- Uniswap's CEO will receive an SEC Wells Notice, similar to Coinbase.

- Ripple’s resilience holds lessons for Uniswap.

Amidst ongoing legal battle with Ripple [XRP] In addition to the Security and Exchange Commission (SEC), Uniswap Labs is in the spotlight.

April 10th, Uniswap [UNI] CEO, via X (formerly Twitter) postnotified the cryptocurrency community that it had received a Wells Notice from the SEC.

Uniswap CEO's consistent optimism

Uniswap CEO Hayden Adams expressed his concerns during a recent conversation with the podcast Bankless, saying:

“The SEC has basically taken a very aggressive stance and is basically trying to shut down cryptocurrencies.”

He also highlighted Wells' notice regarding Uniswap's interface. This was consistent with a recent court ruling regarding Coinbase's classification as a broker.

He said,

“They just lost a case against Coinbase two weeks ago, right? They lost in court because they didn’t want to go to court, and they lost at the earliest possible stage they could have.”

This comparison highlights the importance of the ruling and suggests a potential precedent for the Uniswap case.

Uniswap follows in Ripple's footsteps

moreover, Stuart AlderottiRipple's CLO cited criticism of the SEC and emphasized:

“The SEC continues to lose. The Second Circuit declined to reconsider the Govil decision, which held that the SEC is not entitled to disgorgement from a seller if the buyer has not suffered economic loss.”

This suggests that Uniswap may be taking notes from Ripple's resilience playbook. Notably, despite regulatory hurdles, Ripple maintained positive trading momentum until the recent market downturn.

Considering the recent cryptocurrency fiasco, many tokens have experienced significant double-digit declines. However, some investors seem to have seized the opportunity to accumulate more XRP.

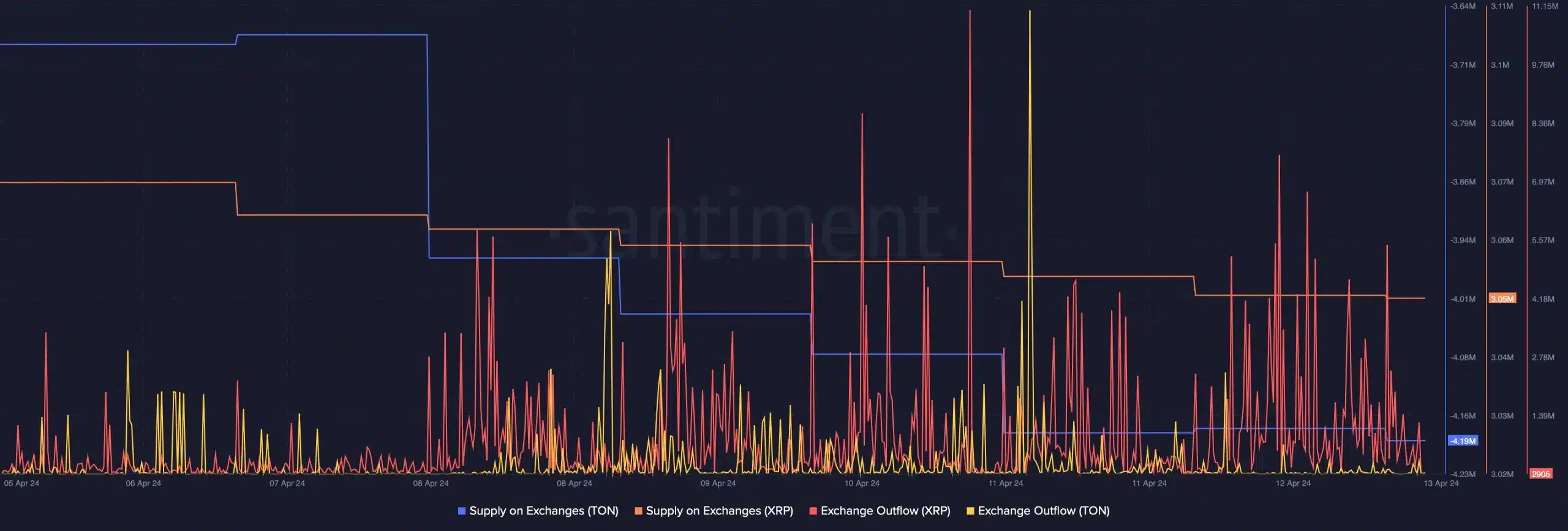

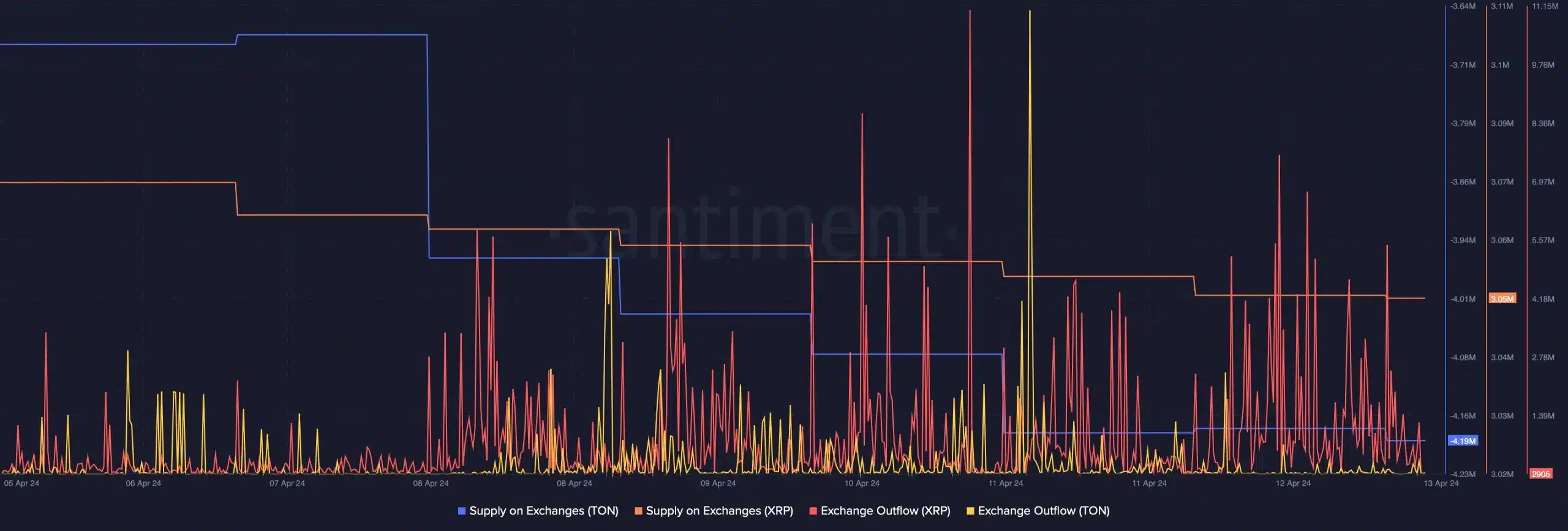

This is highlighted by AMBCrypto’s analysis of Santiment data, which has seen an increase in outflows on XRP exchanges in recent days.

This shows that even though the overall market is falling, some investors are viewing falling prices as a buying opportunity.

What's in store for Uniswap?

In the face of these challenges, UNI experienced a significant decline of 12.64% in the past 24 hours, indicating that it has entered a consolidation phase.

The weekly chart reveals a massive 28.21% decline, plummeting from $11 to $7 in just three days.

The length of Uniswap's legal battle remains unclear, so the question of how far the SEC will go remains open.

However, with continued resilience and learnings from other altcoins, especially XRP, UNI token holders could foresee a significant increase in value in the coming days.