NEW YORK (AP) — Crypto Entrepreneur Sam Bankman Freed He was sentenced to 25 years in prison on Thursday for the massive fraud against hundreds of thousands of customers uncovered in the collapse of FTX, once one of the world's most popular digital currency exchange platforms.

U.S. District Judge Louis A. Kaplan called Bankman Fried “very smart,” but before sentencing him to half the sentence sought by prosecutors, less than a quarter of 105 years in prison. A harsh analysis of Bankman Freed and his crimes. Recommended by the court's probation officer.

“Currently, Bankman Fried's name has become quite popular around the world,” Kaplan said of the 32-year-old California man who seemed to be at the top of the cryptocurrency world until his business collapsed in November 2022. There is no doubt that there is,” he said. Customers, investors and lenders were left with more than $11 billion, which a judge ordered forfeited.

he was there Convicted in November The dramatic rise from the height of success, including Super Bowl ads, testimony before Congress, and celebrity endorsements from stars like quarterback Tom Brady, basketball point guard Stephen Curry, and comedian Larry David. It's a fall.

Kaplan, who was sentenced in the same Manhattan courtroom, testified four months earlier that Bankman Fried intended to revolutionize the emerging crypto market with an innovative and altruistic idea, not theft. did.

The judge said Bankman Fried repeatedly perjured himself on the stand, “often evasive and dodging chilling questions.”

Kaplan said the ruling reflects the risk that Bankman Freed “will be in a position to do very bad things in the future.” And it is by no means a trivial risk. He added that the sentence was designed to “injure him to the extent reasonably possible for a significant period of time”.

Mr. Kaplan told the Federal Bureau of Prisons that Mr. Bankman-Fried's notoriety, association with great wealth, autism, and social awkwardness would likely make him particularly vulnerable to high concentrations. He said he would recommend sending Bankman-Fried to a medium-security prison near San Francisco. Security facility.

Recommended by Assistant U.S. Attorney Nicholas Luce prison sentence He said it was the only way to “prevent the defendant from doing this again.”

Prosecutors said tens of thousands of people and businesses around the world have suffered billions of dollars in losses since 2017, when Bankman Fried looted FTX customer accounts he promised would be safe. He also allegedly sent forged documents to his lenders, made tens of millions of dollars in illegal political contributions, and bribed Chinese officials.

Prosecutors say the billions he stole were used to make risky investments, make charitable contributions, make political contributions to candidates in both major political parties, and support a lavish lifestyle that included buying private jets and expensive real estate in the Caribbean. It is said that it was used for

Kaplan agreed Thursday with prosecutors that Bankman Fried should not be trusted because some investors and customers may get some of their money back. He noted that customers lost about $8 billion, investors lost $1.7 billion and lenders were shorted by $1.3 billion.

During her speech, Bankman-Fried stood up and apologized in a rambling statement: And they were very disappointed. Sorry about that. I am sorry for what happened every step of the way. ”

He further added: “My useful life is probably over. It's been a while since I was arrested.”

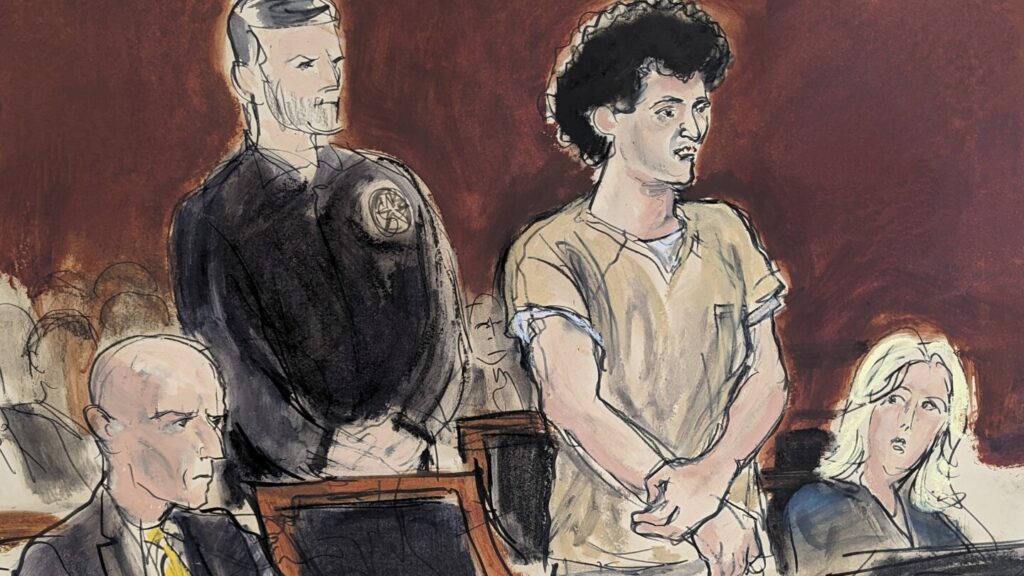

Bankman Fried, wearing a khaki prison uniform and chained around his ankles, appeared briefly emotional during his approximately 20-minute speech, expressing regret for “many mistakes.” but shifted some of the responsibility to others. His trademark unkempt, bushy hair had returned from the trimmer look he wore at trial.

Kaplan later criticized those statements, saying, “There was not a single word of remorse for committing such a horrific crime.”

As his client looked on through bleary eyes, defense attorney Mark Mukasey called the Massachusetts Institute of Technology graduate “an arrogant, greedy con man who thought he could get away with extorting hard-working people of their hard-earned money.” He said the depiction was incorrect. .

“Sam was not a ruthless financial serial killer who sets out every morning to hurt people,” Mukasey told Kaplan in court after pleading for any prison sentence to be in the single digits in court papers. . “Sam Bankman Freed doesn't make decisions with malice in his mind. He makes decisions with the math in his head.”

The judge later criticized Bankman-Fried's calculations, saying he was truly a “math nerd and looked at decisions in terms of mathematics and expected value.”

Bankman Freed's ex-girlfriend and fellow executive, Caroline Ellison, said that Bankman Freed once told her that he was so willing to take risks that if things turned out wrong, the world would go awry. He cited trial testimony in which he said he would happily flip a coin if Destroyed – even if we won, the world would be twice as good.

The judge said Bankman Freed took advantage of the company's risk-taking nature and “bet on expectations”, weighing the risk of being caught against the potential for big profits.

“That was the game,” Kaplan said. “That's his nature.”

Bankman Freed's Lawyers, Friends and Family asked for leniency, said he was unlikely to reoffend again. They also said FTX's investors had recovered most of their funds, a claim disputed by bankruptcy lawyers, FTX and its creditors.

“Mr. Bankman Freed continues to live a life of delusion,” wrote FTX CEO John Ray, who is cleaning up the bankrupt company. “The ‘business’ he left on November 11, 2022, was neither solvent nor secure.”

Bankman-Fried's parents, both professors at Stanford Law School, did not speak as they left the courthouse Thursday, but later said, “We are heartbroken and want to express our condolences to our son.'' We will continue to fight.''

Bankman Fried was worth billions of dollars on paper as co-founder and CEO of FTX, once the world's second-largest cryptocurrency exchange.

FTX allows investors to buy dozens of cryptocurrencies, from Bitcoin to obscure ones like Shiba Inu Coin. Enriched with billions of dollars in investor cash, Bankman Fried ran Super Bowl ads to promote his business and bought the naming rights to an arena in Miami.

but Cryptocurrency price collapse 2022 dealt a huge blow to FTX, ultimately leading to its collapse. Alameda Research, FTX's hedge fund affiliate, had purchased billions of dollars of various crypto investments that lost significant value in 2022. Bankman Freed sought to fill holes in Alameda's balance sheet with FTX client funds.

Three of Bankman Fried's associates pleaded guilty to related crimes and testified at trial.

In addition to Ellison, two former friends of Bankman Freed, Gary Wang and Nishad Singh, testified that they felt Bankman Freed directed them to commit fraud.