Over the past few months, bank accounts of cryptocurrency professionals have increasingly been frozen or restricted across the UK, US and EU. They say they often don't care until something happens to them. Well, that was the case this week as well. To my real surprise, it came from a place I least expected.

Revolut has long been considered the UK's most crypto-friendly bank, offering in-app crypto purchases, and in 2023 will finally offer the ability to send and receive crypto, albeit with certain restrictions. Added. However, recent events have called into question banks' commitment to providing a seamless experience for customers using cryptocurrencies.

Although the UK is no longer part of the European Union and the MiCA EU regulations apply, the new travel rules require similar disclosures. This means that users will need to reveal and identify the owners of non-hosted wallets that are recipients of withdrawals from Revolut.

However, UK cryptocurrency companies are allowed to apply a risk-based approach to deciding when to collect information about non-hosted wallets. All you need is the ability to identify where your customers are transacting using unhosted wallets and assess the risk of those transactions.

How the UK's most crypto-friendly bank froze 0.23 ETH in my account

Two days ago, I bought a small amount of 0.23 ETH (£550) through the Revolut app and tried to transfer the funds to my personal Ethereum wallet linked to a well-known ENS domain. To my surprise, Revolut blocked the transaction and took a fee from my account. Furthermore, all of his bank accounts were frozen, including his joint account with his wife.

After several hours of frustration and confusion, the account was finally unfrozen and the fee was refunded after further requests. However, certain wallet addresses remain blocked and you are unable to transfer funds to that account. This experience led me to question the nature of Revolut's affinity for cryptocurrencies. Considering the UK alternatives, Revolut remains the best option for those who aren't satisfied with traditional banks, but the bar is low. I believe incidents like this have less to do with Revolut being “anti-crypto” and more to do with fear of regulatory retaliation.

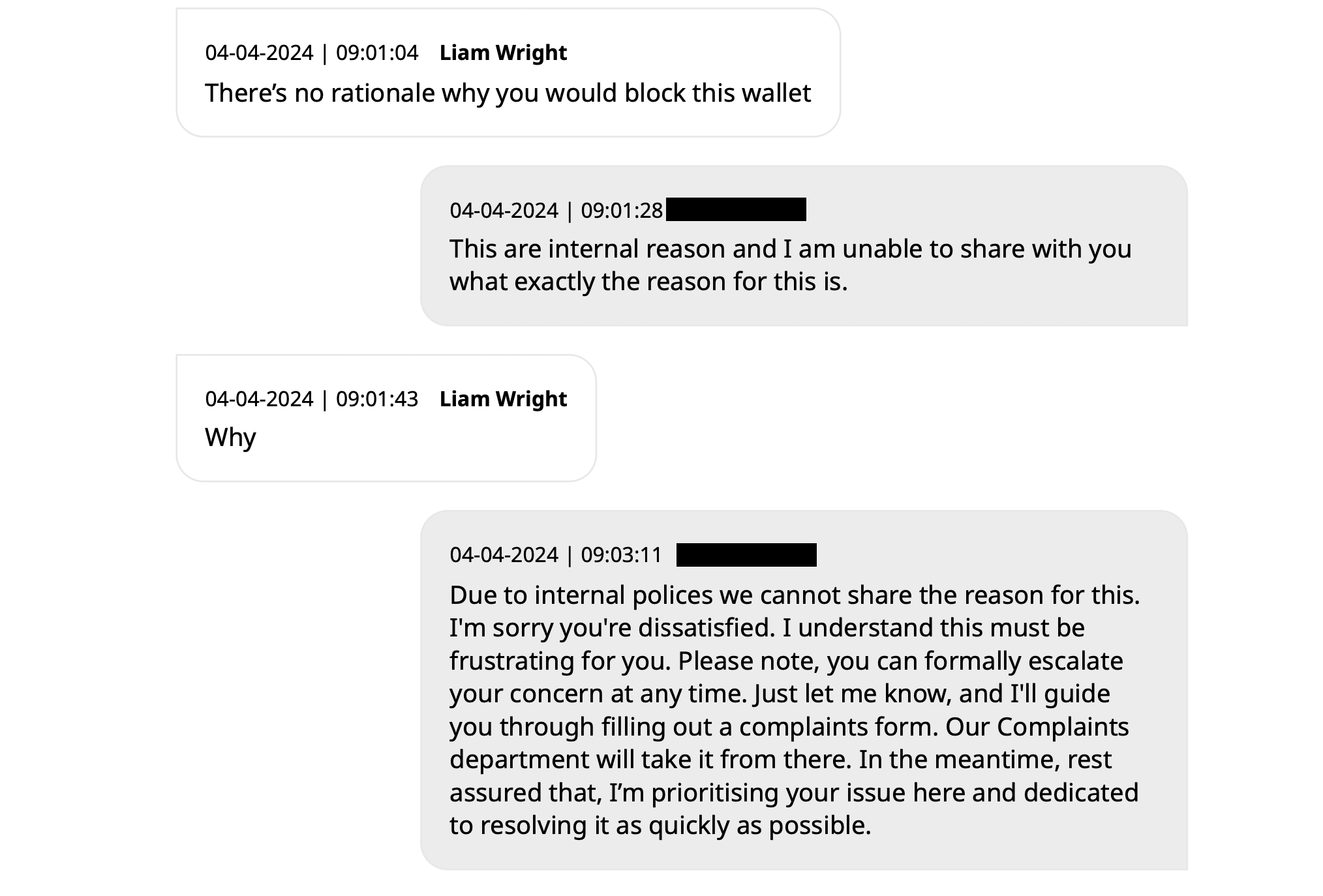

Still, chat transcripts between Revolut's support team and me reveal a lack of transparency regarding the reasons behind account freezes and wallet address blocks. Support representatives were unable to provide a clear explanation, citing internal policies that prevent them from sharing specific reasons for such actions.

The incident raises concerns about the autonomy and control Revolut users have over their funds, particularly when it comes to digital asset trading. Blocking an individual’s wallet address without a satisfactory explanation undermines confidence in banks’ ability to facilitate smooth cryptocurrency transactions.

As the UK navigates the post-Brexit financial landscape, banks like Revolut will need to balance regulatory compliance with providing an easy-to-use experience for their customers. Strict enforcement of the law and lack of transparency in addressing account and wallet issues risks alienating cryptocurrency users who rely on these services. This is especially true given that the company is considering opening a dedicated cryptocurrency exchange.

Deactivate bank accounts of US crypto users

In the United States, even crypto users who are long-time customers of traditional banks are facing account closures due to their involvement in digital assets. ETH Denver co-founder John Paylor recently shared his experience on Twitter, revealing that Wells Fargo de-banked him after 26 years of sponsorship and millions of dollars in fees. revealed. Paler's checking, savings, credit cards, personal lines, non-profit accounts, and business accounts were all closed without explanation, even though he did not use his personal accounts to purchase crypto assets recently.

Caitlin Long, founder and CEO of Custodea Bank, responded to Parra's tweet, saying the bank has received a large number of inquiries from crypto companies urgently seeking replacements for closed bank accounts. It was pointed out that there was an increase in She called this trend a new wave of “Operation Choke Point 2.0” and suggested a full-scale witch hunt against crypto-related businesses.

Bob Summerwill, director of the Ethereum Classic Cooperative, echoed similar sentiments, emphasizing the need for banks like Custodea. He shared his experience with PayPal, which closed the Ethereum Classic Cooperative account without giving a specific reason, only saying that the decision is permanent and cannot be reversed.

These incidents highlight growing concerns within the crypto community. Even people who have established relationships with traditional banks and are compliant are at risk of losing access to banking services. The lack of transparency and sudden nature of these account closures raises questions about the underlying motivations behind these actions and their potential impact on the growth and adoption of cryptocurrencies in the United States.

Positive friction actually means a terrible user experience

As a side note, I have also heard from at least five other individuals who work in crypto and regularly move large amounts of fiat currency through traditional banks who have had their accounts frozen. I'm not advocating the Wild West. All I ask for is common sense regulation.

The UK's approach to regulation also includes what the UK considers 'positive friction'. The concept refers to a set of regulatory measures aimed at introducing certain barriers and checks that slow down the process of investing in digital assets. These measures are aimed at countering the social and emotional pressures that can lead individuals to make hasty or poorly informed investment decisions. The Financial Conduct Authority (FCA) introduced these “positive frictions” as part of the Financial Promotion Act, which aims to strengthen consumer protection in the crypto market.

Examples of “positive friction” include personalized risk warnings and 24-hour cooling-off periods for first-time investors in a company. These measures ensure that individuals are fully informed about the risks associated with cryptocurrency investments and have sufficient time to reconsider their investment decisions without being influenced by immediate emotional or social pressures. It is designed to.

In reality, the unsightly banner warning that appears at the top of every crypto app appears after a series of questions aimed at scaring new investors and never disappears even after meeting all the requirements. Apparently not.

I want to know when the government will test fractional reserve banking for all traditional financial customers. You need to know the nuances of government regulation of currencies. Suppose he is on the street and asks 10 people what will happen if they deposit money into their checking account. How many people will pass the exam?

How many people know that banks in the US and UK have a reserve requirement ratio of 0%? The previous cap of 5-10% was removed in 2020, and now only a fraction of customers' funds are actually How much is held in cash is at the sole discretion of banks. It is therefore perfectly legal for the bank to take her £1,000 deposit and lend the entire amount to another party.

Of course, traditional finance is regulated and your money is “guaranteed” by government insurance, so you don't have to worry. Don't look back to 2008 when you had to rely on tools like this. He said it took customers less than 10% of the time to withdraw their funds before Northern Rock collapsed.

Banks don't have all your money. Well-run crypto exchanges and self-custodial wallets do so, but does regulation suggest we should fear cryptocurrencies?

I think it's the banks that are scared.

Prior to this editorial, I asked Revolut's support and X team if their PR department would like to comment on my situation, but my questions were repeatedly ignored.