Most readers would already know that the China Oriental Education Holdings (HKG:667) share price has increased by a significant 8.4% in the last month. But markets usually pay for long-term fundamentals, and in this case they don't look very promising, so we wanted to take a closer look at its key financial indicators. In this article, we decided to focus on China Oriental Education Holdings' ROE.

ROE or return on equity is a useful tool for evaluating how effectively a company can generate returns on the investment it receives from its shareholders. In other words, it is a profitability ratio that measures the rate of return on the capital provided by a company's shareholders.

Check out our latest analysis for China Oriental Education Holdings.

How do I calculate return on equity?

of Formula for calculating return on equity teeth:

Return on equity = Net income (from continuing operations) ÷ Shareholders' equity

So, based on the above formula, the ROE for China Oriental Education Holdings is:

5.9% = CA$328 million ÷ CA$5.5 billion (based on trailing twelve months to June 2023).

“Return” refers to a company's earnings over the past year. That means for every HK$1 of shareholders' equity, the company generated HK$0.06 of his profit.

What relationship does ROE have with profit growth?

It has already been established that ROE serves as an indicator of how efficiently a company will generate future profits. Depending on how much of these profits a company reinvests or “retains”, and how effectively it does so, we are then able to assess a company's earnings growth potential. Generally speaking, other things being equal, companies with high return on equity and profit retention will have higher growth rates than companies without these attributes.

China Oriental Education Holdings' revenue growth and ROE 5.9%

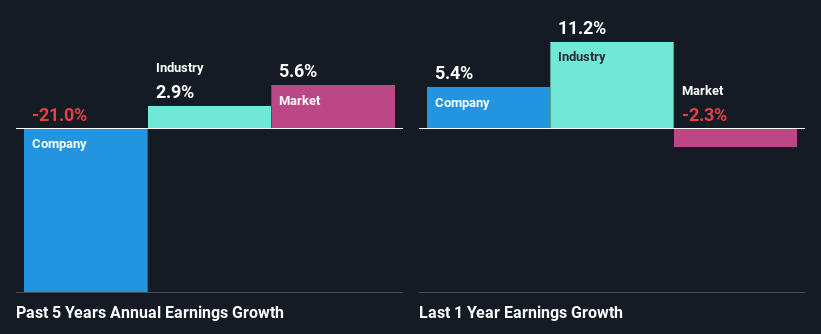

At first glance, China Eastern Education Holding's ROE does not seem to be very promising. Next, when compared to the industry average for his ROE of 14%, his ROE for the company is even less encouraging. Therefore, it might not be wrong to say that his 21% decline in China Oriental Education Holdings' net profit over five years is probably a result of his ROE falling. We believe there may be other aspects that are negatively impacting the company's earnings outlook. For example, the company has a very high dividend payout ratio or faces competitive pressures.

Having said that, we compared China Oriental Education Holdings' performance with the industry and found that while the company has shrunk its profits, the industry has grown its profits at a rate of 2.9% over the same five-year period. I understand and was concerned.

Earnings growth is an important metric to consider when evaluating a stock. Investors should check whether expected growth or decline in earnings has been factored in in any case. This will help you determine whether the stock's future is bright or bleak. What is 667 worth today? Our free research report's intrinsic value infographic helps you visualize whether 667 is currently mispriced on the market.

Is China Oriental Education Holdings reinvesting profits efficiently?

With a median three-year payout ratio of 106%, the company is paying more than it can afford, so the shrinking profits are not surprising. Paying dividends above your means is usually not feasible in the long term. The risks dashboard should now show the two risks he has identified for China Oriental Education Holdings.

Moreover, China Oriental Education Holdings has been paying dividends for four years. This means that the company's management is rather focused on maintaining the dividend despite shrinking profits. After researching the latest analyst consensus data, we find that the company's future dividend payout ratio is expected to drop to 54% over the next three years. Therefore, the expected drop in dividend payout ratio explains that the company's ROE is expected to rise to his 12% over the same period.

summary

Overall, we would be very cautious before making any decisions about China Oriental Education Holdings. Specifically, it is a very unsatisfactory performance in terms of earnings growth, and we believe that the low ROE and low reinvestment rate are the reasons for this unsatisfactory performance. If so, based on the latest industry analyst forecasts, analysts expect the company's profit growth rate to improve significantly. To know more about the latest analyst forecasts for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we help make it simple.

Please check it out China Oriental Education Holdings Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.