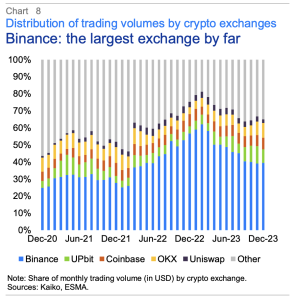

European Union securities regulators have warned about the concentration of trading activity on a limited number of virtual currency exchanges. Notably, it was announced on Wednesday that a single platform, Binance, controls about half of the total market.

Analysis by the European Securities and Markets Authority It has been revealed that just 10 exchanges handle around 90% of all cryptocurrency transactions. Additionally, the report identified that market liquidity fluctuates widely, with larger exchanges tending to exhibit higher levels of liquidity.

“While this may be advantageous from an efficiency perspective (due to economies of scale), it raises considerable concerns about the impact that a failure or malfunction in a major asset or exchange would have on the broader cryptocurrency ecosystem.” said ESMA.

MiCA regulation still does not facilitate euro adoption in cryptocurrencies

An investigation into the fiat currencies used in the cryptocurrency market revealed a heavy reliance on the US dollar and the Korean won. On the other hand, the role of the euro is relatively small, accounting for about 10% of transactions.

In addition, the following were also observed: Crypto Asset Market (MiCA) Regulation To date, there has been no measurable increase in the use of the euro in the crypto market.

Despite the current lack of impact, ESMA expects MiCA to come into force in 2024 and could emerge as a potential growth booster. This expected effect is due to MiCA's focus on strengthening investor protection within the market.

ESMA challenges crypto safe haven status

Additionally, ESMA challenged the notion that crypto assets serve as a safe haven during broader market distress. While the report identified some degree of correlation between crypto assets and equities, it also highlighted the lack of a consistent relationship with gold, traditionally recognized as a safe-haven asset.

Licensed exchange, unknown location

The regulator also highlighted that the inherent opacity of cryptocurrency transactions makes it difficult to determine their origins. However, a significant portion of crypto exchanges are found to be located in jurisdictions characterized as tax havens.

According to ESMA, around 55% of transactions take place on crypto exchanges licensed under the EU's VASP framework. However, a significant proportion of these transactions are likely to occur outside the European Union.

Bitcoin, Ether and Tether dominate the crypto market

Separately, it was found that the increase in the number of actively traded crypto assets since 2020 has not alleviated significant concentration within the market. As of December 2023, there are only three cryptocurrencies – Bitcoin (BTC), ether (ETH), and stablecoins tether (USDT) – accounts for a significant 74% of market capitalization and 55% of annual trading volume.