Important points

- Chinese e-commerce giant JD.com reported better-than-expected sales for the fourth quarter of 2023, with ADRs rising in early trading.

- JD.com reported revenue of 306.1 billion Chinese yuan ($43.1 billion), an increase of 3.6% from the fourth quarter of 2022, exceeding analyst expectations.

- The company pointed out that although it rolled out a series of low-price measures to increase sales, it incurred a number of impairment charges, which suppressed profits.

- Jingdong's fourth-quarter net profit was 3.4 billion yuan ($500 million), up from 3 billion yuan ($420 million) in the same period last year, but fell short of analysts' expectations.

- The company also announced a $3 billion share repurchase program and an annual dividend of 76 cents per U.S.-listed share.

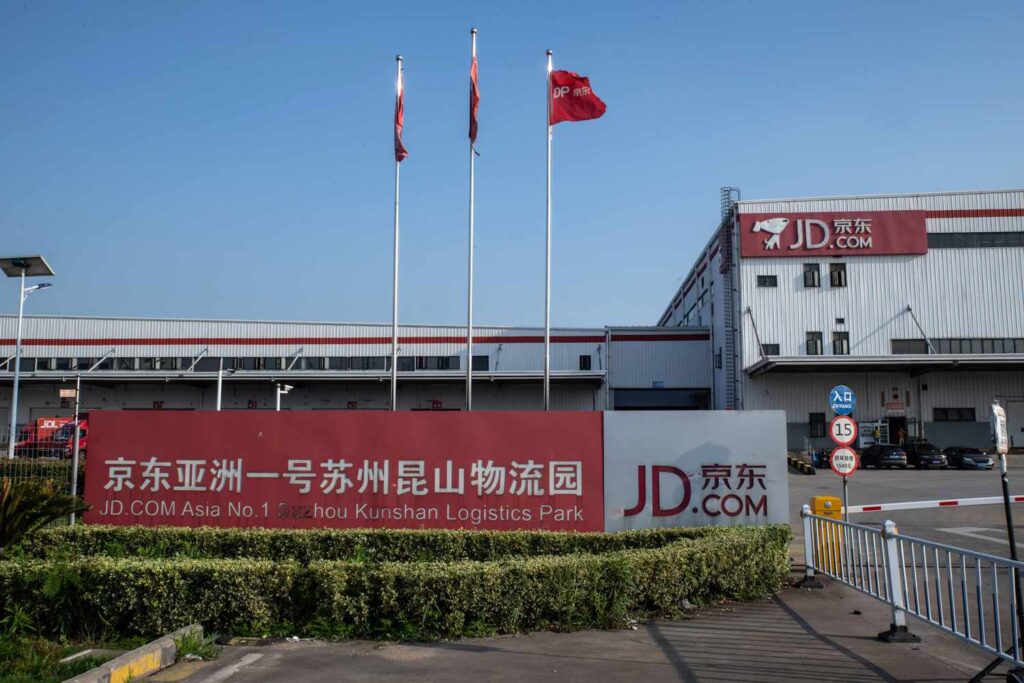

American depositary receipts (ADRs) of Chinese e-commerce retailer JD.com (JD) soared more than 16% in early trading on Wednesday after the company reported better-than-expected fourth-quarter sales. .

JD.com reported revenue of 306.1 billion Chinese yuan ($43.1 billion), an increase of 3.6% from the fourth quarter of 2022, exceeding analyst expectations. The e-commerce giant said it rolled out a series of low-price measures to boost sales, but incurred a number of impairment charges, which held down profits.

JD.com's fourth-quarter net profit was 3.4 billion yuan ($500 million), up from 3 billion yuan ($420 million) in the same period last year. Diluted earnings per share (EPS) fell short of expectations of 2.13 yuan (30 cents).

Full-year net profit was 24.2 billion yuan ($3.4 billion), more than double the 2022 figure of 10.4 billion yuan ($1.44 billion). The company's sales in 2023 were 1,084.7 billion yuan ($152.8 billion), an increase of 3.7% from 2022.

The company also announced a $3 billion share repurchase program and an annual dividend of 76 cents per U.S.-listed share.

Jingdong's ADRs rose more than 16% after the start of trading on Wednesday, but are still down about 8% so far into 2024.