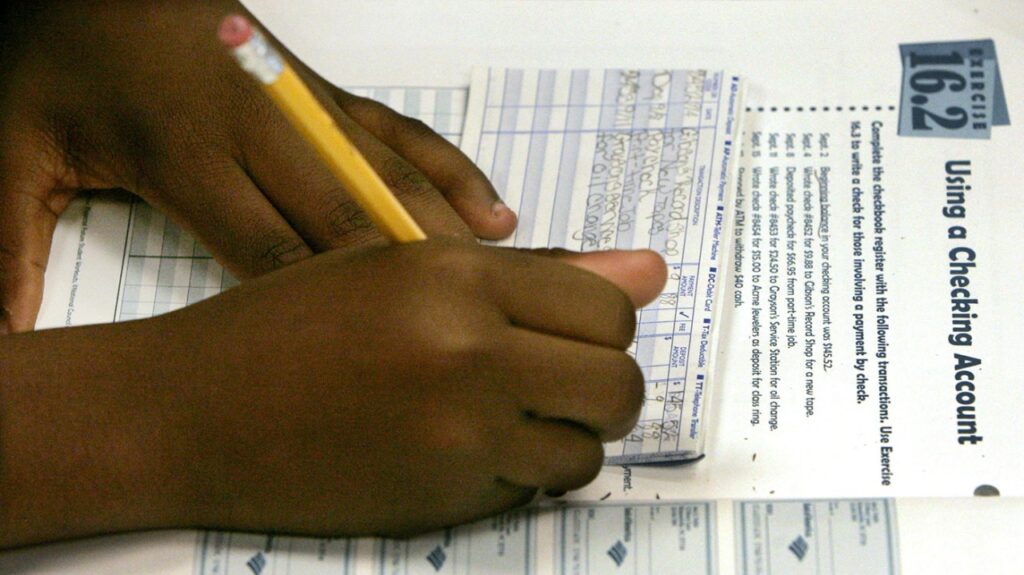

In recent years, personal finance classes have become a requirement for high school graduation in dozens of states, raising hopes among activists that financial literacy is finally getting the support it deserves.

In 2020, only eight states had stand-alone personal finance courses available to all high school students, according to tracking by Next Gen Personal Finance. This year, 25 states will offer financial literacy classes for K-12 students. Eight states have fully implemented the class, and 17 states are still implementing it.

“It seems like all of a sudden states are sitting up and taking notice, but that's really just happened in the last few years,” said Jessica Pelletier, executive director of FitMoney.

Experts say these classes go beyond just writing a check and will continue to expand to high school students and potentially middle school students, even as COVID-19 has put a damper on that goal. There is.

Pelletier speculated that the pandemic has created a sense of urgency for educators and parents about financial literacy as the economy plummets and households struggle to make ends meet.

“Those two things have combined to create such a unified voice from parents and educators on financial literacy that I think legislators are taking notice.” [of] “This is what they're hearing from their constituents, this is what they want,” she said.

Lindsey Toriko, executive director of the American Bankers Association (ABA) Foundation, said the number of individuals reached through financial education resources and programs has doubled since 2019.

“Last year we launched a new initiative to get more banks involved in financial education. With a goal of reaching 5 million people with financial education over the next three years, we launched a new commitment that banks will sign up to. ,” Toriko said. “And the response has been overwhelmingly positive. In about a year, approximately 816 banks have signed on to this initiative, and in total he is providing financial education services and resources to 1.23 million people.”

According to Laura Levine, president and CEO of the Jump$tart Coalition for Personal Financial Literacy, financial literacy in schools has steadily improved over the past 20 years, and it naturally increases during periods of economic instability, such as the 2008 recession. It seems that this topic has become popular. And the 2020 pandemic.

He said the coalition has been creating a guide to national standards for personal finance education since 1999. The latest edition covers six topics: earning income, spending, saving, investing, managing credit, and managing risk.

“If you look at the standards, you'll see they cover a whole range of areas: investing, insurance, saving, spending, budgeting,” Levine said in a school financial literacy class.

This includes K-12 schools across the state with or without mandatory financial education classes, and much of the movement stems from spontaneous interest in the subject.

While the legal initiative is welcome, many schools are beginning to realize that relying on financial education at home is not viable for many students who need it.

“There are children who don't have families, so they're foster children. […] Or maybe your family isn't as fortunate and your parents don't know much about the financial system,” Levine said.

In addition to making financial education courses more comprehensive, activists also aim to start them earlier.

The ABA Foundation has a program that targets kindergarten through eighth grade directly, with bankers going into elementary school classrooms and giving PowerPoints and lessons.

“The program is currently actively used by nearly 1,000 banks, and a variety of unique banks are using our materials, even though many states do not yet have laws in place to support financial literacy. “We're trying to use this to reach kids at the right age and promote financial literacy,” said Kelsey Haveman, senior manager at ABA. Foundation's Youth Financial Education Program;

Experts say children want to be actively involved, so efforts to improve financial literacy are largely focused on persuading adults to bring in learning materials.

“This is one of the few classes that I've actually heard that almost every student wants to take. You know the old saying, 'When will I need this?' […] When every student is learning about budgets, credit scores, and insurance, they immediately notice and say, “Oh, I get it!” When I grow up, I will absolutely need all of this information,” Pelletier said. “So when you’re talking to students, it’s a pretty easy sell, so to speak.”

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.