The Financial Crimes Enforcement Network launched the BOI Registry on January 1st. Established under the Corporate Transparency Act, the registry is intended to be a tool to assist law enforcement, banks, and regulators in detecting financial crimes.

For certain companies established or registered to do business before New Year's Day, the filing deadline is up to one year. According to FinCEN, newly formed companies have up to 90 calendar days to register beneficial ownership information.

The number of registration applications has accelerated from the more than 100,000 registered in the first week of registration, but to meet the stated expectations, companies will need to register at a rate of approximately 2.7 million per month. there is.

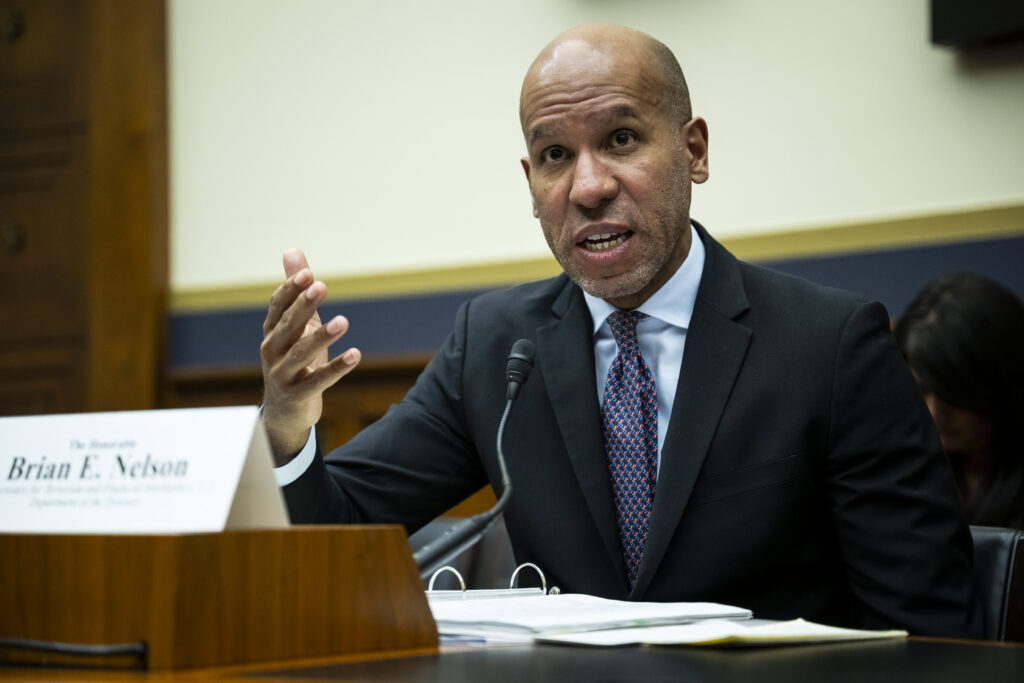

Nelson said the agency is “going full court coverage” to spread awareness about the registry.

“This is both about reporting requirements in the spirit of education and compliance, and about having quality information that is valuable to law enforcement so they can identify bad actors and shell companies that seek to exploit the financial system,” he said. ” he said. Added.

“Many small and family-run businesses have never heard of FinCEN,” Nelson says. “The majority of people have probably never heard of FinCEN.”

“And two…this is a new and novel reporting requirement,” he added.

Nelson said the Treasury Department is working with the Secretary of State and Chambers of Commerce to provide information to business owners, using multilingual guidance, informational webinars and YouTube.

“Law enforcement, national security, intelligence agencies…this data is for them,” Nelson said. Uploaded reports must identify credentials such as registered company name and location.

“This lack of necessary information means, at the very least, 'Hey, this is a concern. We should commit law enforcement resources to deal with whatever this organization is that doesn't know its beneficiaries. This will shed light on the fact that

The BOI will force the United States to comply with the recommendations of the Financial Action Task Force, which sets international standards for anti-money laundering and counter-terrorism. For example, the UK has had an active registry since 2016.

“There was no beneficial ownership system in the United States to speak of,” Nelson said. “Therefore, I am very proud to be able to share that as of January 1, the register is in place, operational, and has thousands of registrants.”