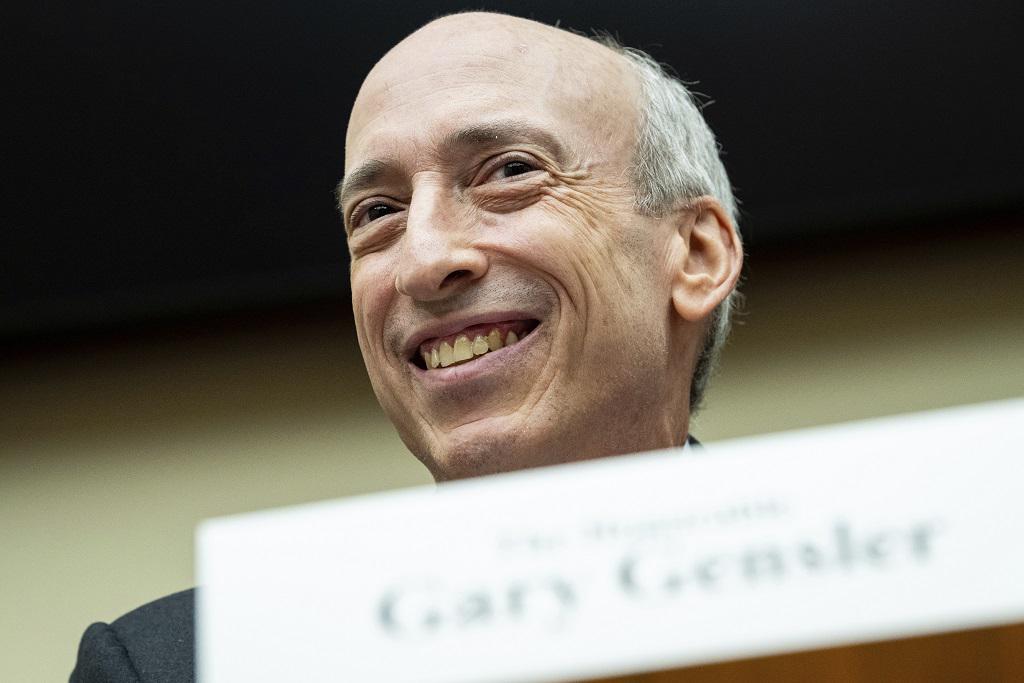

Thanks to SEC Chairman Gary Gensler, Bitcoin, a speculative creation with no backing, has been brought back from the brink. In November 2021, when cryptocurrency fever was at its peak, Bitcoin reached an all-time high of $64,400. Then, after various cryptocurrency scandals, Bitcoin's value plummeted to below $35,000 for most of 2023. Bitcoin is currently trading at over $63,000, close to its all-time high.

In January, Gensler sided with the SEC's two Republican commissioners in a 3-2 vote that saw 11 major financial companies approve exchange-traded products (ETPs), tradable funds backed by Bitcoin. ). It is almost unprecedented for a Democratic chair to vote against two Democratic colleagues and side with a Republican committee member.

These new funds do not add any value. Any investor who wants to buy Bitcoin can go out and buy Bitcoin. However, these funds are sponsored by reputable companies like Fidelity and are tacitly blessed by the SEC, giving the impression that Bitcoin is a safe investment.

Other works by Robert Kuttner

Why did Gensler, a regulator who spent much of his recent career as an MIT professor and then as SEC chairman warning against cryptocurrency abuse, change his mind?Simply put, Gensler was overturned in court. It means that you are too afraid of something.

Last August, the D.C. Circuit Court of Appeals sided with Grayscale, whose request to create a fund based on the spot price of Bitcoin was rejected by the SEC. The court pointed out that if the SEC approves funds based on the value of Bitcoin in the futures market, why not in the spot market? The European Commission had argued that the two markets were substantially different.

The court did not require the SEC to grant Grayscale's request. It simply sent the case back to the SEC for further consideration. Gensler feared it would be overturned again.

In fierce opposition to Gensler's ruling granting the request, another Democratic member of the committee, Caroline Crenshaw, weighed in on all the ways Bitcoin transactions are characterized by fraud and manipulation. The conclusion was as follows. It will be invested squarely in the retirement accounts of American households where the loss of savings to fraud and manipulation can be minimized…I believe that today's actions will ensure that no such oversight actually exists. Nevertheless, there are concerns that the commission's approval and oversight of the underlying spot market could result in illegal activity. ”

It would have been much better for the SEC to deny these applications, better distinguish these proposed products from other SEC-approved products, and take its chances in court. At the very least, this would have slowed down the recent Bitcoin gold rush.

The January ruling opens the floodgates to other exchange-traded products being proposed by several other investment firms, including one that backs Ethereum, a crypto commodity with an even more volatile track record than Bitcoin. will open. The SEC has until the end of May to rule on these applications.

Why did the largest investment firm like BlackRock, which was skeptical of a creation like Bitcoin, change tack and become a proponent of Bitcoin-backed funds? Fees, of course. BlackRock's fund reached $10 billion in record time.

On March 6, the SEC also watered down proposed regulations that would require public companies to disclose material risks related to climate change. Once again, those concerns are being overturned in court.

There is a fascinating symmetry between the SEC's fallout over Bitcoin and the climate, as “mining” Bitcoin and other cryptocurrencies uses large server farms that consume energy for entirely spurious purposes. There is sex. As for court appeasement, the Fifth Circuit Court of Appeals yesterday ruled that even the SEC's weakening of climate change regulations went too far and ordered a moratorium.

It's better to stick to your principles, keep fighting and let the chips fall.