Warner Bros. Discovery is no longer pursuing an acquisition of Paramount Global, CNBC reported Tuesday. Meanwhile, Skydance is still conducting due diligence on a potential merger with Paramount or perhaps an acquisition of its parent company.

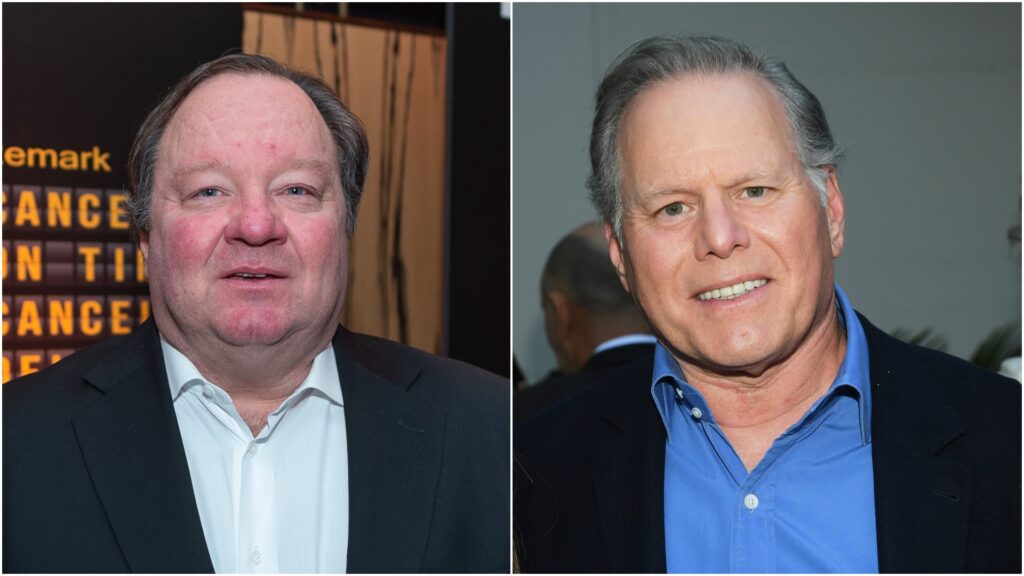

WBD CEO David Zaslav met with Paramount CEO Bob Bakish in December to discuss a possible merger. These debates intensified in January, but CNBC says they have since subsided.

Paramount and Warner Bros. Discovery did not comment on the matter when contacted by IndieWire.

Warner Bros. Discovery cannot engage in any M&A activity until April 8, when the Reverse Morris Trust lock-up period under Discovery's WarnerMedia deal with AT&T ends.

Paramount has formed a special committee of financial advisors to vet potential bidders. Presumably, the committee is already evaluating Byron Allen's $30 billion bid. Some analysts believe Allen doesn't have enough money.

As first reported by the Wall Street Journal, Comcast also has no interest in acquiring Paramount, writes CNBC, although the two companies continue to discuss bundling and merging Peacock and Paramount+. It is said that there is. Consumers would be excited about the idea of combining Peacock and Paramount+, but three-quarters of respondents were at least “somewhat” to “very concerned” about the combined cost, according to a new study from Civic Science. “Yes,” I answered.

News of Mr. Zaslav's exit comes as Paramount's stock is nearing a 52-week low. The company is scheduled to announce its fourth quarter 2023 earnings on Wednesday, February 28th. Despite overall subscriber growth for Max and Discovery+, Warner Bros. Discovery's stock fell 10% last Friday after the company missed Wall Street's earnings expectations. .

Paramount laid off 800 employees earlier this month, a cost-cutting move in hopes of returning the company to profitable growth in 2024.

One of the most likely scenarios for Paramount is that Skydance's David Ellison owns National Amusements Inc., the theater chain owned by Shari Redstone, which owns 77 percent of Paramount Global's voting stock. It is to acquire. That means Mr. Ellison will be buying a controlling interest in Paramount Global, not his assets themselves. IndieWire reported in December that Skydance and NAI were “fully committed” to such an acquisition.

If Paramount is acquired and Bakish is fired, he will receive a golden parachute worth $50 million.