The end of earnings season is a great time to discover new stocks and evaluate how companies are handling the current business environment, so let's take a look at how BigCommerce (NASDAQ:BIGC) and other ecommerce software stocks performed in the first quarter.

E-commerce has been around for over 20 years and has experienced significant growth, but overall penetration into retail remains low. Only around $1 of every $5 spent on retail purchases is ordered digitally, and over 80% of the retail market is still disrupted by online disruption. The demand for a variety of e-commerce software solutions is driven by the vast areas of retail where e-commerce has yet to take hold.

The six e-commerce software stocks we track reported decent results in the first quarter. On average, revenue beat analysts' consensus estimates by 1.5%, while revenue guidance for the next quarter was in line with consensus. Stocks, especially those trading at high multiples, had a strong end to 2023 but are facing a volatile 2024. Mixed signals on inflation have led to uncertainty around interest rate cuts, but e-commerce software stocks have shown resilience, with stocks up an average of 9.6% since their last earnings results.

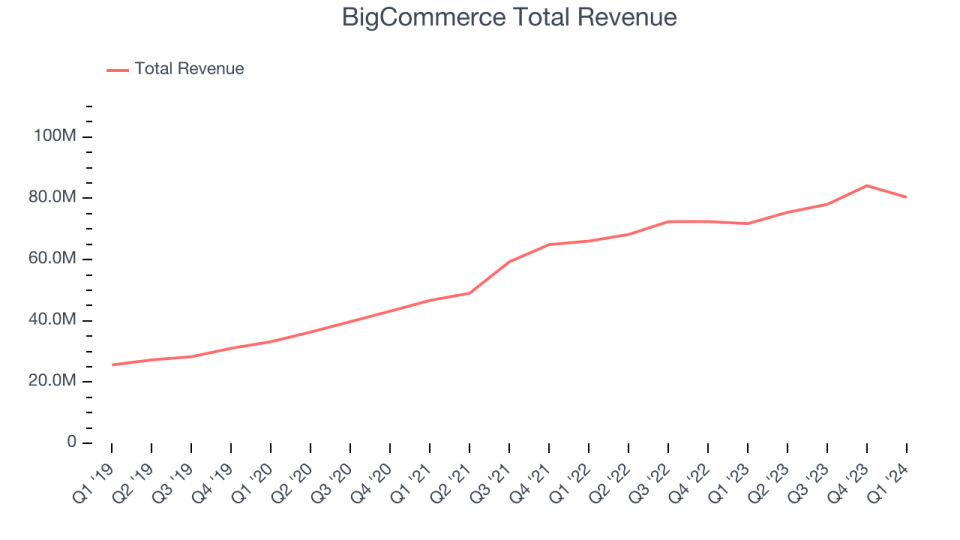

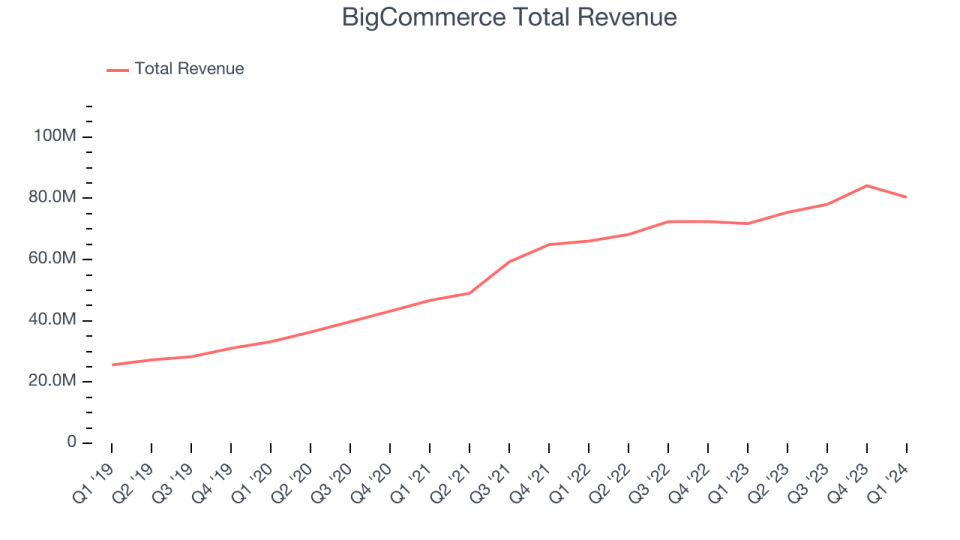

Best of Q1: BigCommerce (NASDAQ:BIGC)

BigCommerce (NASDAQ:BIGC) was founded in 2009 in Sydney, Australia by Mitchell Harper and Eddie Machaalani and provides software that makes it easy for businesses to create online stores.

BigCommerce reported that revenue increased 12% year over year to $80.36 million, beating analyst expectations by 4.1%. It was a strong quarter for the company, which significantly beat analysts' billing estimates and also delivered full-year revenue guidance that beat analysts' expectations.

“Our first quarter results reflect a strong start to the year with total revenue exceeding $80 million, up 12% year over year. We also saw significant improvement in our bottom line, with net income increasing approximately 23% of revenue year over year,” said Brent Bellm, CEO of BigCommerce.

BigCommerce beat analyst expectations the most across the group. The company's shares have risen 15.8% since the earnings report and are currently trading at $7.75.

Is now the time to buy BigCommerce? Get your free full analysis of revenue results here.

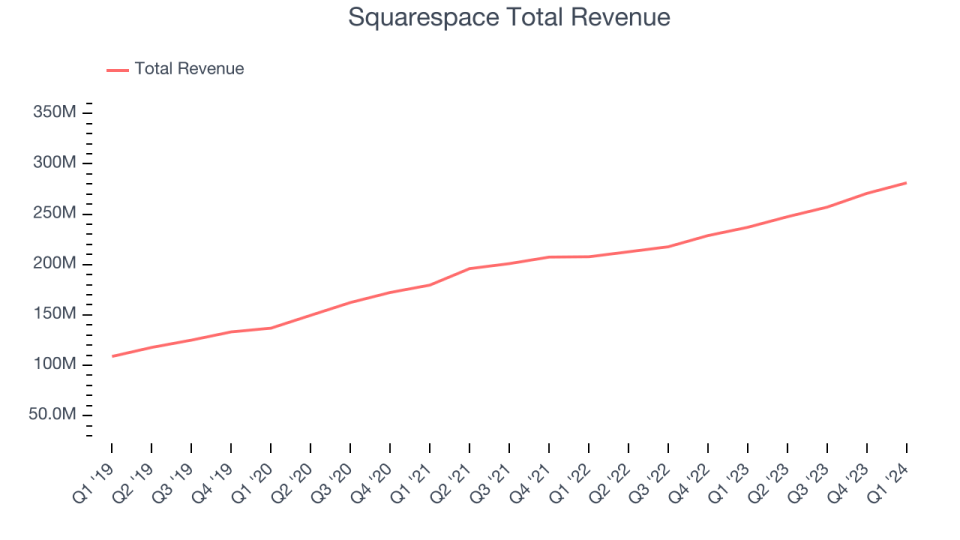

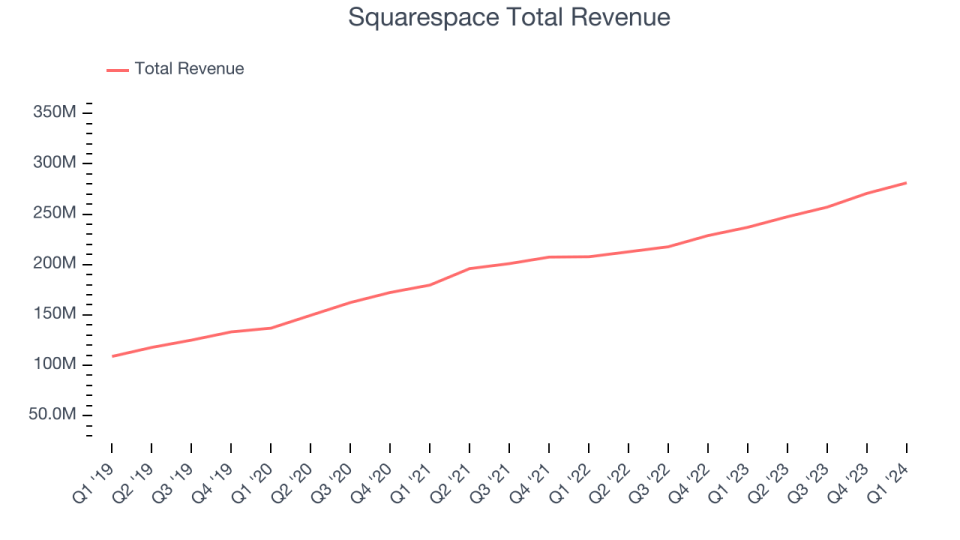

Squarespace (NYSE:SQSP)

Founded in New York City in 2003, Squarespace (NYSE:SQSP) is a platform that helps small businesses and creatives build their digital presence online.

Squarespace reported revenue of $281.1 million, up 18.6% year over year and beating analyst expectations by 1.7%. It was a decent quarter for the company, with revenue well ahead of analyst expectations but gross profit down.

Squarespace announced the highest full-year earnings forecast hike of any company in the industry. The company's shares have risen 23.5% since the earnings report and are currently trading at $43.77.

Is now the time to buy Squarespace? Get your free full analysis of earnings results here.

WIX (NASDAQ:WIX)

Founded in Tel Aviv in 2006, Wix.com (NASDAQ:WIX) offers a free, easy-to-use website building platform.

Wix reported revenue of $419.8 million, up 12.2% year over year, in line with analysts' expectations. It was a mixed quarter for the company, with sales beating analysts' expectations but gross profit declining.

Wix had the worst performance relative to analyst expectations and also had the weakest full-year guidance update of the group. The company's shares have risen 24.1% since the earnings release and are currently trading at $168.73.

Read the full analysis of Wix's results here.

Shopify (NYSE:SHOP)

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and running an e-commerce business.

Shopify reported revenue of $1.86 billion, up 23.4% year over year, in line with analysts' expectations. It was a decent quarter for the company, with gross profits improving significantly but revenues falling short of analysts' expectations.

Shopify had the fastest revenue growth among its peers. The company's shares have fallen 14.8% since the earnings report and are currently trading at $65.7.

Read our complete and actionable Shopify report for free here.

Verisign (NASDAQ:VRSN)

While the company isn't a domain registrar and doesn't sell domain names directly to end users, Verisign (NASDAQ:VRSN) operates and maintains the infrastructure that supports domain names like .com and .net.

VeriSign reported revenue of $384.3 million, up 5.5% year over year, in line with analysts' expectations. It was a strong quarter for the company. VeriSign beat analysts' revenue and EPS expectations.

VeriSign had the slowest revenue growth among its peers. The company's shares have fallen 2.4% since the earnings report and are currently trading at $178.28.

Read the full actionable report on VeriSign for free here.

Participate in paid stock investor research

Help us make StockStory more useful for investors like you by participating in a paid user research session, providing your feedback and earning a $50 Amazon Gift Card. Sign up here.