- Natalie Sherman, Kayla Epstein, Michelle Fleury

- BBC news

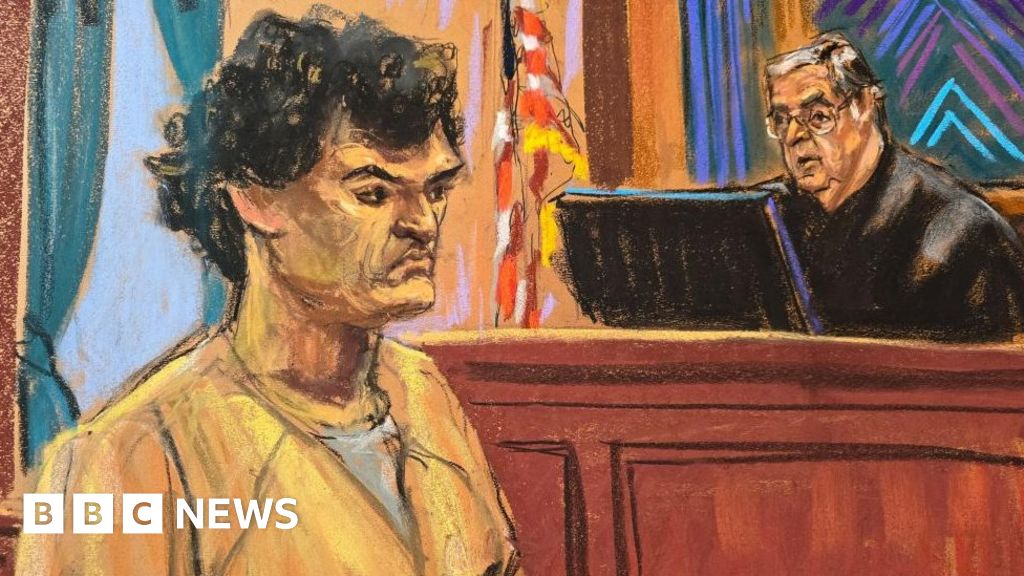

Sam Bankman Fried, co-founder of failed cryptocurrency exchange FTX, was sentenced to 25 years in prison for defrauding the bankrupt company's customers and investors.

The ruling cements the fall of the former billionaire, who gained attention as a champion of cryptocurrencies until his company's dramatic bankruptcy in 2022.

He was found to have stolen billions of dollars from customers before the bankruptcy.

Bankman Freed's legal team plans to appeal the conviction.

A message from Bankman-Freed's parents, which was shared with the BBC by a representative, said: “We are heartbroken but will continue to fight for our son.”

Earlier, the 32-year-old told the court he knew “a lot of people” felt “really disappointed”.

“I'm sorry for that. I'm sorry for what happened every step of the way,” he said quietly and clearly before the verdict.

FTX was one of the world's largest crypto exchanges before its demise, turning Bankman Freed into a celebrity in the business world and attracting millions of customers who use the platform to buy and trade cryptocurrencies. did.

Rumors of a financial crisis led to a deposit run in 2022, leading to the company's bankruptcy and exposing Bankman Freed's crimes.

He was arrested in New York last year on charges including wire fraud and money laundering conspiracy after a trial detailing how he took more than $8 billion from clients and used the money to buy real estate. Convicted by a jury. , make political contributions and make other investments.

Before reading Thursday's verdict, Judge Lewis Kaplan issued a scathing assessment of Bankman Fried's actions, saying during trial testimony that Bankman Fried had made it clear that his company was keeping the funds entrusted to it safe. He claimed to have lied, claiming that he did not know until the end that he had kept it in his possession.・If the customer stores it and uses it for other purposes.

“He knew it was wrong. He knew it was a crime. He regrets taking such a bad bet on his chances of getting caught, but he's not going to admit anything. No,” the judge said.

He added that Bankman Freed had made a “protest of grief” over the loss of his clients, but had “expressed no remorse for having committed such a horrific crime”.

While 25 years is a serious sentence, it is far less than the more than 100 years Bankman-Freed could receive under official government guidelines.

image source, Getty Images

Barbara Freed and Alan Joseph Bankman, parents of FTX co-founder Sam Bankman Freed, said they were “heartbroken” after the verdict.

Federal prosecutors in New York told the judge this month that such a long term was not necessary.

But they called for at least 40 years in prison, arguing that Bankman-Fried committed massive fraud while showing “brazen contempt” for the law.

Bankman Freed's team had argued for a lighter sentence of approximately five to six-and-a-half years.

They argued that he was a non-violent first-time offender, noted mental health difficulties and that their client was poised to recover large sums of money under a plan currently working its way through bankruptcy court. .

“The victims want and deserve their money back,” his lawyer Mark Mukasey argued in court Thursday morning. “Sentence him to work hard and give his all.”

Mitchell Epner, a former federal prosecutor and current attorney at Rottenberg Lippman Rich, said he was “extremely surprised” by the ruling, which will allow Bankman Fried to be released in about 13 years. He pointed out that there is a possibility.

But Jennifer Taub, a law professor at Western New England University and an expert on white-collar crime, said she believes the length of the sentence is appropriate.

“It's the right balance between his age and the purpose of deterrence,” she says.

In his sentencing remarks, Judge Kaplan said that while a sentence equivalent to life in prison was unnecessary, Mr. Bankman-Fried should receive sufficient punishment to prevent future crimes.

“This man risks being in a position to do some very bad things in the future, and that's not a trivial risk, it's not a trivial risk at all,” he said.

He also ordered Bankman Freed to forfeit $11 billion that could be used to compensate victims.

The government has already seized some of those assets, including Bankman Fried's stake in trading app Robinhood, which raised more than $600 million when sold last year.

Bankman Fried showed little visible reaction to the verdict.

Bankman Freed acknowledged the mismanagement but insisted he had acted in good faith.

In comments ahead of the ruling, he stuck to his contention that FTX had stock holdings to repay customers when it went bankrupt, saying the reasons behind customers' suffering were “not being properly told.” “No,” he said.

“Countless people have failed,” he said of the exchange's customers, including himself. “It was excruciating to watch.”

Bankman Fried said he regrets letting down not only his customers but also his former employees, including a former close friend who testified against him at trial and praised him in his remarks. Former employees included Lt. Caroline Ellison and Lt. Gary Wang.

“They all created something really beautiful and threw themselves into it, and I threw it all away,” he added. “It bothers me every day.”

Dozens of people, including former FTX customers, family members, friends of the parents, and complete strangers, filed letters with the court in an attempt to sway the outcome.

Louis Dorigny, a California resident who was a former FTX customer, said it was a “bittersweet moment for creditors.”

“I don't want anyone to go to prison. 25 years is a very long sentence, but it does nothing to compensate the victims who lost their cryptocurrencies.”

Samuel Hapag, CEO of crypto trading fund Wincent, held millions of dollars and represented 200 investors when FTX went into bankruptcy. He told the BBC he thought the sentence was “fair”.

“Twenty-five years is a long time, and I believe this sounds like a reasonable signal to the industry that it needs to be more competitive,” he said.

Judge Kaplan said he would not recommend that Mr. Bankman-Freed serve time in a maximum-security prison because the court had no reason to believe that Mr. Bankman-Freed posed a threat of violence.

He said he was also considering concerns from lawyers and parents that Bankman-Freed's social awkwardness, caused by his autism spectrum disorder, could make him vulnerable in prison.

Bankman Freed's case is being closely watched by other crypto executives and companies that have been sued.

But he is not the first person in the industry to be sentenced.

Karl Sebastian Greenwood, who collaborated with “crypto queen” Ruja Ignatova, was sentenced last year to 20 years in prison for his role in persuading millions of people to invest more than $4 billion in the fraudulent currency OneCoin. Ta.

His case also drew comparisons to Bernie Madoff, who was convicted of a $64 billion pyramid scheme and sentenced to 150 years in prison.

Mark Litt, a former federal prosecutor who handled the case against Madoff and is now Wachtel Misley's lawyer, said Madoff was older when he was convicted and that he committed crimes over a period of decades. , noted that he stole the money and said he felt there was a big difference between the two scammers. Those he knew well never stepped forward to testify to his character.

“I believe that the court has implicitly taken these differences into account and that the resulting sentence is just and unlikely to be changed on appeal,” he said. .