed reactions. Ta. The idea behind it was that giving states control over spending would prevent future overspending and similar situations, something school groups strongly opposed.

“There were so many questions, the questions were so important, and the pace of the process was so fast that we didn't have to respond,” Francis said.

Although the commission ultimately sided with the school groups and backed out, saying it was too hasty, the Scott administration was intrigued.

“It would have been an out-of-year change, but it was an interesting change,” said state Tax Commissioner Craig Borio.

In any case, the idea would not have affected the present, and the government considered things like deferring payments on Friday morning.

“That would give us an opportunity to reduce the surge this year and give districts time to plan how to deal with the postponement,” Borio said.

Returning to the longer term, all ideas need to be considered, so a study is planned to strengthen spending control by states and take away spending from local governments.

“The bill, which has a revised funding formula, was recognized by the committee as requiring additional guardrails and fiscal controls. The formula is very complex and can be difficult to determine on a district-by-district basis. Yes,” Borio said.

Lawmakers are also considering how school budget questions should appear on Town Meeting day ballots. For example, it includes additional property tax increases if approved and compares the year's spending to previous years for transparency. The bill is expected to be finalized on Tuesday.