Pro-crypto Republicans are preparing a broadside to the U.S. Securities and Exchange Commission (SEC) this week, calling for a reversal of current guidance that they say prevents banks from offering crypto custody services. request to the committee.

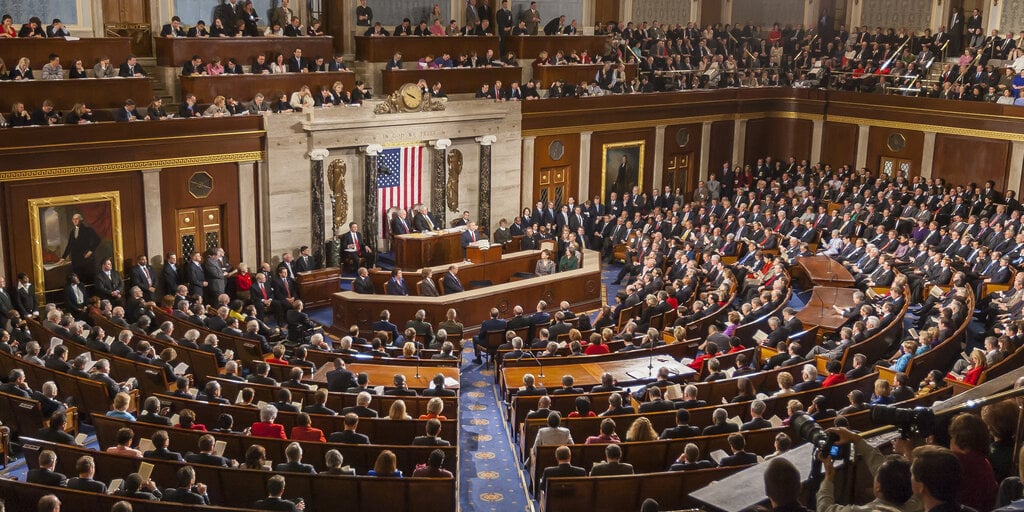

The House of Representatives is scheduled to vote on Wednesday on a joint resolution by Rep. Mike Flood (R-Nebraska) to disapprove Staff Accounting Bulletin (SAB) No. 121 to Congress. A companion resolution was introduced in the Senate.

SAB 121, published on the SEC website, outlines the SEC staff's opinion regarding the risks virtual currency custodians should consider and establishes related disclosure requirements under federal securities laws.

Although the SEC positions the SAB as a guide rather than a formal rule, Flood argued Monday that SAB 121 represents “both a policy change and a controversial change.” He said the SEC also avoided the traditional SAB development process, which typically involves consultation with federal banking agencies.

“It is unfortunate that the SEC would seek to circumvent the rulemaking process while falsely claiming that SAB 121 is merely non-binding staff-level guidance,” Flood told the House Rules Committee on Monday.

In SAB 121, the SEC warned of “technical,” “legal,” and “regulatory” risks specific to cryptocurrency custodians that could have a “material impact on an entity’s operations and financial condition.” It is claimed that it can be given. Flood accused such warnings of discouraging banks and broker-dealers from protecting crypto assets like other financial assets, even four months after the agency approved the Bitcoin Spot ETF. are doing.

“The SEC has thwarted this long-standing practice, imposing prohibitive costs on protecting digital assets for trusted, highly regulated institutions,” he continued.

Resolutions are not legally binding but express the collective sentiments of Congress.

Tom Emmer (R-Minn.), perhaps the SEC's fiercest critic on Capitol Hill, on Monday endorsed the flood bill, saying “illegal” SAB 121 would seek to assert regulatory authority over the entire crypto industry. He said this is an example of the SEC's efforts.

“SAB 121 introduces further unnecessary and avoidable concentration risks into the digital asset ecosystem, making our markets less fair, less orderly, and less efficient,” he asserted. . Emmer added that foreign banks are already able to compete in this space, leaving the US behind.

The SEC has targeted several major cryptocurrency companies with lawsuits, from exchanges and other custodial service providers to software development teams, including Coinbase, Binance, Kraken, Uniswap Labs, and Robinhood.

Even if the joint resolution, known as HJRes.109, passes a floor vote in the House tomorrow, it will have to await its fate in the Senate, where a companion resolution, SJRes.59, has yet to pass out of committee. The bill will be passed with two-thirds approval from both houses.

Edited by Ryan Ozawa.