For example, we know that one day print newspapers will probably be replaced entirely by online newspapers, but no one knows when that will be.

We know that we will never one day burn oil or gas for energy, and we know that buying goods online will one day surpass buying them in stores, but we don't know when that tipping point will be.

Companies of all shapes and sizes are betting on when these tipping points will occur. They shape their business models and investments based on their perception of when certain activities will end and when others will enter an explosive growth phase. Getting it wrong can be costly. First adopters are rarely the winners, and latecomers are often rewarded for their patience and caution.

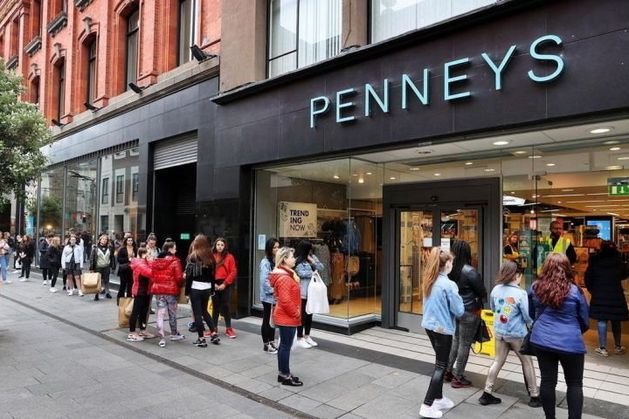

An example of the latter could be seen in the global retail industry, where Primark (trading as Penneys in Ireland) continues to defy convention by refusing to offer true e-commerce. Recent financials suggest that so far it's Penneys 2, conventional wisdom 0.

The strategy, coming from a company that still holds dear the “load products, load them up, load them down” mantra of founder Arthur Ryan, is sure to infuriate some customers and confound many retail analysts who for years have been premature in predicting the demise of brick-and-mortar stores.

Indeed, the company, which has 37 stores in Ireland, currently offers click and collect in some UK locations, but has steadfastly refused to go fully Amazon-ify by offering a delivery option.While this would seem to remove the company from the wider consensus on the direction of e-commerce and retail, the decision is based on solid business principles.

Primark is a low-margin business, and costs are a measure of its very existence, so having a fleet of trucks commuting to and from consumers' homes (not just making deliveries, but also accepting returns) makes little sense.

Additionally, the company sells a lot of very cheap clothing items that they could never sell at a profit.

But e-commerce options aren't a good fit for Primark/Penneys today, and critics would argue it's only a matter of time before the company goes under. Again, this is the crux of the issue: we know that e-commerce is growing, but not fast enough.

For example, consulting firm Forrester predicts that while e-commerce will grow, its rate of growth will be much slower than in the early pioneering days, so that by 2028, more than 75% of global retail sales will still take place in brick-and-mortar stores.

Ireland is a good example of how timing remains uncertain in retail and getting ahead of yourself can be detrimental: for example, according to the Central Statistics Office, only 4.9% of Irish retail sales in May were made online.

Yes, this is a big

While this underestimates Amazon's impact, the trend lines are more revealing: Pre-COVID, the figure was slightly lower (4.5% as of March 2020).

In other words, despite what seemed like certainty during the Covid-19 pandemic, e-commerce in Ireland has stagnated somewhat – it is growing, but only at a relatively modest rate.

While some categories, such as white goods and books, are popular for online ordering, efforts to encourage grocery ordering appear to be much slower.Primark/Penneys has a mixed picture: CSO estimates that around 9.3% of total clothing/footwear sales come from online sources.

So what's going on? For many shoppers, ordering online is simply too expensive or too risky. You can't afford to order the wrong item. Visits to physical stores are an important part of your shopping plan, not just retail therapy but also a kind of insurance.

We see a similar trend in the Irish grocery industry. Who are the ones offering pure delivery and e-commerce services? Tesco, Supervalue and, more recently, Dunns Stores, which acquired Buy Me. But the German discounters Aldi and Lidl are not.

This hasn't hurt them much: Lidl, which doesn't even offer click and collect, has gained the lion's share of the Irish grocery market over the past decade at the expense of those offering full e-commerce services.

Ireland's low population density also poses e-commerce challenges for some brands: There are just over 71 people per square kilometre in Ireland, compared with 279 in the UK.

Primark/Penneys will likely consider much of this evidence and conclude that its current approach of dipping its toe in the water through limited click and collect is the right approach to e-commerce. In time, the company may go deeper, but at a time of its choosing. But with their current business models that rely on volume and low costs, it's hard to imagine fast fashion and discount stores ever truly succumbing to online ordering.

Penneys/Primark is a great example of a company that hasn't gotten too carried away with market hype, has trusted its own internal judgement and maintained flexibility in its business model.

It's true that rust never stops, but how quickly it spreads is crucial when you're managing shareholders' funds and your own reputation.

Pilots rejoice, but Aer Lingus now a thorn in IAG's side

The decision by Aer Lingus pilots to accept a 17.75% pay rise and put an end to a bitter airline dispute has left the battlefield littered with casualties. Not all of the bodies are visible. While the pilots will be happy with the inflation-adjusted pay increase, local management is not happy, as the airline's future as part of the IAG group is now uncertain.

Aer Lingus has long been the ugly duckling within IAG, with the highest labor costs as a percentage of revenue and the lowest profit margins and load factors of the four airlines that make up IAG.

Now, these metrics could be even worse, except perhaps for the load factor.

Given Dublin Airport's passenger capacity cap, the gap between Aer Lingus and other IAG members' financial performance and future growth caps is set to widen, which may mean no more capacity is brought to Ireland.

There are certainly improvements being considered to boost profitability, perhaps by adding more efficient jets to boost revenue or by cutting costs.

At the moment, local governments appear to be limited in what they can do.

Aer Lingus is set to introduce next-generation Airbus XLR aircraft in the coming months, which will increase capacity but have the benefit of a lower cost structure. However, one of these allocations has already been cancelled, indicating that while currently employed Ialpa pilots did not necessarily lose out from last week's pay deal, pilots not yet employed by the airline likely did.