Tim van Leeuwen, part of Rotate Consulting, shares his team's views on the scale and impact of e-commerce on the air cargo market and how this will affect the near-term outlook.

When delegates gathered at the Air Cargo China Conference in Shanghai for the first time since 2018, the mood was much better than at the industry gathering a year ago. It was only fitting that the conference was held in China, where demand for cross-border e-commerce is continually growing.

Quantifying e-commerce volumes remains a challenge. No direct data exists on e-commerce volumes, so the best indicators we have are anecdotal (“more than 50% of shipping volume from Hong Kong is e-commerce”). What information is available on e-commerce volumes and how does it affect the near-term outlook for the air cargo market?

Air cargo transportation in elevator

The subdued mood in the air cargo industry in 2023 was primarily due to slowing demand. Air cargo traffic remained well below its peak in 2021, when the pandemic caused a huge increase in demand. By mid-2023, air cargo traffic had recorded 17 consecutive months of year-over-year declines (see Figure 1).

Thankfully, fortunes have changed in 2023. As of May 2024, air cargo demand has seen 10 consecutive months of year-over-year growth. The past six months have seen double-digit growth. This strong demand is likely to continue into the second half of the year, but growth rates will slow to single digits compared to the robust growth in the second half of 2023.

Figure 1: Monthly (year-over-year) growth in international air cargo traffic as reported by IATA

Capacity as an indicator of air freight transport

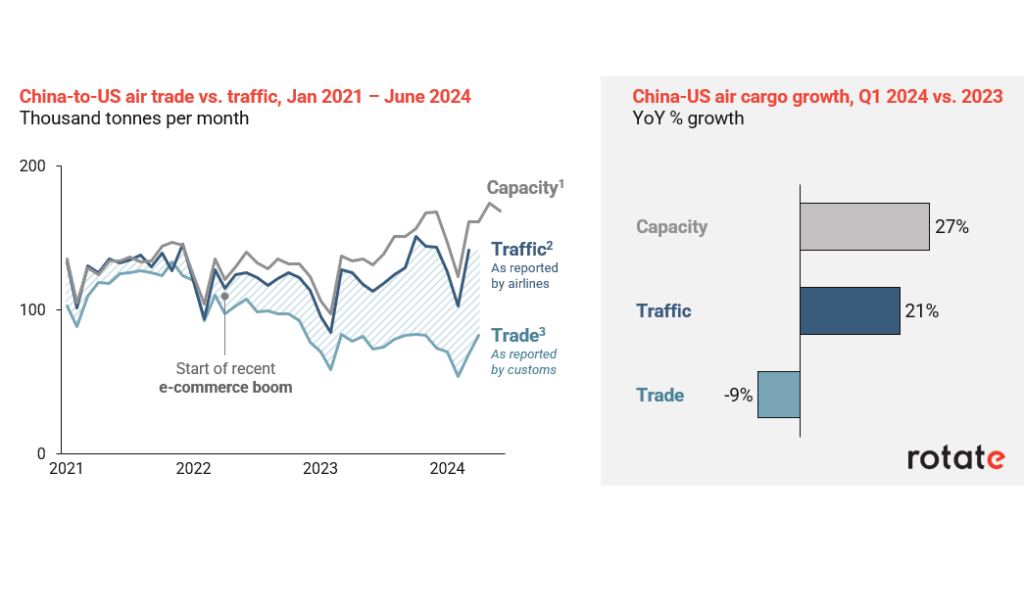

Surprisingly, one data source paints a slightly gloomier picture: Air trade data (reported by Customs) is declining through 2024. According to U.S. Customs data, trans-Pacific air trade is declining by 9% (see Figure 2). This contrasts with the 21% growth reported by air traffic volumes (the dark blue line in Figure 2).

The difference in trends between these sources arises due to the customs authorities’ so-called “de minimis” thresholds, i.e. the maximum value of a shipment that can be imported duty-free: for example, imports into the United States are only subject to customs duties if their value exceeds $800 and therefore require detailed registration at customs.

Because e-commerce shipments are almost always below this value, customs-based trade data typically do not cover e-commerce volumes, but traffic statistics do. As e-commerce demand continues to grow, the gap between these metrics widens significantly from 2022 onward (see Figure 2).

Figure 2: Monthly data on air cargo trade (as reported by US Customs), air cargo volumes (as reported by airlines), and air cargo capacity (from Rotate Live Capacity) between China (including Hong Kong) and the US. Sources: US Census, BTS, Rotate Live Capacity

While air freight traffic data can provide a more accurate picture of actual demand, it has the drawback of typically having a significant delay (up to three months), meaning it is difficult to adjust strategies in real time based on this information. Rotate's consulting team has found that for high-demand trade routes (such as trans-Pacific routes), real-time air freight capacity is one of the best indicators of air freight traffic (see Figure 2). Capacity data is quickly becoming the best indicator of air freight demand, especially for routes heavily influenced by e-commerce.

Cargo ship shortage improves short-term outlook

With e-commerce volumes making up a significant portion of air cargo demand from Asia, Air Cargo China representatives said they were concerned that the air cargo industry was becoming increasingly dependent on cross-border e-commerce volumes.A popular question at the conference was about the outlook for the air cargo market for the remainder of the year, with Rotate's consulting team focusing on three trends in particular:

The first is a potential change to de minimis thresholds, particularly in the US, where adjustments are under discussion. However, given the low value of cargo, thresholds would need to be significantly lowered to impact a significant number of e-commerce shipments. At present, our capacity data shows no signs of a slowdown in flights to the US.

Second, there are signs that consumer interest in e-commerce platforms is waning. At Rotate, we monitor download and usage statistics for popular shopping apps. Here again, our analysis shows that consumer interest is not waning.

The third trend is on the supply side, with several carriers and forwarders commenting that capacity is difficult to come by in the current market, which can be attributed in part to the decline in deliveries of larger wide-body freighters to the market.

For example, engine supply issues and quality assurance efforts have limited Boeing’s deliveries of B777-200LRF freighters to just seven so far this year (see Figure 3). Boeing’s ongoing production issues (and high demand for passenger aircraft) have also delayed the certification of the impending Boeing 777-P2F conversion program.

Figure 3: Slowing large widebody freighter deliveries to 2024 (Source: Boeing) and recent news of delays to large freighter conversion programs

Taking all these trends together, there is every reason to believe that the air cargo market will remain strong in the second half of 2024. E-commerce demand will continue to play a key role in established as well as emerging markets. Air cargo continues to meet the relentless demand of consumers.

Tim van Leeuwen heads up the strategy consulting practice at Netherlands-based Rotate, the go-to team for commercial decision-making in the freight industry.

Freight forwarders face profit pressure