Are you thinking about studying in the USA and looking for Education Loan to Study in USA? then you have landed on right article. It is a big dream for many students, but the cost can be huge. With an education loan, you can get the money you need to afford that top-notch education without stressing about finances right away.

In this article, we will talk about the benefits of an education loan to study in USA, how to choose a bank, who can get them, how to apply, and what your options are for paying this education loan back. We have all the info you need to make smart choices about financing your education in the USA. Let’s get started!

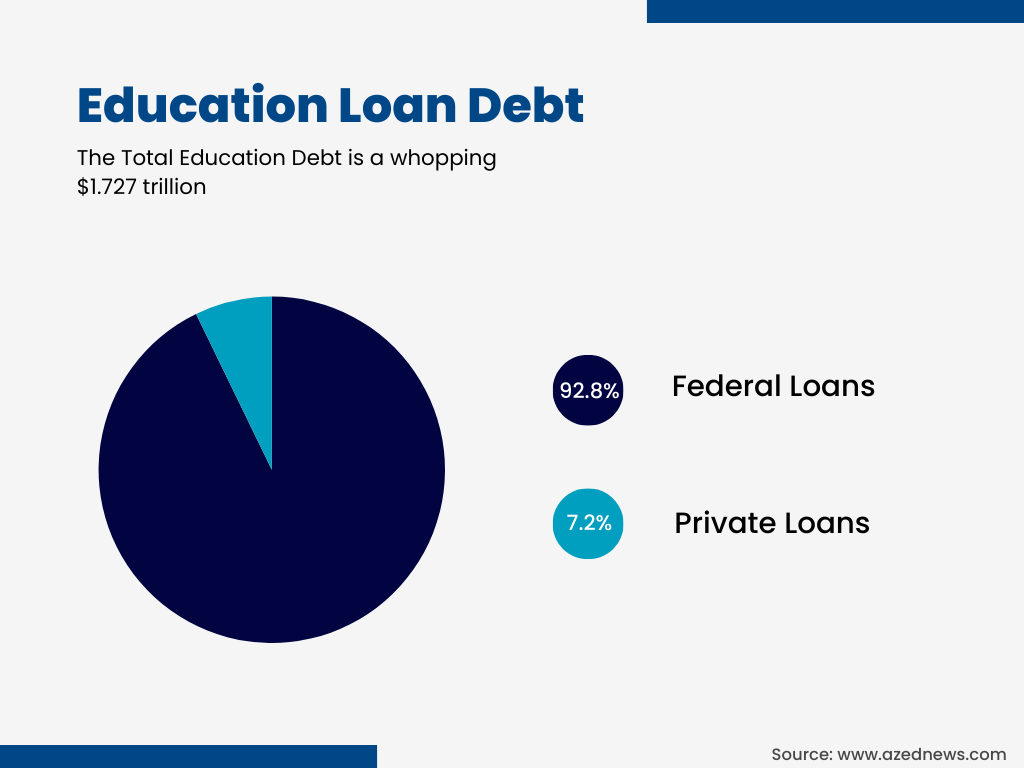

Overview of Education Loan Debt Statistics

Here is the overview of education loan debt in the US:

- The Total Education Debt is a whopping $1.727 trillion. But in 2023, it went down for the first time!

- Most of this debt, about 92.8%, comes from federal loans, totaling $1.602 trillion.

- About 43.2 million people are dealing with federal student loan debt.

- On average, each person owes around $37,088 in federal student loans. But when you add private loans, that number jumps to about $39,981.

- Surprisingly, only less than 2% of private student loans end up in default.

- If you are going to a public university, the average student borrows about $32,637 to get their bachelor’s degree.

Benefits of Education Loan to Study in USA

If you are thinking about getting an education loan to study in the USA? It is a big decision, but it can come with some amazing benefits. Let’s break it down:

1. Financial Flexibility

With an education loan, you will have the money you need to cover things like tuition, housing, books, and other school expenses. This means you can focus on your studies without worrying about money right away.

2. Access to Quality Education

Studying in the USA opens doors to some of the best universities and colleges in the world. With an education loan, you can attend these top-notch schools and take advantage of all the amazing programs they offer.

3. Career Opportunities

Graduating from a US institution can boost your job prospects. Employers love seeing international experience and diverse skills, which you will gain while studying in the USA. An education loan can help you get there and set you up for success in your career.

How To Choose a Bank for Education Loans in the USA?

When you are comparing different banks’ loans, there are a few key things to look at:

- Interest Rate: This is how much extra you will pay on top of the loan amount. The lower the interest rate, the less you will pay overall.

- What it Covers: Some loans only cover tuition fees, while others might help with living expenses, books, and more. Make sure you know what you are getting.

- Processing Fee: This is the fee you will pay to the bank to process your loan application. It can vary from bank to bank, so it is worth comparing.

- Tax Exemptions: Some loans come with tax benefits, which can save you money in the long run.

- Loan Margin: This is the percentage of the total cost that the bank will cover. The rest you will need to pay upfront.

- Processing Time: How long it takes for the bank to approve your loan and give you the money.

- Prepayment Terms: This is all about whether you can pay back your loan early without any extra charges.

So, when you are comparing loans, make sure you look at all these factors to find the one that is right for you.

Factors to Look for Before Applying for Education Loans in the USA

If you are thinking about applying for an education loan, you must know certain things beforehand. Here are some important things to consider:

- Choose Your Course and University: First, decide what you want to study and where. This will help you figure out how much money you will need.

- Estimate Your Expenses: Take a look at your finances and work out how much you will need to cover your education costs.

- Get Your Documents Ready: Make sure you have all the paperwork you need to apply for the loan.

- Find a Guarantor: Some loans might require a guarantor who can vouch for you and your ability to repay the loan.

- Apply Early: It is a good idea to apply for the loan at least three months before your visa interview date. So, you have plenty of time to get everything sorted.

- Know When You will Get the Money: You should ask in advance when the loan will be disbursed, so you can plan your finances accordingly.

By keeping these factors in mind, you will be well-prepared to apply for an education loan and fund your studies in the USA.

Eligibility Criteria for Education Loans in the USA

Here are some things you need to know about eligibility before getting an education loan to study in the USA.

1. Academic Qualifications

You will need a solid academic background, like a high school diploma or equivalent. Some lenders might also look at your GPA or test scores.

2. Admission to a Recognized Institution

You have to be accepted into a recognized school in the USA, like a university or college.

3. Co-signer (If needed)

Sometimes, lenders might ask for a co-signer to guarantee the loan. This could be someone who has a good credit history and can vouch for you.

So, if you are considering an education loan, make sure you meet these eligibility criteria. It will help you finish the process smoothly and get the financial support you need for your studies in the USA.

Additional Requirements for Education Loans in the U.S.

To apply for an education loan to study in USA, you need to provide a few extra things:

- Some lenders might have extra conditions, like your citizenship status or whether you are studying full-time or part-time.

- It is important to do your homework and understand what each lender expects before you apply for a loan. This way, you can avoid any surprises.

Meeting these criteria helps you in getting the financial support you need to pursue your education. So, make sure you check all the boxes.

Expenses Covered Under Education Loans in the USA

When you are considering an education loan, it is important to know what it covers besides just tuition fees. There are lots of other expenses you will need to think about, so please be sure to check out all the details.

These days, many loan schemes cover more than just tuition fees. Here are some of the other things you might find covered under your loan:

- Fees for college and hostel

- Exam, library, and lab fees

- Buying books, equipment, or instruments

- Deposits for things like buildings or refunds

- Travel costs

- Insurance premiums (if needed)

- Getting a laptop for your course

- Other expenses like study trips or projects

So, before you sign the loan agreement, make sure you know exactly what your loan covers. It will help you plan.

Application Process for Education Loans in the USA

The application process for an education loan in the USA is simple. Here is an easy-to-follow guide to help you understand the process:

- Collect all the paperwork you will need. This could include stuff like your passport, school records, test scores, and your acceptance letter from a US school.

- Check out different lenders to see what they offer. Look at things like interest rates, how you will pay back the loan, and what other people have to say about them. Find the one that works best for you.

- Once you have picked a lender, it is time to fill out the application. They will want to know things like your personal info, your school stuff, and how much money you need.

- Finally, send all your documents to the lender. You might have to mail them or upload them online. Just make sure you follow the instructions carefully.

Things To Remember While Applying for Education Loans in the USA

When you are getting a student loan, there are a few important things you should remember while applying:

- Moratorium Period: This is a time when you don’t have to pay back the loan. It varies from bank to bank and might last even after you finish your studies.

- Loan Margin: Most banks won’t give you the full amount you need for your education. They will cover about 90%, and you will need to find the rest yourself.

- Exchange Rate: Make sure you know how much money you will actually get when the loan is paid out. Changes in the exchange rate can affect the amount you receive.

By keeping these points in mind, you can make sure you are prepared for your education loan and all its details.

Repayment Options for Education Loans in the USA

Once you have finished your studies in the USA with the help of an education loan, you need to think about paying it back. Here is what you need to know:

1. Grace Period

After you graduate or leave school, most loans give you a bit of time before you have to start paying them back. This grace period is usually around six to nine months. So you can get settled and find a job without worrying about payments right away.

2. Interest Rates

Pay attention to the interest rates on your loan. They can make a big difference in how much you end up paying back. Depending on your loan, the rates might stay the same or change over time. Please make sure you understand what you are dealing with.

3. Repayment Plans

There are different ways to pay back your loan. It depends on your financial situation. You might go for a standard plan, where you pay a set amount each month for a certain number of years.

You could choose a graduated plan, where your payments start low and go up over time. There are also income-driven plans, where your payments are based on how much you earn. You can pick the one that works best for you and your wallet.

It is ok to feel overwhelmed by education loans. But, don’t worry, we have got you covered with the top 10 grants to tackle any student loans. These grants offer a range of solutions.

They include forgiveness programs for specific professions, repayment options based on your income, and even rewards for community service. If you are curious to know more, please check our detailed guide to discover which grants could be the perfect fit for your situation.

Understanding your repayment options is important. It will help you manage your finances and keep up with your loan payments. So, please take the time to do your research and choose the plan that is right for you.

Potential Loan Forgiveness Programs

Did you know some programs can help you get rid of some or all of your student loan debt? Yes, it’s true! These programs are called loan forgiveness programs. This might be an option if you work in certain fields like public service or teaching.

If you meet certain requirements, you could qualify to have part or all of your loan balance forgiven. This means you would not have to pay it back, which can be a huge relief.

If you are in a job that qualifies and you meet the criteria, it is worth looking into loan forgiveness programs. They could save you a ton of money and help you get rid of that student loan debt once and for all.

| Repayment Option | Description |

| Standard Repayment Plan | Fixed monthly repayments over a set time |

| Graduated Repayment Plan | Lower initial payments gradually increase over time |

| Income-Driven Repayment Plans | Payments based on income and family size |

Let’s look at some numbers when it comes to loan forgiveness programs:

- Since Public Service Loan Forgiveness (PSLF) started, only about 3.3% of applications have been approved. Back in April 2018, the approval rate was even lower, at just 0.28%.

- There are around 3.72 million people who could qualify for PSLF based on their jobs. On average, these students owe about $88,260.

- The government has forgiven a whopping $46.8 billion in federal student loans through PSLF so far.

- About 10,100 teachers have had part or all of their loans forgiven through this program, totaling $197.3 million.

- On average, each borrower sees about $1,073 of their student loans forgiven by the government.

These numbers show that while loan forgiveness programs can help, the process is not always easy. So, it is important to understand your options.

Frequently Asked Questions

1. What is an education loan?

An education loan is like a helping hand from lenders to cover your education costs while you are studying abroad. This includes things like tuition fees, books, and living expenses.

2. Why should you consider taking an education loan to study in the USA?

Studying in the USA with an education loan has many advantages. You get financial flexibility to focus on your studies without having to repay immediately. Also, it lets you attend top-notch schools and opens up career options after you graduate.

3. What are the eligibility criteria for education loans in the USA?

The eligibility requirements for education loans in the USA can differ among lenders. But usually, you need a strong academic record, admission to a recognized school, and proof that you can pay back the loan. Sometimes, you might need a cosigner too.

4. How do I apply for an education loan in the USA?

If you want to get an education loan in the USA, it requires a few steps. You should start by collecting documents like your admission letter, academic transcripts, and financial details. Then, check out different lenders and compare their terms and rates. When you have picked one, fill out the application and send it with your documents.

5. What are the repayment options for education loans in the USA?

Education loan repayment options in the USA often start with a grace period after you graduate. During this time, you don’t have to make payments.

After the grace period, you can select from different repayment plans like standard, graduated, or income-driven options. Please make sure to check the interest rates and any loan forgiveness programs that might apply to you.

Conclusion

If you are getting an education loan to study in USA, it has many benefits. They can cover tuition fees, living costs, and other expenses related to your studies. By using these loans, you can attend top schools and access various academic opportunities that can shape your future.

Throughout this article, we have discussed why education loans are important for studying in the USA. To apply for an education loan, you must meet certain criteria. This includes having the right academic qualifications and getting into a recognized school. Applying for these educational loans is easier if you follow the steps, like gathering the required documents and finding reputable lenders.

After getting an education loan, it is important to know how to repay it. You should understand things like the grace period, interest rates, and repayment plans that fit your financial situation. It is important to be informed. This helps you plan your finances well and have a smooth repayment process.